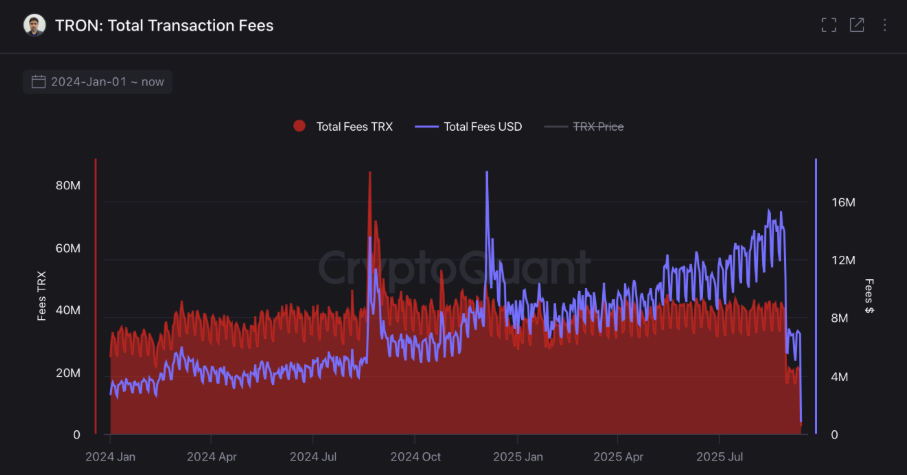

Tron’s Gas Fee Reduction Cuts Daily Revenue by 64% in 10 Days

Tron’s decision to lower transaction fees has quickly reduced the daily revenue earned by its block producers. Within 10 days of the fee change, revenue dropped sharply, according to recent on-chain data.

In Brief

- Tron’s gas fee cut reduced daily revenue by 64%, falling to $5M, the lowest in over a year.

- Proposal #789 lowered Tron’s energy unit price from 210 sun to 100 sun, cutting transaction costs by 60%.

- Despite reduced fees, Tron still captured 92.8% of layer-1 blockchain revenue over the past week.

Daily Revenue Falls After Proposal #789

Tron’s total daily network fees fell to $5 million on Sept. 7 as reported by CryptoQuant. This was the lowest level in more than a year . Just before the adjustment, on Aug. 28, daily revenue stood at $13.9 million.

The reduction followed the approval of Tron Proposal #789, which became active on Aug. 29. The proposal was supported by the Super Representative community. It lowered the energy unit price from 210 sun to 100 sun.

Average gas fees dropped by 60% after the change. Gas fees on the Tron network are measured in sun, the smallest divisible unit of TRX. One TRX is equal to one million sun. The new fee model has therefore reduced the cost of each transaction across the network.

Community Argument for Lower Transaction Fees

GrothenDI issued the proposal in August, seeking to create more user activity on Tron. “This change will ensure the sustainable and healthy development of the Tron ecosystem,” the proposal stated.

The adjustment was expected to encourage new transactions by making transfers less costly for users. GrothenDI estimated the lower fees could allow for 12 million additional transfers on the network. This would create new activity that may balance the lower revenue from fees.

Super Representatives, who validate and produce blocks on Tron, experienced the direct effect of the reduced revenue. However, the fee cut was designed to support the longer-term growth of the ecosystem by attracting more usage. The move also aimed to make Tron more competitive against other blockchains.

Tron Maintains Lead in Blockchain Revenue

Even with reduced fees, Tron remains the leading layer-1 network in terms of revenue. Data from Token Terminal showed that over the past seven days, Tron captured 92.8% of total revenue among layer-1 blockchains .

In the last 90 days, fees generated on Tron reached $1.1 billion. This placed it well ahead of Ethereum, Solana, BNB Chain, and Avalanche in the same period. Ethereum, however, continues to lead over a longer timeframe, with $13 billion in revenue over the past five years compared to Tron’s $6.3 billion.

The data shows Tron’s strong position despite the drop in daily income from gas fees. The network continues to handle large volumes of transactions that keep it ahead of its competitors. The long-term effect of the fee reduction will depend on whether higher user activity offsets the lower fee rate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins in 2025: You Are in Dream of the Red Chamber, I Am in Journey to the West

But in the end, we may all arrive at the same destination through different paths.

XRP’s Extreme Fear Level Mirrors Past 22 % Rally

Critical Bitcoin Bear Market Signal: 100-1,000 BTC Wallet Buying Slows Dramatically

Stunning Bitcoin Whale Awakening: Dormant Addresses Move $178M After 13 Years