Date: Thu, Aug 14, 2025 | 05:50 AM GMT

The cryptocurrency market is in full bullish swing as Bitcoin (BTC) hits a new all-time high of $124,000 today, while Ethereum (ETH) broke above the $4,700 mark for the first time since 2021, surging over 28% in weekly gains. This wave of bullishness has lifted sentiment across major altcoins, including Cronos (CRO).

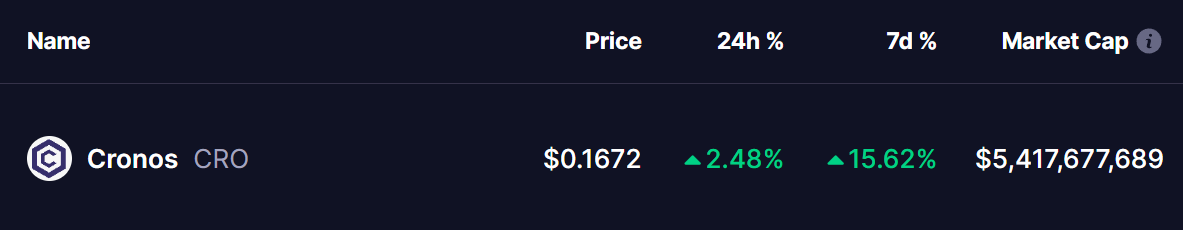

CRO has posted an impressive 15% gain over the past week, and notably, its latest price structure is revealing a key harmonic setup that signals potential upside in the near term.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Bounce

On the daily chart, CRO is developing a Bearish ABCD harmonic pattern — a formation that, despite its name, often experiences a strong bullish CD-leg before hitting the final Potential Reversal Zone (PRZ).

The rally began with a move from Point A near $0.07989 to Point B, followed by a retracement to Point C around $0.12200, where buying pressure reemerged. Since then, CRO has climbed to roughly $0.1669, indicating that the CD leg is actively in progress.

Cronos (CRO) Daily Chart/Coinsprobe (Source: Tradingview)

Cronos (CRO) Daily Chart/Coinsprobe (Source: Tradingview)

If the pattern follows the traditional ABCD projection, the CD leg could extend toward the 2.51 Fibonacci projection of the BC leg, placing the PRZ near $0.1919 — about 15% above current prices.

What’s Next for CRO?

If bullish momentum persists, CRO could test the $0.1919 level. However, this zone is expected to act as a strong resistance area, potentially triggering profit-taking or short-term pullbacks. Before the target is reached, traders should also remain cautious about possible retracements toward lower support zones.