$120K and Rising: What On-Chain Data Says About Bitcoin’s Next Move

Bitcoin has continued its upward momentum over the past week, reclaiming price levels close to its all-time high. At the time of writing, the cryptocurrency is trading above $120,000, only a short distance from the record of more than $123,000.

Over the last seven days, the asset has posted a gain of approximately 5.1%, placing it among the stronger performers in the digital asset market.

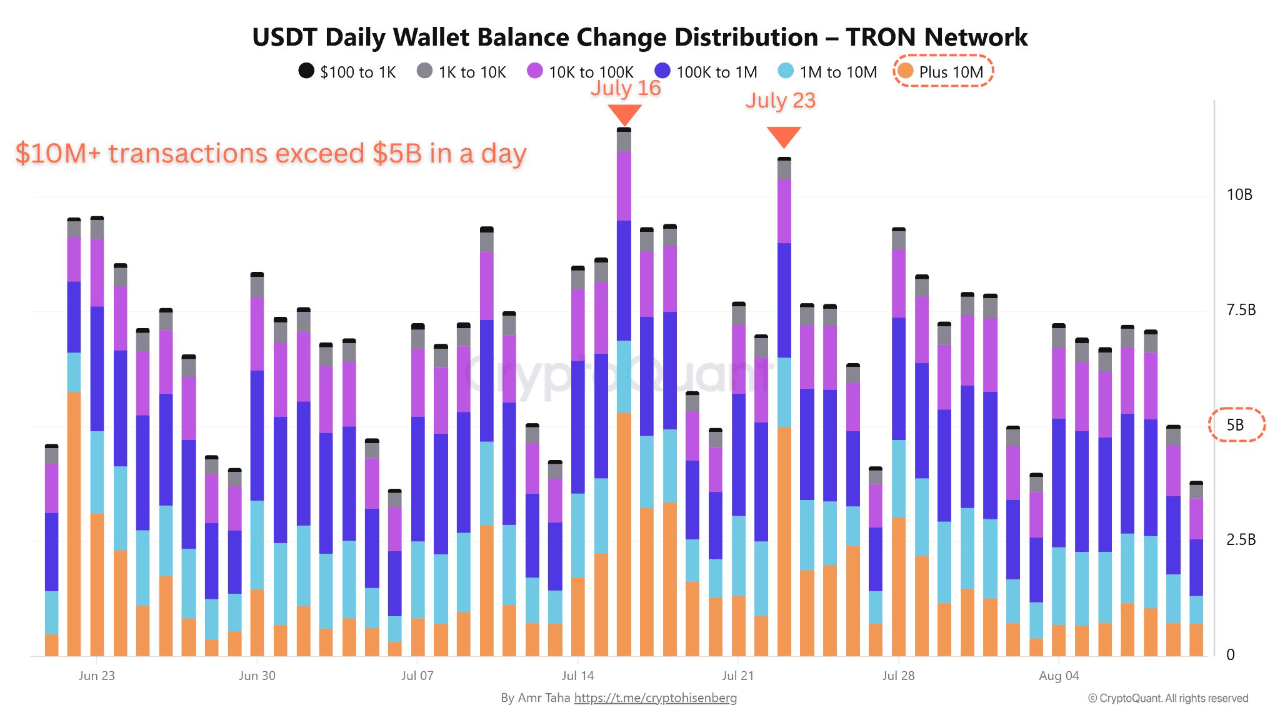

Amid the price movement, on-chain data from the TRON network’s USDT transfers is offering insights into current market behavior. CryptoQuant contributor Amr Taha analyzed TRC-20 USDT transaction flows and identified patterns that may serve as potential indicators of Bitcoin price shifts.

By categorizing transactions into six size groups, ranging from retail trades of $100 to large “super whale” transfers exceeding $10 million, the analysis aims to distinguish between everyday market activity and institutional-scale transactions.

Large USDT Transfers as a Market Signal

Taha’s research notes that when transactions exceeding $10 million in USDT on the TRON network surpass $5 billion in a single day, this often coincides with significant profit-taking in Bitcoin.

Such activity typically involves converting BTC into USDT, followed by transferring the stablecoins to private wallets, reducing buying pressure in the spot market.

Past examples include July 16, when $10M+ USDT transfers reached $5.2 billion, followed by a 4.5% decline in BTC, and July 23, when $5.8 billion in similar transfers preceded a 3.8% drop within 48 hours.

Current data, however, shows a lack of such large-scale transactions, suggesting that major holders are not actively selling into stablecoins at present. This absence of substantial whale outflows may indicate that large investors are maintaining positions rather than exiting the market.

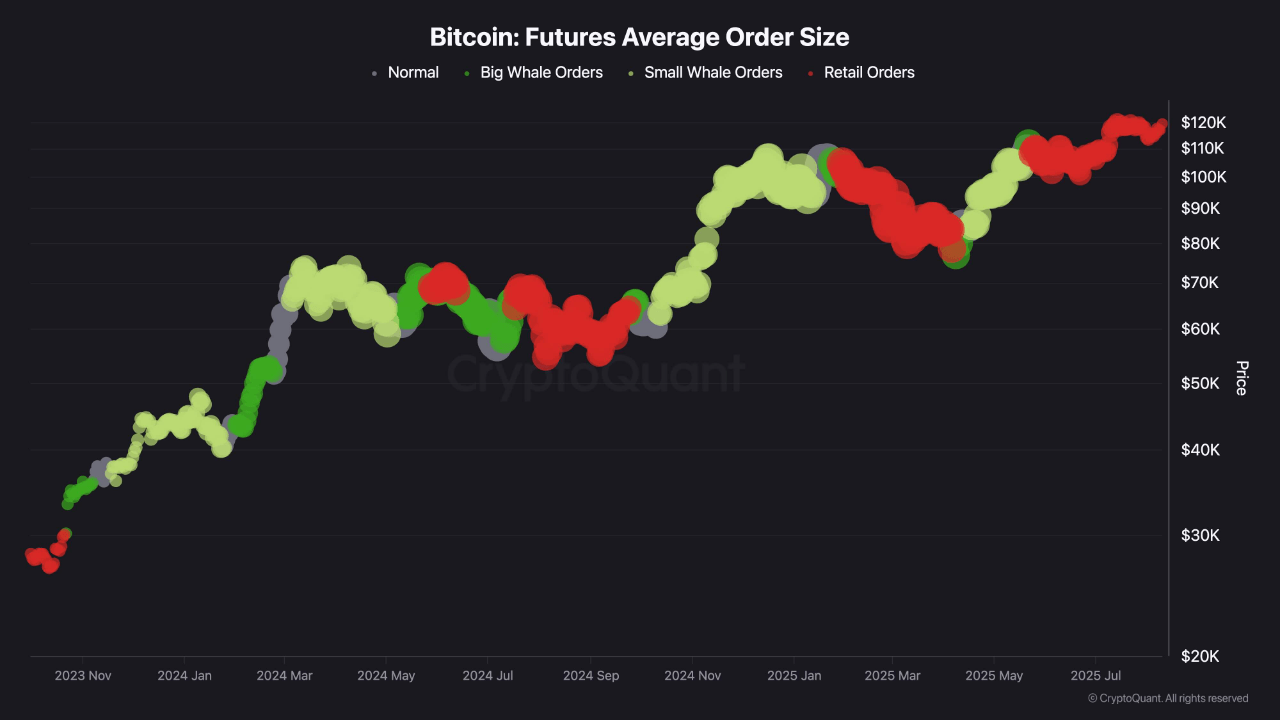

Bitcoin Shifting Market Participation and Potential Breakout Scenarios

A separate analysis from CryptoQuant’s ShayanMarkets examined the average executed order size in Bitcoin futures markets, providing another perspective on participation trends.

This metric, which divides total traded volume by the number of executed orders, helps identify whether activity is being driven by retail participants or larger, institutional traders.

Data from late 2024 and early 2025 showed periods of whale dominance, which coincided with strong rallies. In contrast, recent weeks have seen a rise in smaller, retail-sized orders, while whale-driven trades have diminished.

This shift suggests that large-scale buyers may be holding positions acquired at lower price levels or waiting for new market conditions before re-entering with significant volume.

Historically, extended whale dominance near market highs has often been associated with distribution phases, where large holders take profits.

The current absence of such behavior leaves open the possibility of a bullish breakout above Bitcoin’s previous all-time high, provided that renewed selling pressure from large investors does not emerge in the near term.

Featured image created with DALL-E, Chart from TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.