Ethereum exchange balances have dropped to a nine-year low of 14.8 million ETH, driven by institutional accumulation, spot ETF inflows and increased staking. This shift reduces exchange liquidity and suggests longer-term custody or DeFi deployment for significant portions of the circulating supply.

-

Exchange reserves hit 14.8M ETH — lowest since 2016

-

Institutional treasuries and spot ETFs now hold ~10% of total ETH supply.

-

Glassnode and CryptoQuant data show sustained net outflows and a 30-day EMA spike, signaling reduced selling pressure.

Ethereum exchange balances fall to 14.8M ETH; institutional accumulation accelerates. Read analysis and implications for supply, staking, and price action — COINOTAG.

What are Ethereum exchange balances and why do they matter?

Ethereum exchange balances measure how much ETH is held on centralized trading platforms. Lower exchange balances usually indicate assets moving to cold storage, staking, or DeFi, which reduces immediate sell-side liquidity and can tighten available supply on exchanges.

How fast are ETH exchange outflows accelerating?

Exchange outflows have accelerated since mid-July, with a 20% decline in exchange supply over that period. Glassnode reports the total on exchanges at 14.8 million ETH. CryptoQuant’s exchange supply ratio sits at ~0.14, the lowest reading since July 2016.

Ethereum exchange balances dropped to a nine-year low of 14.8 million ETH as digital asset treasury firms and exchange-traded funds accelerate buying.

The amount of Ethereum held on centralized crypto exchanges has fallen to its lowest level since 2016 amid an increase in institutional accumulation.

The amount of Ether (ETH) on exchanges has been declining since mid-2020. Over the past two years, exchange-held ETH has been reduced by approximately half as institutions and long-term holders remove supply from orderbooks.

The ETH exchange exodus accelerated in mid-July and has declined 20% since then amid aggressive accumulation by digital asset treasuries. As of Thursday, it is down to 14.8 million ETH, according to Glassnode.

CryptoQuant reports a similar trend with its Ethereum exchange supply ratio, which measures exchange reserves divided by total supply, at 0.14 — its lowest level since July 2016.

ETH exchange balance at nine-year low. Source: Glassnode

When exchange supplies fall, assets typically move into cold wallets, staking contracts, or DeFi protocols seeking yield. Conversely, rising balances often indicate growing sell-side intent as investors prepare to trade.

How are net flows changing?

CryptoQuant data shows the 30-day moving average of total Ethereum exchange net flows reached its highest point since late 2022 this week, signaling accelerating outflows.

“Large-scale withdrawals often indicate a shift toward self-custody or DeFi deployments, reducing exchange liquidity and immediate selling pressure,” commented CryptoOnchain (CryptoQuant author).

Glassnode’s exchange net position change registered a negative 2.18 million ETH on Wednesday — a level only exceeded five times in the past decade, underscoring the scale of recent withdrawals.

Exchange net position change tops -2 million ETH. Source: Glassnode

How are treasuries and ETFs influencing ETH supply?

Corporate Ether treasuries began accumulating aggressively in June. BitMine — chaired by Tom Lee — now holds over 2% of total supply in its treasury allocations.

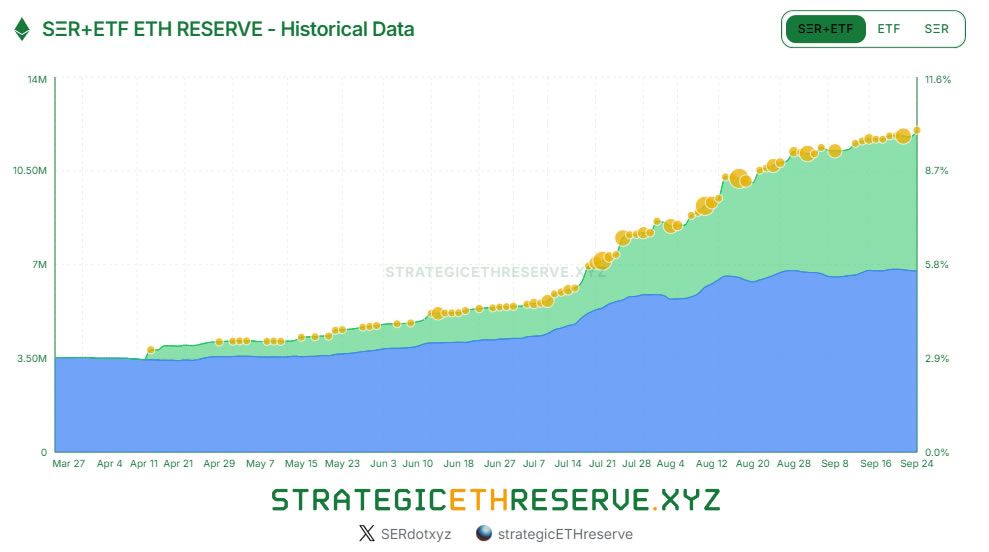

Since April, approximately 68 entities have acquired 5.26 million ETH (about $21.7 billion), or roughly 4.3% of supply, according to StrategicEthReserve. Most of these positions are being staked or held off-exchange.

US spot Ether ETFs have also seen elevated inflows, now holding around 6.75 million ETH (nearly $28 billion), approximately 5.6% of total supply. Combined, institutional entities account for roughly 10% of circulating ETH.

Institutional Ether accumulation ramped up in July. Source: StrategicEthReserve

Why does institutional accumulation matter?

Institutional accumulation reduces tradable supply, potentially lowering selling pressure and supporting price stability over time. Many institutional holders stake ETH, removing it from active trading and increasing on-chain locked supply.

What are market reactions and expert views?

Market commentators describe the trend as a “Wall Street glow-up.” BTC Markets analyst Rachael Lucas noted institutional stacking and high-profile price targets being discussed publicly.

Despite accumulation, Ether saw recent price pullbacks — down over 11% in the past week and trading below $4,100 on Thursday — illustrating that reduced exchange supply does not prevent short-term volatility.

Frequently Asked Questions

Why are ETH balances on exchanges falling?

Exchange balances fall when holders move ETH to cold wallets, staking contracts, or DeFi — commonly for yield or longer-term custody — which reduces available exchange liquidity and potential selling pressure.

Does lower exchange supply mean ETH price will rise?

Lower exchange supply can support price by reducing immediate sell liquidity, but prices still depend on demand, macro factors, and short-term market sentiment.

Key Takeaways

- Exchange supply hit nine-year low: 14.8 million ETH on exchanges, lowest since 2016.

- Institutional accumulation is material: Treasuries and ETFs now hold about 10% of supply combined.

- Market impact: Reduced exchange liquidity can lower selling pressure but does not eliminate short-term volatility—monitor flows and staking rates.

Conclusion

Ethereum exchange balances have fallen to a nine-year low as institutional treasuries and spot ETFs accelerate accumulation, moving large volumes into staking and self-custody. This trend tightens available exchange liquidity and may support ETH over the medium term. Continue monitoring on-chain flows from Glassnode, CryptoQuant, and StrategicEthReserve for actionable signals. Published by COINOTAG. Updated: 2025-09-25.