- Solana surges past $214 amid strong retail and institutional demand.

- Alpenglow upgrade aims to cut block finality to 150 milliseconds.

- PSG1 console launch merges gaming, NFTs, and secure crypto storage.

Solana (SOL) has captured the attention of cryptocurrency investors this month, surging past $214 and outperforming major cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH).

On August 28, SOL surged to $214.57, marking a near 6% increase over 24 hours and a 14.3% surge over the past week.

This price surge can be attributed to the growing confidence in Solana’s technical roadmap amid the ongoing voting on the Alpenglow upgrade proposal, coupled with the network’s recent achievement of 107,540 transactions per second during a stress test, demonstrating its capacity for high-throughput applications.

Alpenglow upgrade sparks optimism

At the heart of Solana’s recent momentum is the Alpenglow upgrade, a network overhaul aimed at drastically improving transaction speed and consensus efficiency.

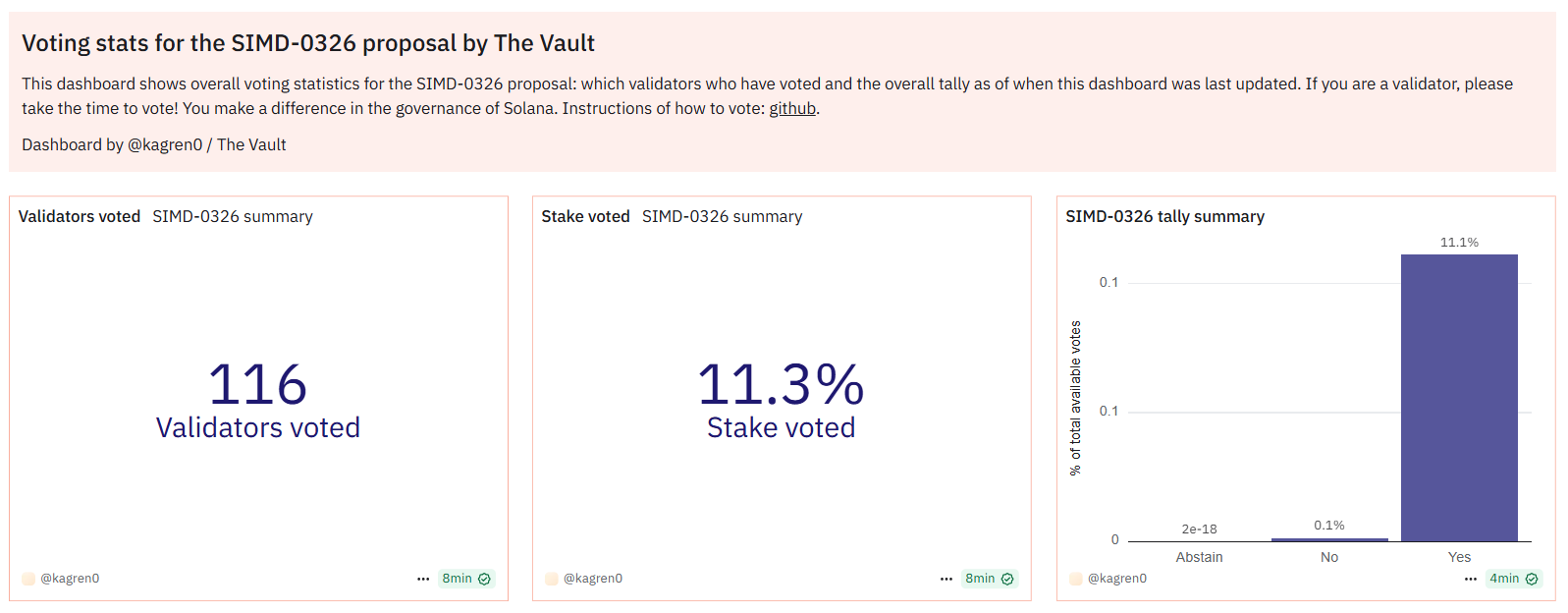

The community has begun voting on the SIMD-0326 proposal , which seeks to replace the current Proof-of-History and TowerBFT mechanisms with a new architecture called Votor.

Votor’s direct-vote protocol is designed to reduce block finality from 12.8 seconds to an impressive 150 milliseconds, while Rotor, a simplified block propagation system, will streamline data dissemination across the network.

Investors and developers alike are closely monitoring the vote, which spans three epochs and requires a two-thirds majority of validators to pass.

Although only 11.3% of validators have cast votes so far, the proposal is being widely viewed as a transformative step for the Solana ecosystem.

The upgrade promises not only to accelerate transaction confirmation but also to enhance the performance of decentralised applications, making the network more competitive in the high-speed blockchain arena.

Play Solana Gen 1 (PSG1) handheld console

Adding to Solana’s bullish narrative is the upcoming release of the Play Solana Gen 1 (PSG1) handheld console.

Scheduled to begin shipping on October 6 , the device represents Solana’s continued push into consumer hardware and Web3 gaming.

The PSG1 combines gaming capabilities with a secure crypto wallet, allowing users to store digital assets via fingerprint authentication while enjoying a touchscreen experience powered by an octa-core ARM processor and 8GB of RAM.

The console also features a limited NFT collection of 2,000 tokens, offering holders early access and exclusive perks.

This marks a logical extension of Solana’s hardware strategy, which began with the Saga smartphone in 2022 and continued with the Seeker device in 2024.

These devices highlighted the demand for blockchain-integrated consumer products, with Seeker alone securing over 150,000 pre-orders and generating an estimated $67.5 million in revenue.

The PSG1 launch not only expands Solana’s physical product portfolio but also reinforces the ecosystem’s focus on blending crypto, NFTs, and gaming, attracting both developers and retail users.

This integration of entertainment and blockchain functionality is expected to drive engagement and position Solana as a pioneer in consumer-facing Web3 products.

Retail and institutional interest surge

Alongside technical upgrades and hardware launches, Solana’s market sentiment has been increasingly bullish.

Retail investors are displaying unprecedented optimism, with bullish-to-bearish sentiment ratios reaching 5.8:1 — the highest in eleven weeks.

Institutional interest has also intensified, with firms such as Pantera, Galaxy Digital, and Jump Crypto taking substantial positions in SOL.

Speculation surrounding a potential Solana ETF approval, anticipated by October, has added further fuel to the market rally.

But despite these positive signals, challenges remain.

Retail participation on Solana-based decentralised exchanges has declined from 4.8 million daily traders earlier this year to just 900,000 in August, influenced by meme coin scams, social media hacks, and the growing dominance of Ethereum’s DeFi ecosystem.

While SOL’s DEX volume share has rebounded to 27%, analysts caution that reliance on meme coin activity may limit long-term growth unless the network diversifies its offerings.

Nevertheless, the combination of network upgrades, innovative hardware releases, institutional backing, and bullish retail sentiment paints a positive outlook for Solana.

With the Alpenglow upgrade and PSG1 console debut on the horizon, the blockchain is positioning itself at the forefront of both high-performance DeFi applications and consumer-facing Web3 products, signalling a period of heightened activity and investor confidence.