Global crypto investment products shed $352 million in weekly outflows despite improved Fed rate cut prospects: CoinShares

Quick Take Global crypto investment products registered net outflows of $352 million last week, according to asset manager CoinShares. Weaker payroll figures and improving U.S. rate cut prospects failed to bolster sentiment, Head of Research James Butterfill said.

Global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares generated net outflows of $352 million last week, reversing the trend once again after the prior week's $2.5 billion inflows, according to CoinShares' data.

Weaker payroll figures and improving prospects for a September interest rate cut in the U.S. failed to bolster sentiment, CoinShares Head of Research James Butterfill said in a Monday report .

Trading volume also fell 27% week-over-week, suggesting the appetite for digital assets has cooled, Butterfill added. Nevertheless, with year-to-date inflows of $35.2 billion, 4.2% ahead of last year's total on an annualized basis, broader sentiment remains intact, he said.

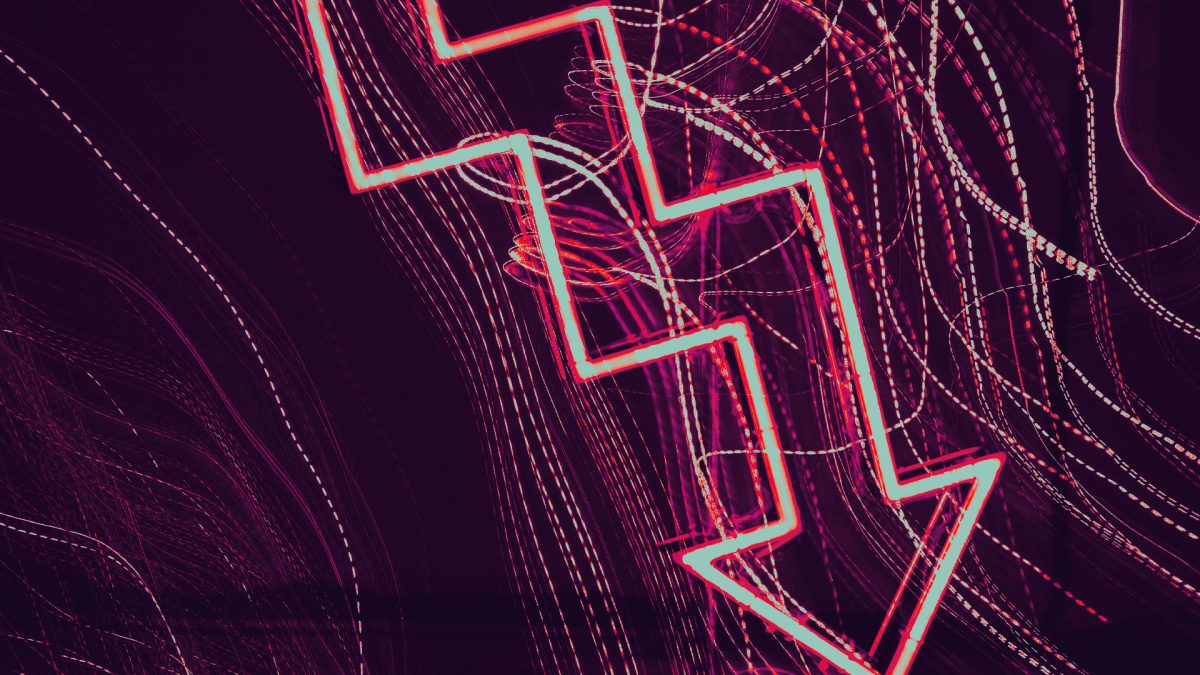

Weekly crypto asset flows. Images: CoinShares .

Ethereum investment products lead outflows

Regionally, sentiment was polarized, Butterfill noted, with U.S.-based digital asset investment products witnessing $440 million in net outflows, while crypto funds in Germany and Hong Kong saw inflows of around $85 million and $8 million, respectively.

Despite softer sentiment and modest outflows later in the week, Bitcoin funds still recorded $524 million in net inflows.

In contrast, Ethereum products drove last week's net outflows, with $912 million exiting across a broad set of ETP issuers. Still, year-to-date inflows remain strong at $11.2 billion, Butterfill said.

The U.S. spot Ethereum ETFs accounted for $787.6 million of last week's net outflow figure, according to data compiled by The Block, while the U.S. spot Bitcoin ETFs brought in $250.3 million.

Meanwhile, Solana and XRP-based investment products continued to witness modest but steady inflows of $16.1 million and $14.7 million, respectively. Solana investment products have now logged 21 consecutive weeks of inflows totaling $1.16 billion, while XRP funds have attracted $1.22 billion over the same period, Butterfill noted.

Earlier on Monday, CoinShares announced it is set to go public in the U.S. via a $1.2 billion merger with special purpose acquisition company Vine Hill that will see it listed on the Nasdaq.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.