Analyst: Even if inflation worsens, expectations for a Fed rate cut in September are unlikely to change

ChainCatcher news, according to Golden Ten Data, analyst Chris Anstey stated that before the release of inflation data, the market has fully anticipated that the Federal Reserve will cut interest rates in two weeks. For traders to abandon this expectation, it may require exceptionally strong employment growth data and a high CPI report. Even if the upcoming CPI shows intensified inflation, a rate cut seems to be a foregone conclusion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

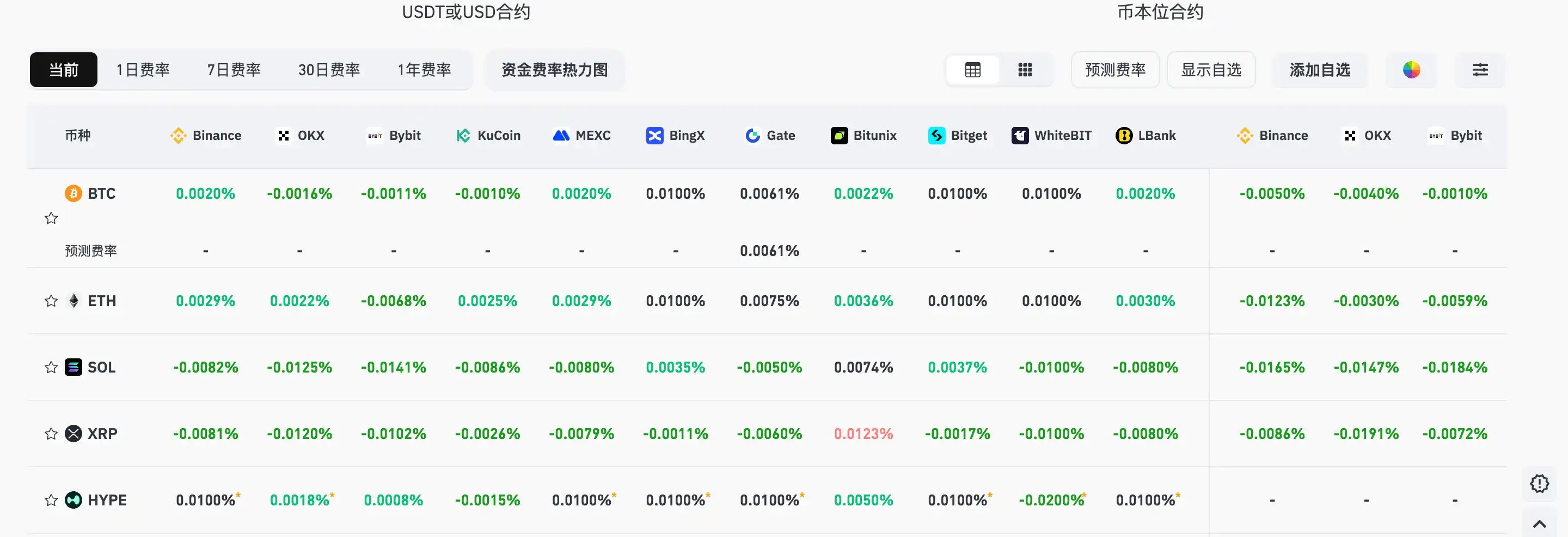

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.