BTC Market Pulse: Week 40

Bitcoin traded above the cost basis of short-term holders this past week, with price fluctuations centered around $111k. Spot market momentum softened as the 14-day RSI eased and net selling pressure declined, reflected in stronger Spot CVD.

Overview

Trading volumes rose meaningfully, highlighting elevated participation despite weakening momentum. This combination suggests that while demand is still present, price strength is beginning to show signs of fatigue, leaving the market vulnerable to shifts in sentiment.

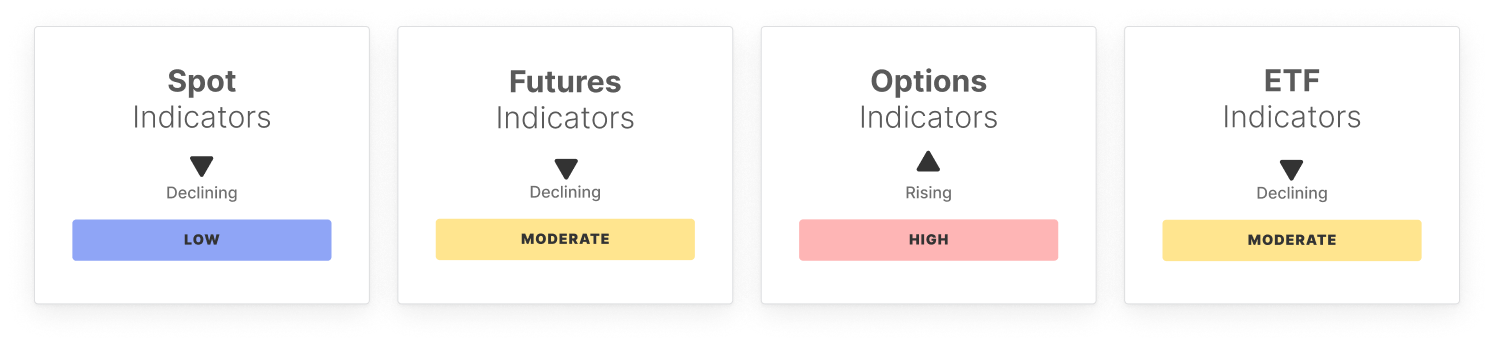

Derivatives signaled a more cautious tone. Futures open interest and funding both declined, pointing to reduced leverage and lower risk appetite among traders. Positioning leaned defensive, with fewer signs of aggressive long exposure. In contrast, the options market showed stronger engagement, with demand skewed toward downside protection as traders sought insurance against potential drawdowns. Volatility spreads remained firm, reflecting heightened expectations for price swings, though not yet accompanied by strong directional conviction. Liquidity conditions stayed stable, helping balance speculative activity with underlying market steadiness, but the tilt toward protection highlights lingering caution beneath the surface.

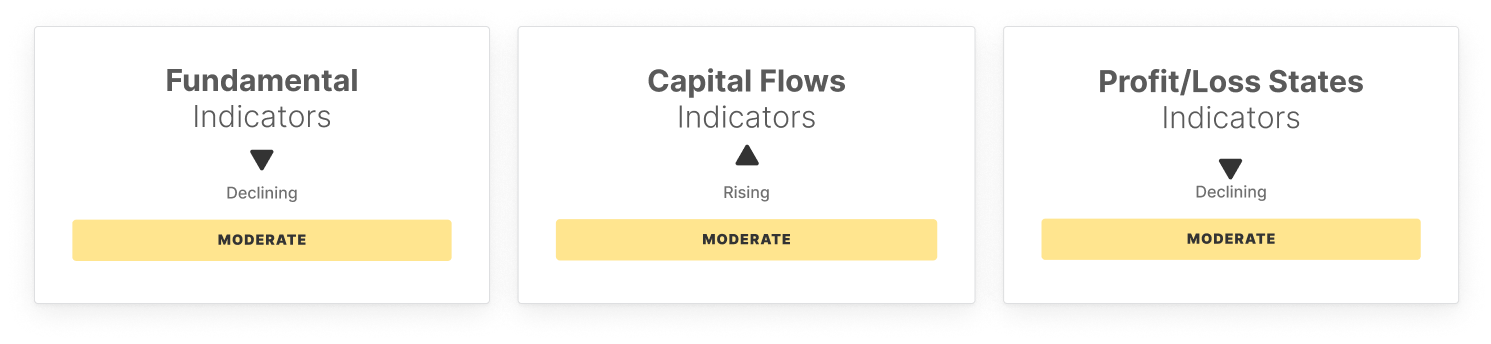

On-chain profitability slipped, with the market shifting from profit- dominant to loss-dominant states. This indicates rising stress, echoed in fundamentals: active addresses declined and transaction fee volume fell, both pointing to quieter activity on-chain. Capital flows also reflected caution, with realized cap inflows easing and long-term holder activity outweighing short-term engagement.

In sum, the market appears to be in transition. Momentum and risk appetite have cooled, even as liquidity and participation remain stable. Heightened spot activity highlights continued interest, yet softer derivatives positioning and weaker on-chain fundamentals suggest a consolidating structure. Unless new demand materializes, external catalysts may be required to shift the balance and drive the next decisive move.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report PDF

Make sure you read it!

Smart market intelligence, straight to your inbox.

Subscribe now- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US investors consider crypto less as risk-taking drops: FINRA study

LUNA climbs 39.89% in 7 days as legal proceedings unfold and the network receives an upgrade

- LUNA surged 39.89% weekly to $0.101 despite 75.65% annual decline, amid legal probes into Luna Innovations' governance. - Binance temporarily halted LUNA transactions Dec 8 for network upgrade, while DOJ seeks 12-year sentence for Terraform Labs founder Do Kwon. - Luna Classic (LUNC) rose 20% pre-sentence hearing, driven by token burns and bullish indicators near key resistance levels. - Legal, technical, and market factors converge as Kwon's Dec 11 sentencing and network upgrades shape LUNA's volatile t

AWS re:Invent went all-in on artificial intelligence, but clients may not be fully prepared.

eSIM usage is increasing due to its compatibility with devices and the convenience it offers travelers