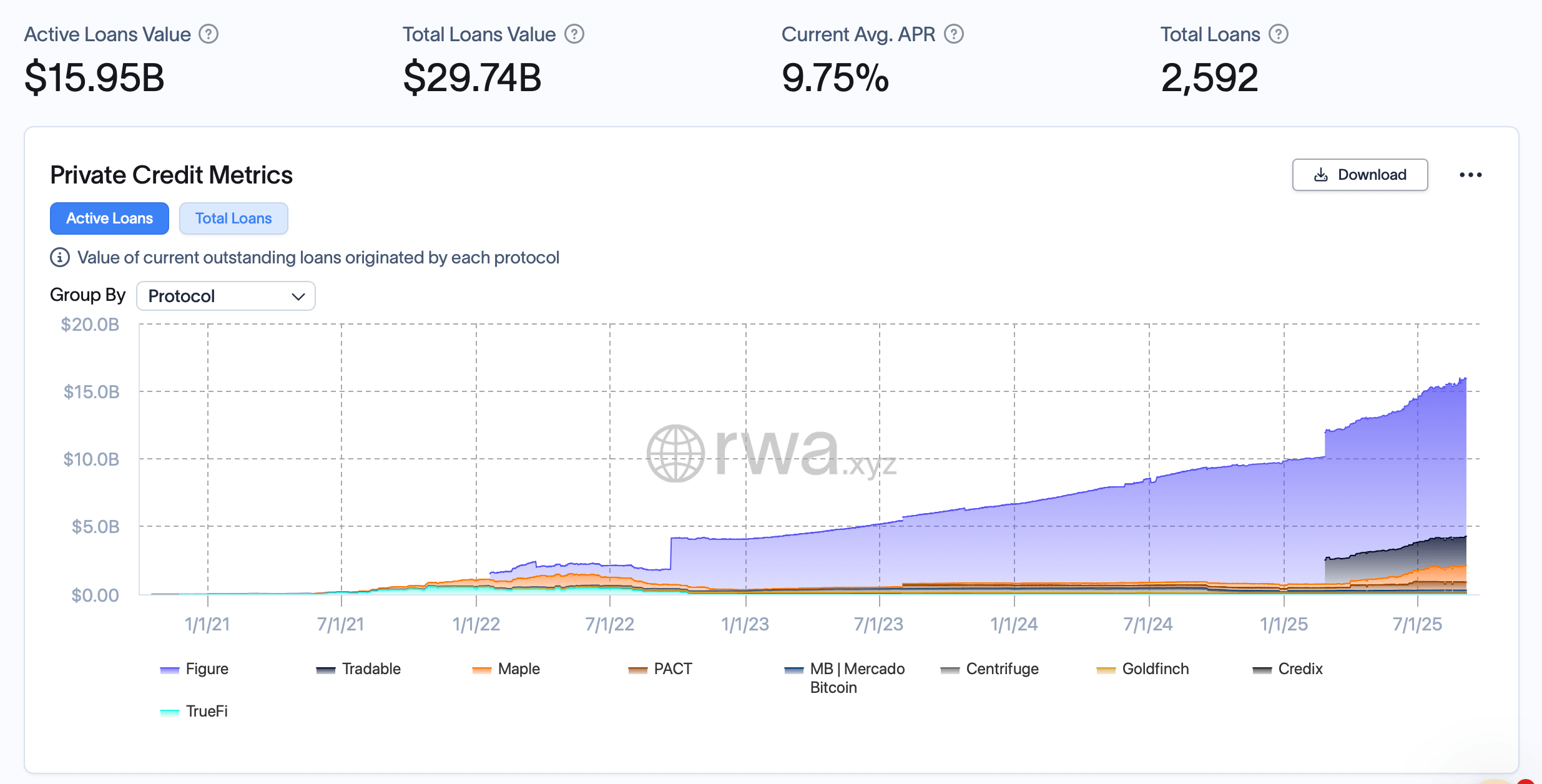

Active Tokenized Private Credit Loans Near $16 Billion, APR Slips Below 10%

Active loans in tokenized private credit now top $15.95 billion, signaling rapid growth but also sharper fault lines in protocol performance.

Loan Counts Fall as Tokenized Credit Market Consolidates

Tokenized private credit has grown significantly since mid-June, adding more than $2 billion in active loans and $4.3 billion in cumulative lending. As of Sept. 6, rwa.xyz stats show that active loans stand at $15.95 billion, while total loans originated reached $29.74 billion across 2,592 onchain loans. The average annual percentage rate (APR) declined from 10.33% to 9.75%, suggesting a tilt toward lower-risk or more competitive lending.

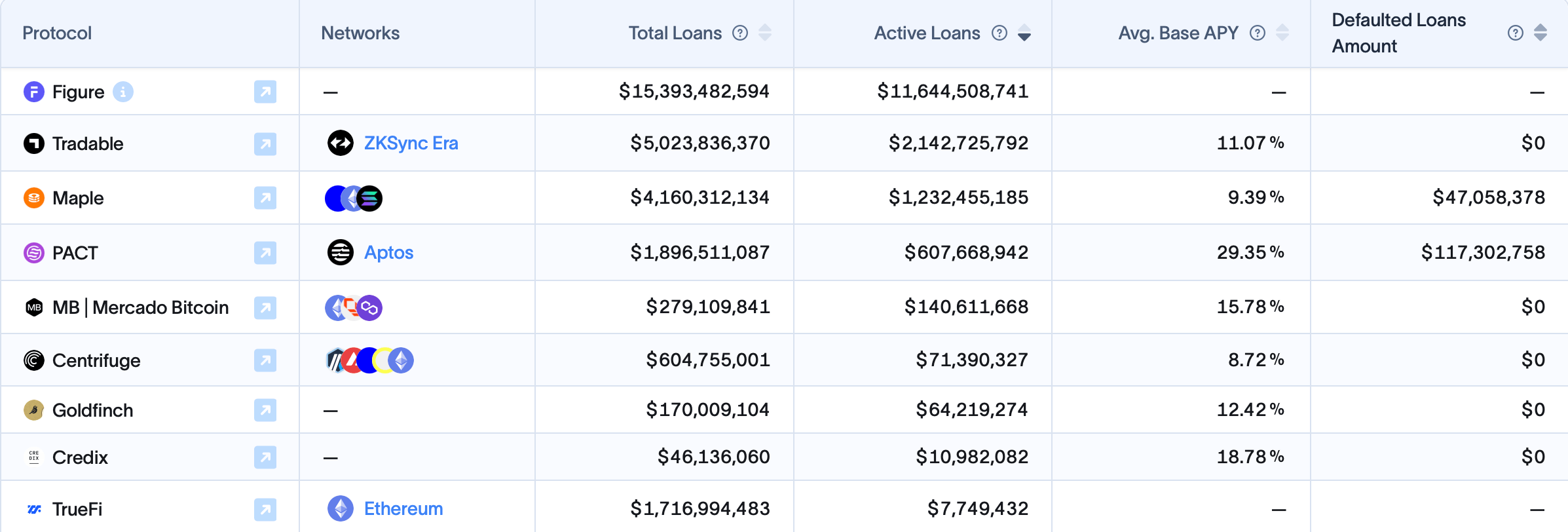

The number of loans fell from 2,665 to 2,592 over the same period, pointing to fewer but larger deals driving growth. Figure remains the dominant protocol, now holding $11.64 billion in active loans and accounting for the largest share of the market. Tradable, built on Zksync Era, has also emerged as a heavyweight with $2.14 billion in active loans out of more than $5 billion in originations.

Maple continues to expand with $1.23 billion active and $4.16 billion in total loans, though it faces $47 million in defaults. PACT, active on Aptos, shows the highest average base APY at 29.35%, paired with the largest default total at $117 million. In contrast, Credix and Centrifuge both show growth without defaults, while Goldfinch maintains $64 million in active loans with a 12.42% APY.

Protocols are now competing not only on origination volume but also on risk management. While defaults remain isolated to Maple and PACT, their scale points to the importance of credit vetting as decentralized finance (DeFi) platforms move deeper into real-world lending.

The overall expansion highlights the acceleration of tokenized credit adoption. With active loans up more than 14% since June and APRs trending lower, protocols appear to be maturing, offering institutional-style lending opportunities while absorbing credit risk in a transparent, onchain manner.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum’s major 2025 upgrade completed: a faster and cheaper mainnet has arrived

On December 4, Ethereum's second major upgrade of the year, Fusaka (corresponding to Epoch 411392), was officially activated on the Ethereum mainnet.

Durov's new project: Want to mine TON on Cocoon? Ordinary people can't afford to play

Want to mine TON on Cocoon? The starting capital is 250,000; ordinary people shouldn't dream of becoming a "computing power landlord."

"If you're afraid, buy bitcoin": BlackRock CEO calls bitcoin a "panic asset", says sovereign funds have quietly increased their holdings

BlackRock CEO Larry Fink defines Bitcoin not as a "hope asset," but as a "panic asset."

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.