Bitcoin Primed To Explode by Double Digits to New All-Time High if This Support Level Holds, Says Trader – But There’s a Catch

Cryptocurrency analyst and trader Ali Martinez says one support level is currently the “most important” for Bitcoin ( BTC ).

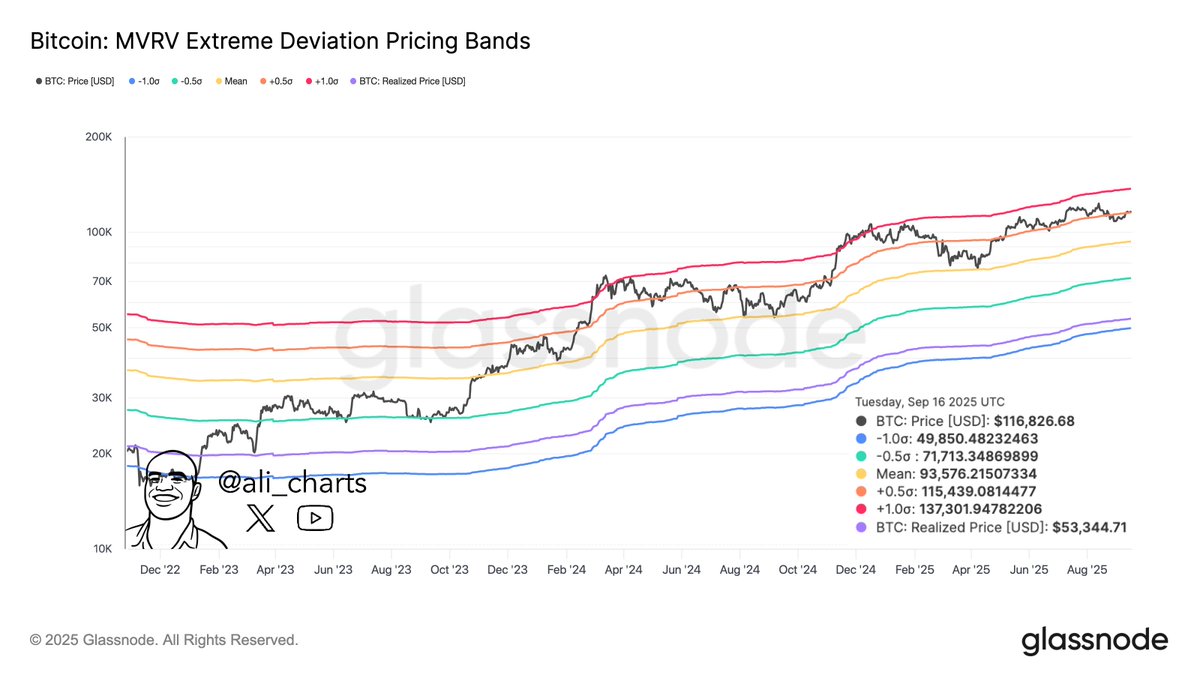

Martinez tells his 156,500 followers on X that, based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands, the $115,440 support level could determine whether Bitcoin hits a new all-time high or plummets to lows last recorded in May.

MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands are a tool in on-chain analysis used to identify potential market tops and bottoms.

Martinez says that if the $115,440 support level holds, Bitcoin could go up by around 17% from the current level. Bitcoin could, however, plummet by around 20% if the support level crumbles, according to Martinez.

“Hold it, and $137,300 is next.

Lose it, and $93,600 comes into play.”

Source: ali_charts/X

Source: ali_charts/X

Bitcoin is trading at $117,150 at time of writing.

According to Martinez, Bitcoin is witnessing an increase in the number of long positions while the open interest, which is an indication of swelling market speculation, is also rising. This is happening at a time when Bitcoin is facing major resistance, Martinez says.

These conditions, per Martinez, pose the “risk of a long squeeze ahead.” A long squeeze occurs when leveraged long positions encounter a price crash, which forces them to sell and thus creates a series of cascading liquidations.

Source: ali_charts/X

Source: ali_charts/X

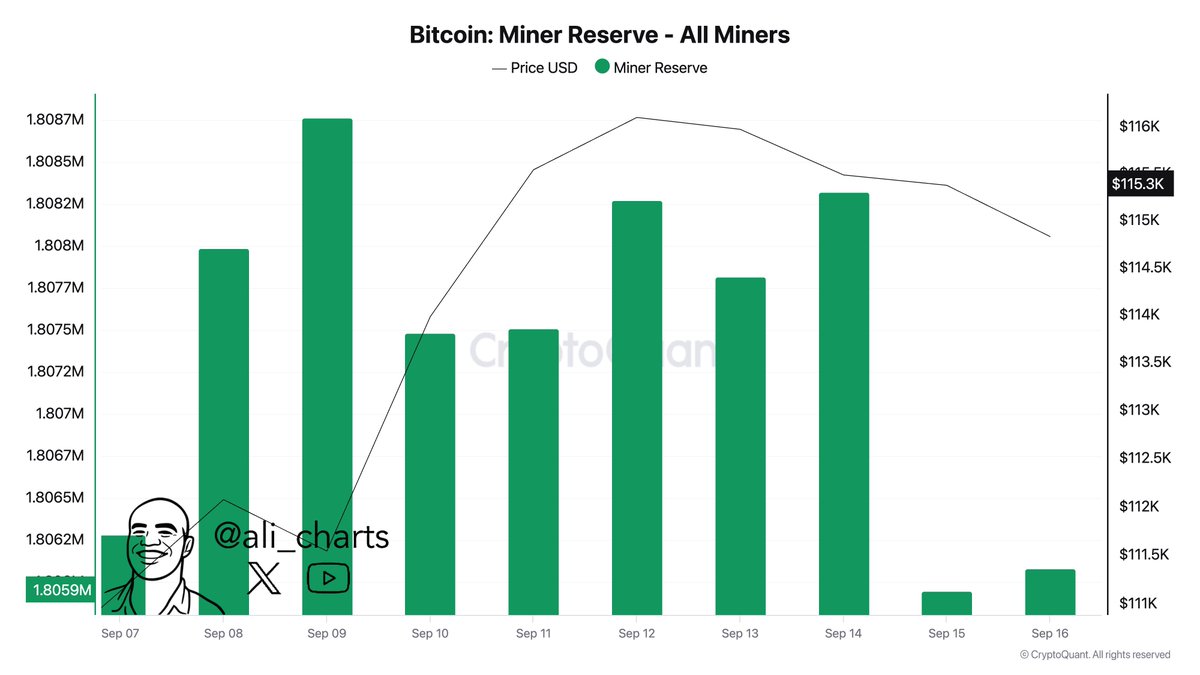

Citing analytics firm CryptoQuant’s data, Martinez further says that over the past three days, Bitcoin miners have disposed of BTC worth more than $234 million.

“Miners sold over 2,000 Bitcoin in the past 72 hours!”

Source: ali_charts/X

Source: ali_charts/X

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.