Bitcoin Leverage Ratio Drops, Easing Correction Risks as Price Holds Near $119K

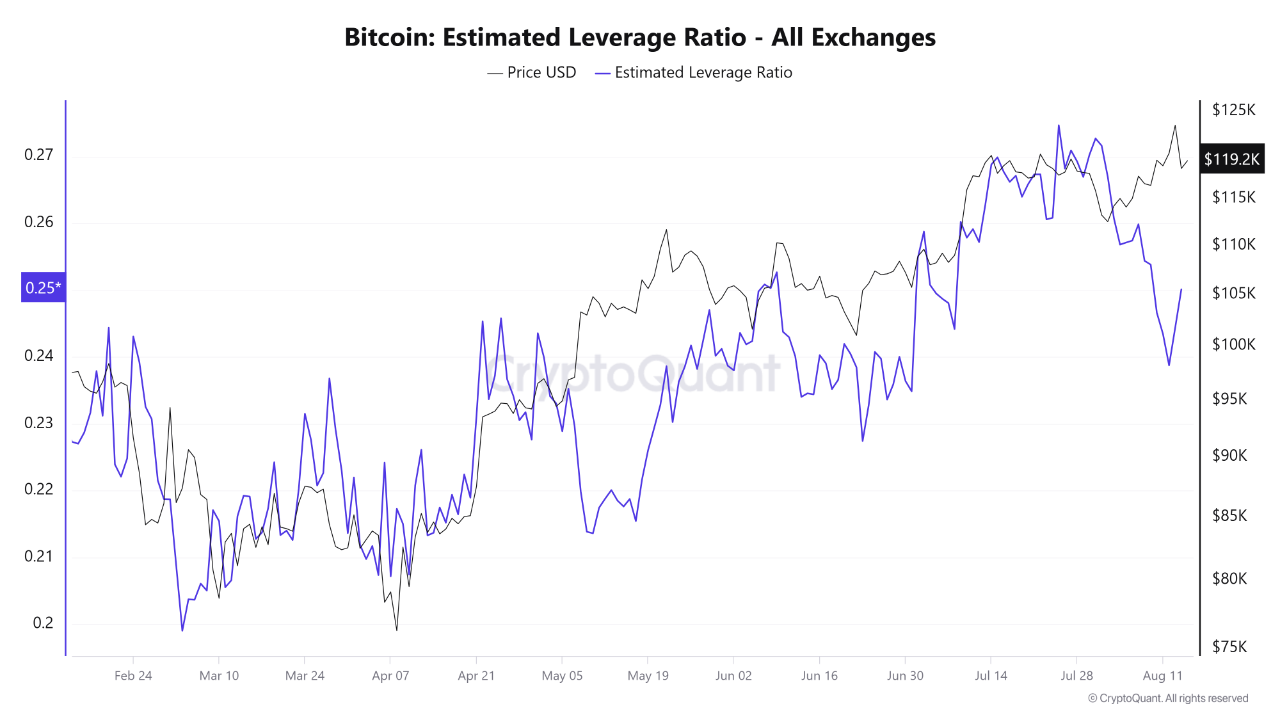

Bitcoin’s estimated leverage ratio (ELR) has dropped from its late July and early August highs, reducing the likelihood of sharp market corrections and helping to sustain price stability at elevated levels.

Bitcoin’s estimated leverage ratio (ELR) has dropped from its late July and early August highs, reducing the likelihood of sharp market corrections and helping to sustain price stability at elevated levels.

Data from CryptoQuant shows the ELR peaked above 0.27 before falling sharply in early August to around 0.25, where it has since stabilized with minor fluctuations. From May to late July, both Bitcoin’s price and leverage ratio rose in parallel, reflecting a surge in traders entering the market with larger positions.

Source

:

CryptoQuant

.

Source

:

CryptoQuant

.

The recent decline in leverage, despite Bitcoin holding near $119,000, points to position closures or liquidations without a matching price drop. Analysts say the lower ELR indicates that current market momentum is being fuelled more by spot buying and genuine liquidity than by speculative leverage.

If the ELR remains between 0.24 and 0.25, coupled with a steady move above the $120,000 threshold, it could pave the way for a renewed rally towards the July highs, supported by moderate funding rates and gradually rising open interest.

However, a sharp rise in leverage above 0.27 before or during a test of the $120,000–$124,000 range could heighten the risk of liquidations and trigger a downside “shakeout”, driven by the combination of high leverage, elevated funding rates, and weak price divergence.

Market conditions are currently calmer than at the July peak, with excess leverage already flushed out. This reduction in speculative pressure could provide a stronger base for the next price move, though the balance between leverage levels and price momentum remains key to Bitcoin’s short-term outlook.

Meanwhile, Bitcoin’s futures market momentum has cooled. The Bitcoin Futures Power Index has fallen to zero in August after a series of positive readings that coincided with price gains, a shift signalling weaker futures market strength based on open interest, funding rates, and taker order imbalances, according to CryptoQuant.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB shifts stance! Will interest rate hikes resume in 2026?

In the debate over "further tightening" versus "maintaining the status quo," divisions within the European Central Bank are becoming increasingly public. Investors have largely ruled out the possibility of the ECB cutting interest rates in 2026.

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.