Flare (FLR) Price Targets Two-Month High, But Market Sentiment Is Split

Flare (FLR) rallies toward a two-month high with strong buyer momentum, but negative funding rates highlight divided market sentiment.

FLR, the native token of the EVM-based Layer 1 blockchain network Flare, is today’s top gainer, climbing nearly 10% in the past 24 hours.

The token has steadily risen since early September, and recent price action suggests it could reach a two-month high of $0.02798 in the coming trading sessions.

FLR Eyes Higher Ground as Buyers Dominate Market

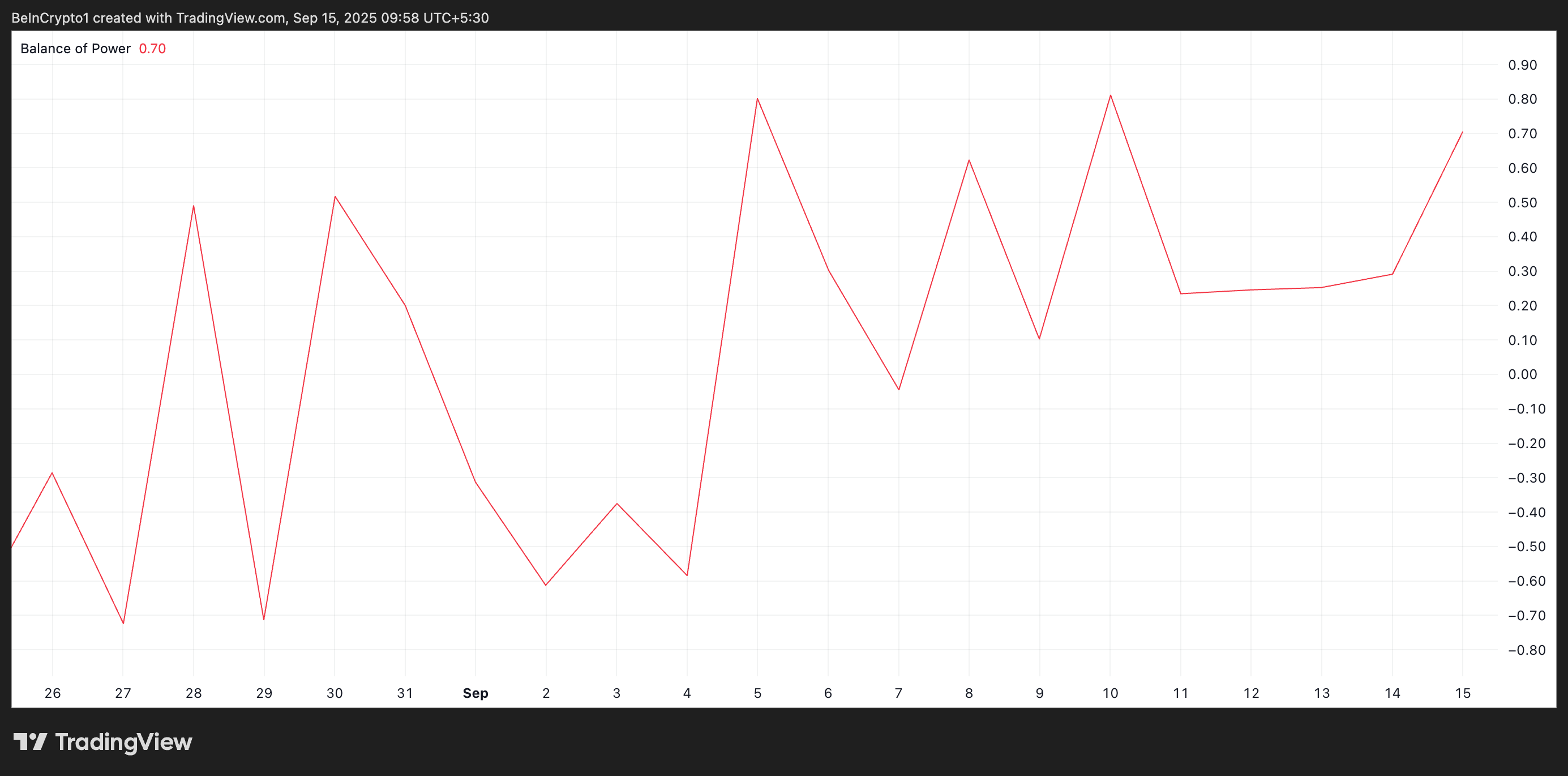

FLR’s positive Balance of Power (BoP), observed on a one-day chart, indicates strong buying momentum. As of this writing, the metric is at 0.70, reflecting that buyers are currently dominating the market.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

FLR BoP. Source:

FLR BoP. Source

FLR BoP. Source:

FLR BoP. Source

The BoP measures the strength of buyers versus sellers over a given period. When an asset’s BoP is positive, it signals that buying pressure exceeds selling pressure, pointing to bullish conditions.

Conversely, a negative BoP indicates that sellers are in control, a trend that often precedes price declines or periods of consolidation.

FLR’s current positive sentiment suggests buyers are actively pushing the price higher, strengthening the likelihood of a sustained rally.

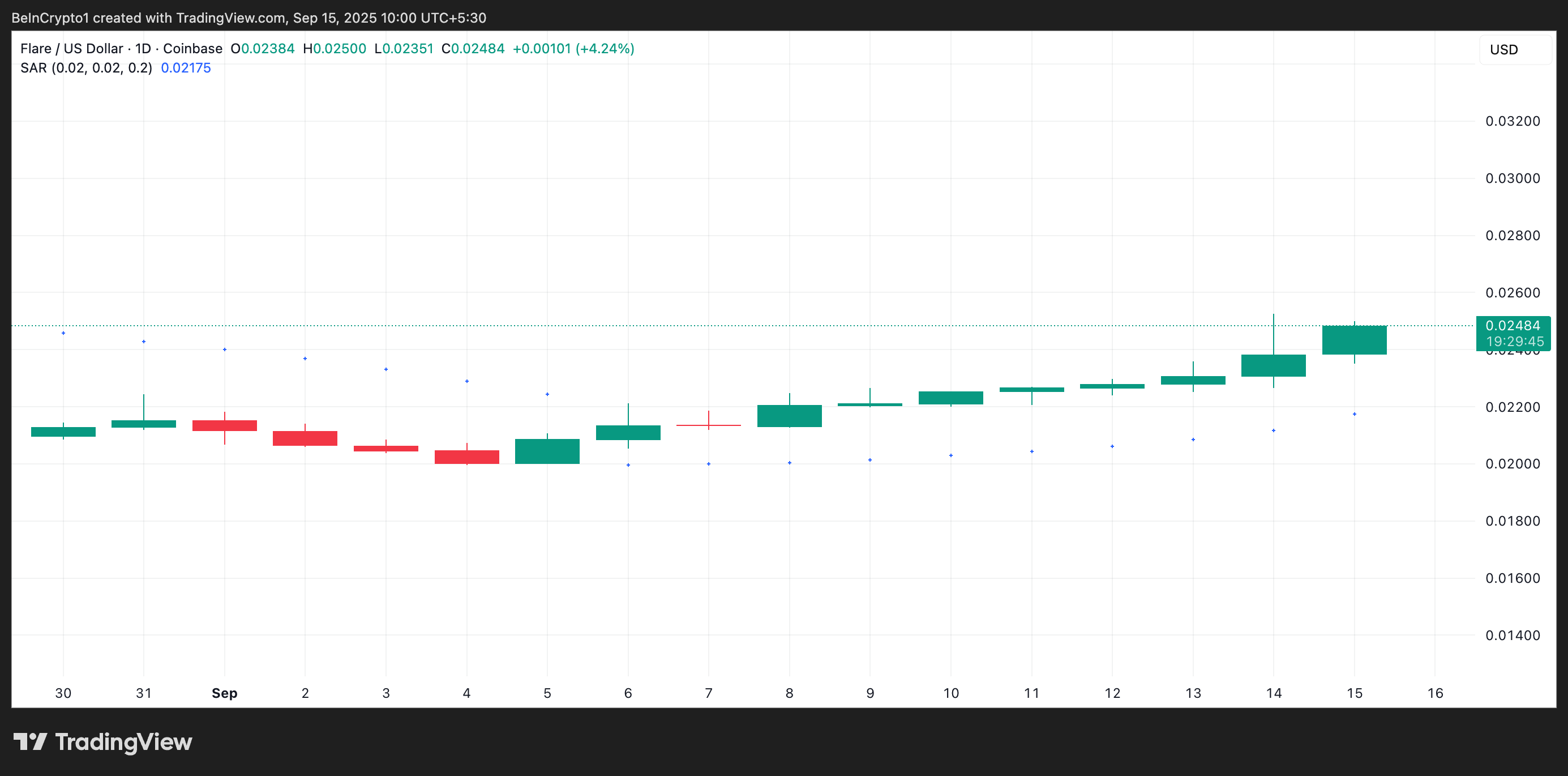

Furthermore, on the daily chart, the token sits above its Parabolic Stop and Reverse (SAR) indicator, adding to this bullish outlook. As of now, the SAR forms dynamic support below the token’s price at $0.02175, acting as a potential safety net for buyers.

FLR Parabolic SAR. Source:

FLR Parabolic SAR. Source

FLR Parabolic SAR. Source:

FLR Parabolic SAR. Source

The Parabolic SAR helps identify potential trend reversals and the overall direction of an asset’s price. It plots a series of dots either above or below the price to signal market trends.

When the dots are positioned below the price, as with FLR, it indicates an ongoing uptrend and that buying pressure is dominant. This means the bullish momentum is still strong and the token may continue climbing in the short term.

FLR Climbs, But Bears in Derivatives Aren’t Ready to Quit

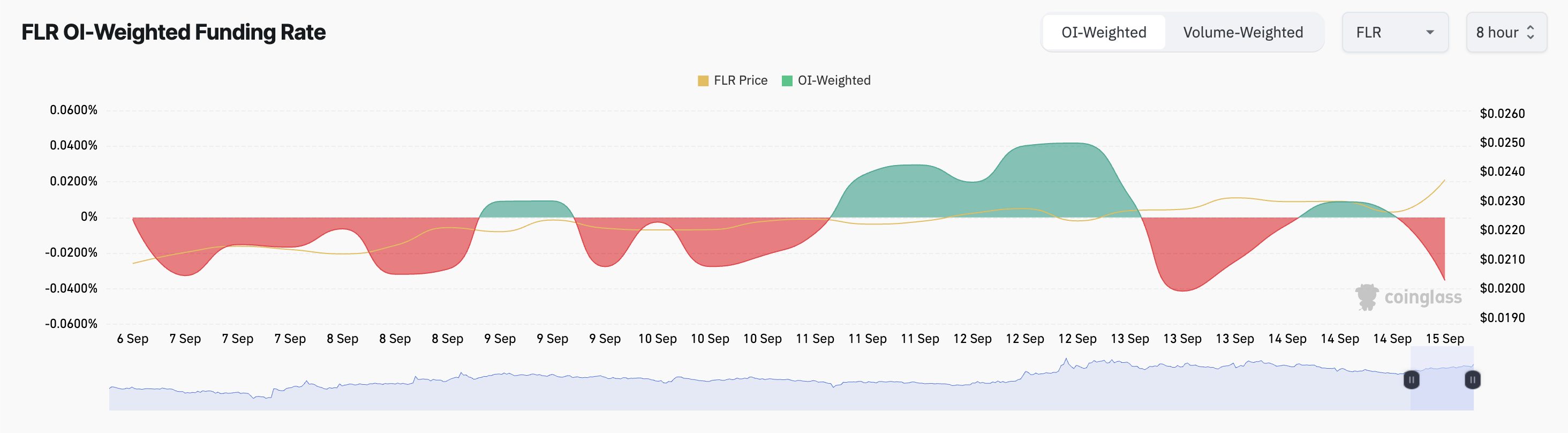

However, on-chain data suggests that derivatives traders are less optimistic about FLR’s recent rally. This is reflected in the token’s persistently negative funding rates, even as its price has surged over the past week. As of this writing, FLR’s funding rate stands at -0.0353%, according to Coinglass.

FLR Funding Rate. Source:

FLR Funding Rate. Source

FLR Funding Rate. Source:

FLR Funding Rate. Source

Funding rates are periodic payments exchanged between long (buy) and short (sell) positions in perpetual futures markets. They are designed to keep the contract price close to the spot price. A positive funding rate indicates that long positions are paying shorts, signaling bullish sentiment among derivatives traders.

Conversely, a negative funding rate means that shorts are paying longs, suggesting bearish sentiment or caution in the futures market.

For FLR, the negative funding rate implies that while spot traders are driving the price higher, derivatives traders are hedging against a potential pullback, highlighting a split in market confidence.

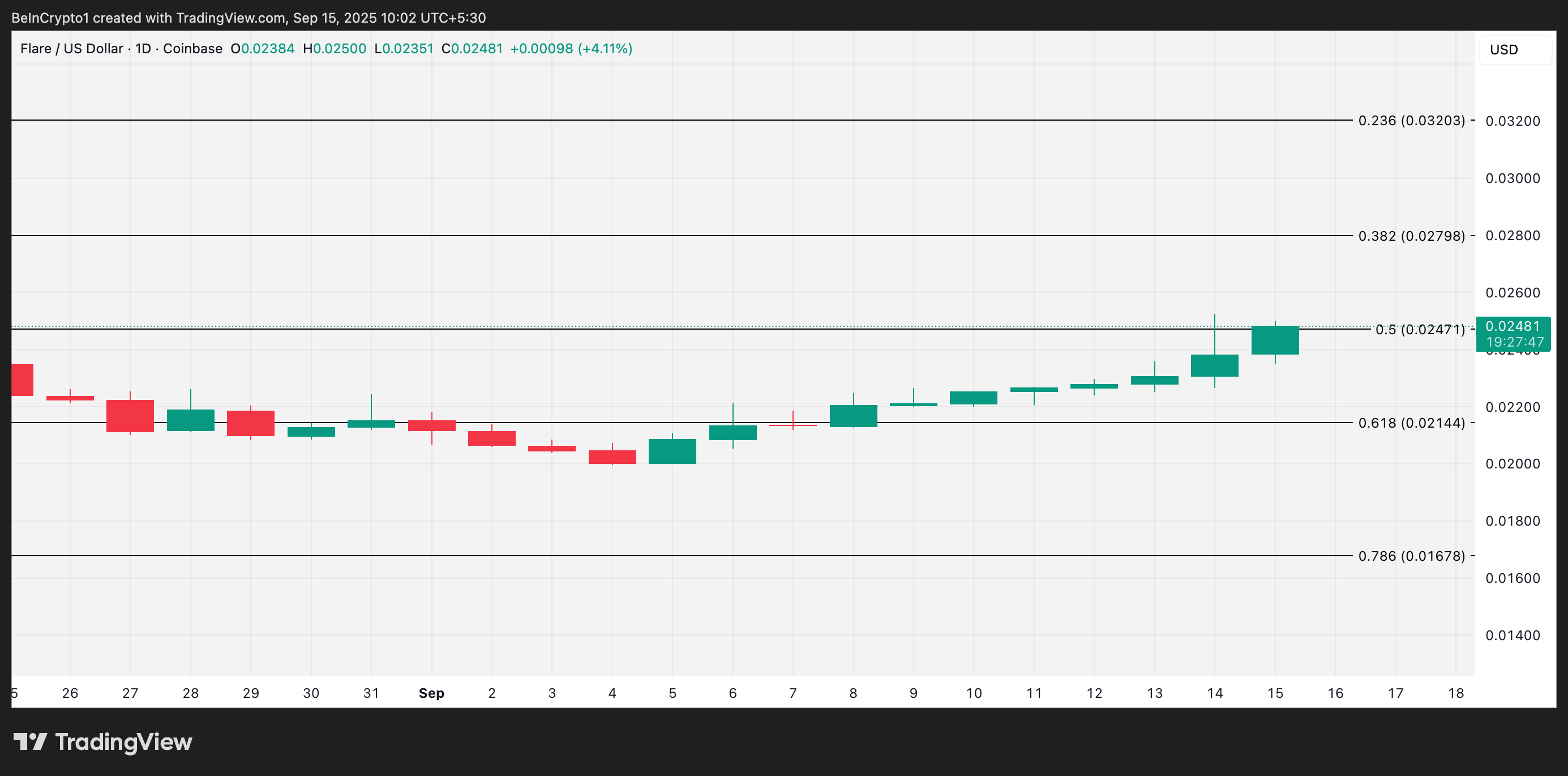

FLR Rally Hangs in the Balance—$0.028 Within Reach or Retreat to $0.021?

This divergence between spot momentum and derivatives sentiment could lead to short-term volatility, impacting FLR’s sustained rally.

If the bearish tilt in market sentiment spreads and spot traders resume profit-taking, the altcoin could shed some gains and fall to $0.02144.

FLR Price Analysis. Source:

FLR Price Analysis. Source

FLR Price Analysis. Source:

FLR Price Analysis. Source

However, a sustained rally could trigger a rally toward a two-month high of $0.02798.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Long English Thread] Scroll Co-founder: The Inevitable Path of ZK

"Tether" in 2025: Capital Analysis

Mars Morning News | The first SUI ETF is approved for listing and trading; SEC meeting reveals regulatory differences on tokenization, with traditional finance and the crypto industry holding opposing views

The first SUI ETF is listed, an SEC meeting reveals regulatory disagreements, bitcoin price drops due to employment data, US debt surpasses 30 trillions, and the IMF warns of stablecoin risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Moore Threads makes its debut with a surge of over 500%! The market value of the first domestic GPU stock once exceeded 300 billions yuan.

On its first day of trading, the "first domestic GPU stock" saw an intraday peak increase of 502.03%, with its total market value once exceeding 300 billions RMB. Market analysis shows that a single lot (500 shares) could earn up to 286,900 RMB at the highest point.