Bitcoin and Ethereum ETFs See Massive Setback After a Record Month

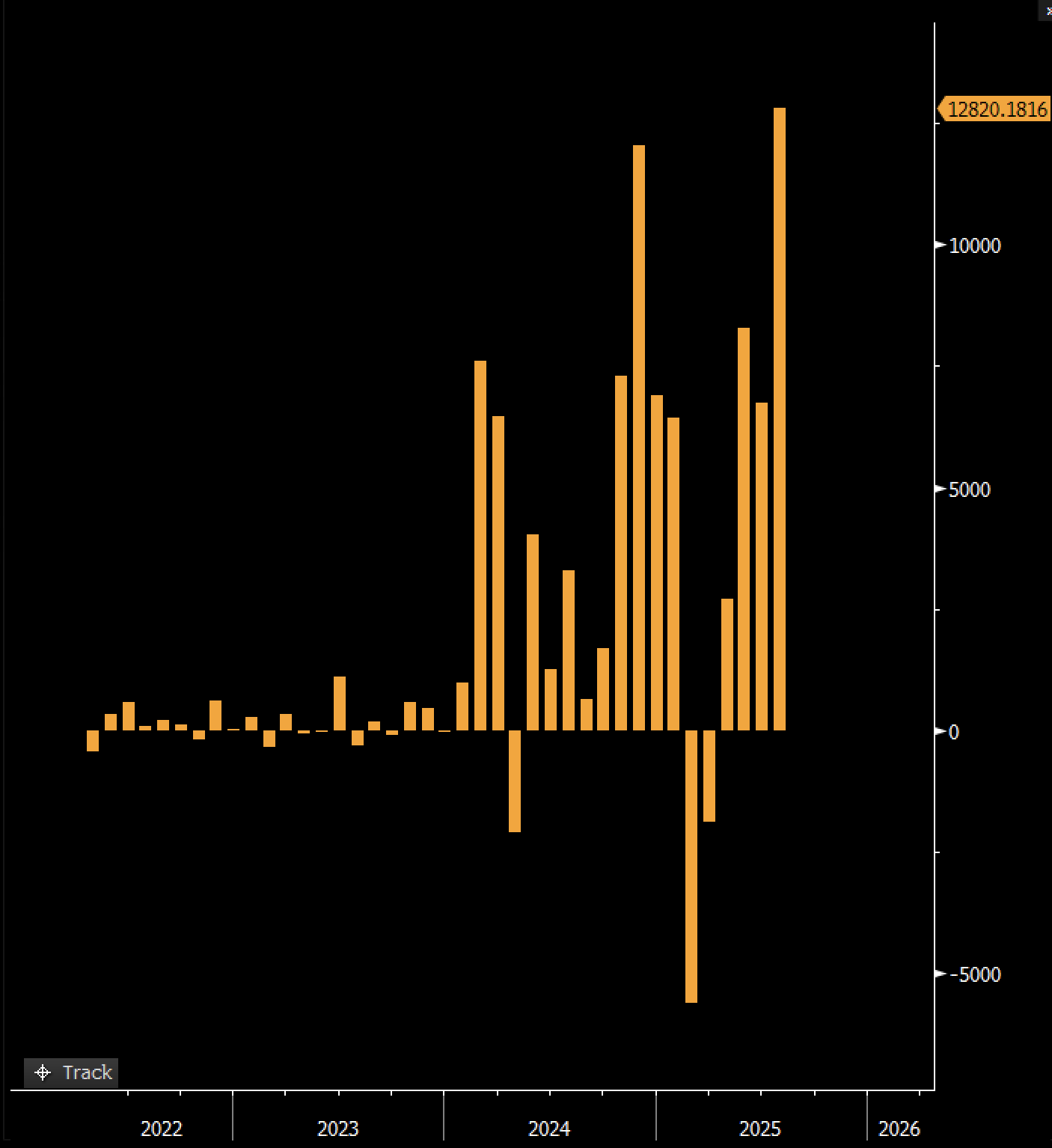

The US crypto ETFs downturn came just after a record-breaking July, where they attracted $12.8 billion in inflows, outpacing even top traditional funds.

US spot crypto exchange-traded funds (ETFs) stumbled into August with nearly $1 billion in combined outflows, ending what had been a strong run in July.

Data from SoSoValue revealed that investors pulled $812 million from 12 US-listed Bitcoin ETFs on August 1. This marked the largest single-day withdrawal in five months and the second-worst for this year.

Crypto ETFs Shock Outflow Contrasts Historic July Gains And Regulatory Developments

Ethereum ETFs, which had recently gained momentum, also saw notable redemptions on the day.

In total, $153 million exited the nine Ethereum products, marking their third-largest single-day outflow since launch and ending a 20-day streak of inflows. During the inflow streak, ETH ETFs pulled in more than $5 billion in fresh capital.

This reversal comes on the heels of a banner month in July, where the crypto industry had scored significant gains.

During the period, Bloomberg senior ETF analyst Eric Balchunas highlighted that US crypto funds attracted $12.8 billion in fresh capital. This represented an average daily inflow of $600 million.

US Crypto ETFs Inflow in July. Source:

Eric Balchunas

US Crypto ETFs Inflow in July. Source:

Eric Balchunas

Notably, the inflows were broadly distributed, with both Bitcoin and Ethereum products contributing significantly.

Balchunas noted that this pace outstripped even the performance of top conventional ETFs like the Vanguard S&P 500 ETF (VOO).

So, the timing of the downturn has raised eyebrows across the industry, especially as regulatory developments appeared to favor continued growth in crypto markets.

In July, SEC Chair Paul Atkins unveiled “Project Crypto,” a new regulatory initiative. The project aims to modernize US securities laws to better align with blockchain-based financial systems.

“The SEC will not stand idly by and watch innovations develop overseas while our capital markets remain stagnant. To achieve President Trump’s vision of making America the crypto capital of the world, the SEC must holistically consider the potential benefits and risks of moving our markets from an off-chain environment to an on-chain one,” Atkins said.

As part of this broader push, the SEC approved in-kind redemptions for crypto ETFs and accelerated the review of applications for exchange-sponsored products.

Considering these developments, NovaDius Wealth President Nate Geraci opined that the ETF outflows were surprising.

According to him, they stood in sharp contrast to the broader momentum seen across the crypto market. He also described the sudden pullback as a surprisingly muted end to one of the most pivotal weeks for the digital asset space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.