Date: Thu, Sept 18, 2025 | 06:55 AM GMT

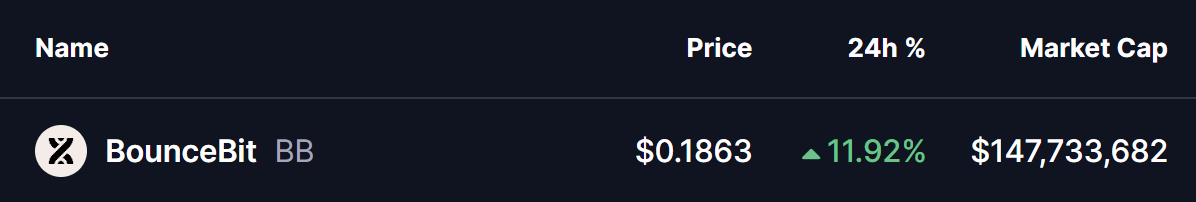

The cryptocurrency market is showing upside resilience today as Ethereum (ETH) climbs near the $4,575 mark with a 0.75% intraday gain following the latest Fed rate cut decision. Riding on this positive sentiment, several altcoins are flashing bullish setups — including BounceBit (BB), which is attracting attention with a potential breakout pattern.

BB has already surged by an impressive 11%, but the chart is suggesting a much bigger development — a bullish rounding bottom formation that could set the stage for further gains in the coming sessions.

Source: Coinmarketcap

Source: Coinmarketcap

Rounding Bottom in Play?

On the daily chart, BB appears to be shaping a rounding bottom, a classic bullish reversal pattern that often signals accumulation before a powerful upward move.

The pattern began forming after BB faced rejection near $0.20 back in February 2025, which led to a sharp pullback toward $0.073. Strong demand emerged at those lower levels, allowing the token to stabilize and gradually recover.

BounceBit (BB) Daily Chart/Coinsprobe (Source: Tradingview)

BounceBit (BB) Daily Chart/Coinsprobe (Source: Tradingview)

Now, BB has reclaimed momentum and is trading around $0.1856, moving closer to the neckline resistance zone. This key level sits between $0.19 and $0.2015, a zone where the next battle between bulls and bears is likely to unfold.

What’s Next for BB?

If BB successfully breaks above the neckline resistance at $0.19–$0.2015, the bullish reversal setup would be confirmed. Such a breakout could open the door for an initial move toward $0.29, and if momentum continues, the rounding bottom projection points toward a target of around $0.3173 — a gain of nearly 70% from the current price.

That said, traders should also keep an eye on possible short-term pullbacks. A dip back toward the rounding support line before the breakout cannot be ruled out.