SHIB Price Meltdown: Why the Worst May Be Yet to Come?

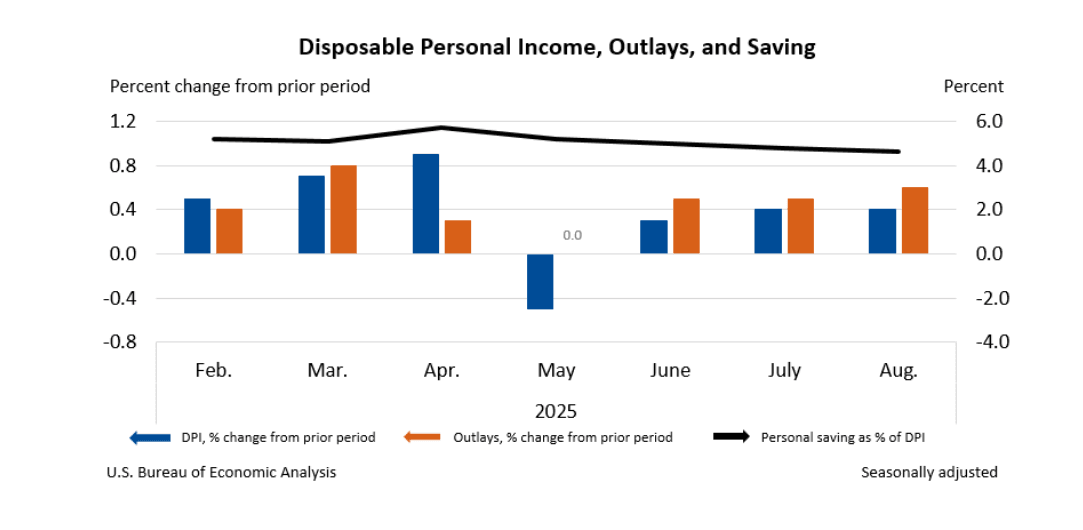

The Shiba Inu price has been grinding lower on the daily chart, and fresh U.S. economic data only adds fuel to the bearish fire. August’s Bureau of Economic Analysis release shows income growing at just 0.4 percent while personal consumption outpaced that at 0.6 percent. The savings rate dropped to 4.6 percent. In plain terms, Americans are spending more than they’re earning, relying on savings buffers that are already thinning. Risk assets like SHIB thrive when consumers and retail investors have excess liquidity, but this report signals the opposite: money is tightening, and speculative flows are drying up.

Shiba Inu Price Prediction:Why SHIB Price Is Under Pressure Today?

The latest macro update reinforces the headwinds already hitting SHIB price. Rising consumer spending alongside higher PCE inflation (0.3 percent in August) suggests the Federal Reserve won’t pivot dovish anytime soon. That means higher borrowing costs stay in play, which directly impacts retail-driven tokens like Shiba Inu. Shiba Inu price has historically surged when meme coin appetite aligns with loose liquidity cycles. This environment looks like the reverse: tighter liquidity, lower savings, and cautious risk sentiment.

Shiba Inu Price Prediction:Daily Chart Breakdown

SHIB/USD Daily Chart- TradingView

SHIB/USD Daily Chart- TradingView

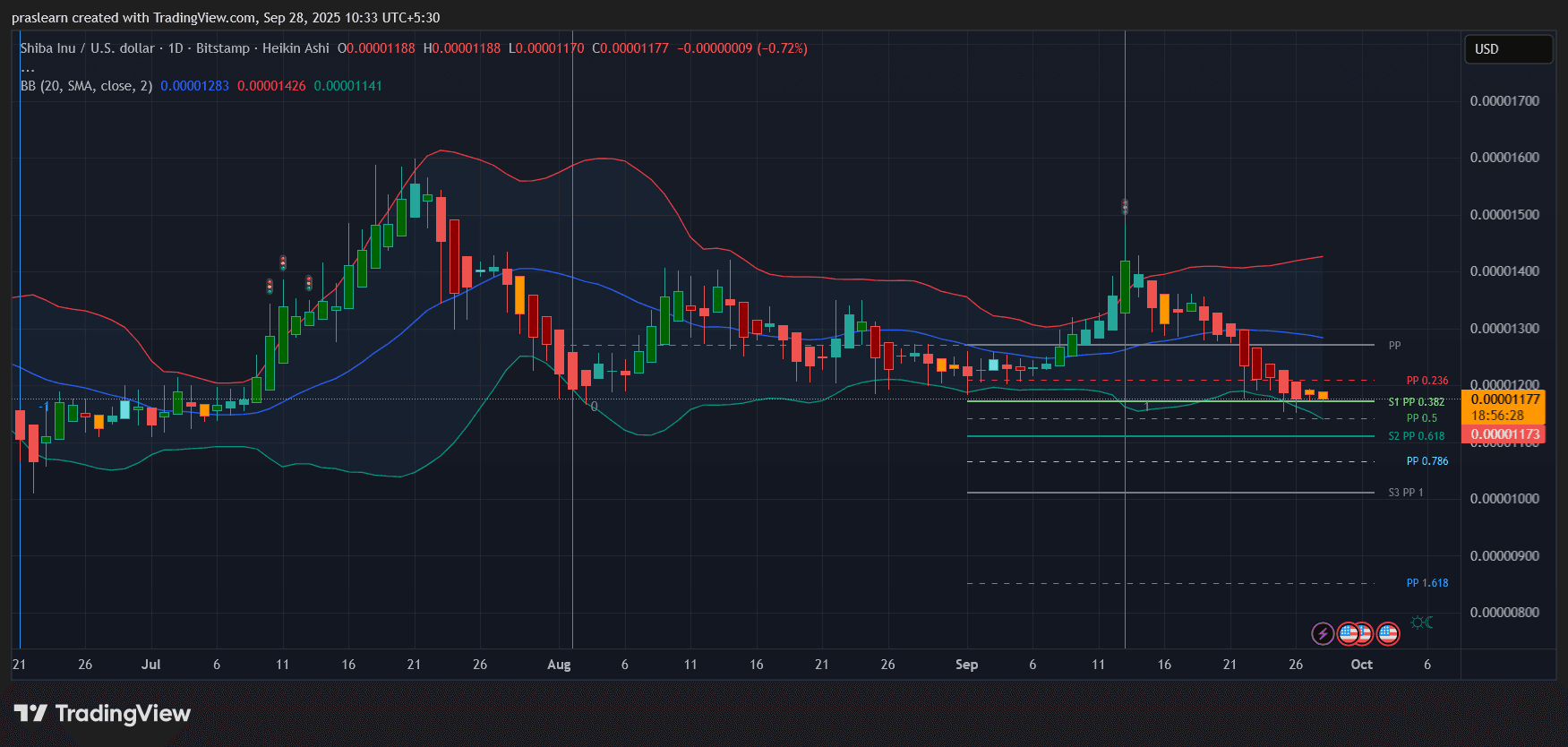

The daily SHIB/USDT chart paints a stark picture:

- Trend direction: The token has been locked in a descending channel since mid-September, trading below both the 20-day moving average and the midline of the Bollinger Bands.

- Support levels: Immediate support rests at 0.00001140 (S1 pivot) and deeper at 0.00001100. If those break, Fibonacci S2 at 0.00001080 and the 0.786 retracement near 0.00001020 come into play.

- Resistance levels: The first hurdle is 0.00001230, where the 20-day SMA and upper Bollinger midline converge. Only a breakout above 0.00001300 would suggest buyers are regaining control.

- Momentum: Red candles dominate with shrinking upper wicks, showing sellers in control but exhaustion signs creeping in. The Bollinger Bands are widening, pointing to volatility expansion downward.

Macro Meets Meme: Why This SHIb Price Crash Has More Weight?

The August report reveals that real disposable income barely grew at 0.1 percent, while real PCE advanced at 0.4 percent. Inflation at 2.7 percent year-over-year locks the Fed into caution. For SHIB, which relies on retail hype and liquidity inflows, this backdrop means less discretionary cash chasing speculative trades. Meme tokens often act like the first domino to fall when retail wallets tighten, and the current data highlights just that scenario.

Shiba Inu Price Prediction: What Happens Next for SHIB Price?

- Bear case: A clean break below 0.00001100 could send SHIB toward 0.00000950, a level not seen since early summer. This aligns with pivot S3 support and would represent a 20 percent drawdown from current prices.

- Neutral case: If buyers hold the 0.00001140–0.00001100 zone, SHIB may consolidate sideways before any relief bounce. A bounce here would be corrective, not trend-changing.

- Bull case: Only a decisive reclaim of 0.00001300 with volume can shift momentum. Without macro support, that’s a low-probability scenario for now.

Bottom Line

The $SHIB crash isn’t just a technical story—it’s being reinforced by macroeconomic reality. As personal savings fall and consumer spending climbs faster than income, retail speculation weakens. SHIB price is already at key support, and unless conditions shift, the path of least resistance is lower. Traders should prepare for deeper downside unless the token proves otherwise with a breakout above the 0.00001300 level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.