Bitcoin Independence Day on August 1, 2017, marks the SegWit upgrade that reduced miner dominance and led to Bitcoin Cash’s creation, fundamentally altering Bitcoin’s scaling path and market dynamics.

-

SegWit activation introduced a protocol upgrade enhancing Bitcoin’s scalability and security.

-

The Bitcoin Cash hard fork emerged from disagreements over block size and transaction capacity.

-

Since 2017, Bitcoin’s price surged over 4,200%, while Bitcoin Cash’s value remained relatively flat.

Bitcoin Independence Day highlights the 2017 SegWit upgrade and Bitcoin Cash fork. Discover how these events shaped BTC’s growth and BCH’s market trajectory.

-

Bitcoin Independence Day marks a pivotal moment in crypto history.

-

The 2017 SegWit upgrade reduced miner control and enabled off-chain scaling solutions.

-

Roger Ver led the Bitcoin Cash faction advocating larger blocks for everyday transactions.

Bitcoin Independence Day celebrates the 2017 SegWit upgrade and BCH fork, key events that shaped Bitcoin’s future. Learn how BTC and BCH have evolved since.

What was the impact of the 2017 SegWit activation on Bitcoin?

The 2017 Segregated Witness (SegWit) activation was a crucial upgrade that improved Bitcoin’s transaction capacity and security by separating signature data from transaction data. This change reduced miner influence over protocol decisions and enabled the development of off-chain scaling solutions like the Lightning Network, preserving decentralization by keeping node operation accessible to average users.

How did the Bitcoin Cash fork originate from the block size debate?

The Bitcoin Cash (BCH) fork resulted from a split between “big blockers,” led by Roger Ver, who advocated increasing Bitcoin’s block size to support more transactions per block, and those prioritizing decentralization by maintaining smaller blocks. This disagreement culminated in August 2017 when BCH was created as a separate chain, focusing on larger blocks to facilitate everyday payments, diverging from Bitcoin’s path as a store of value.

Source: Roger Ver

How have Bitcoin and Bitcoin Cash performed since the split?

Since the August 2017 fork, Bitcoin’s price has increased by approximately 4,200%, rising from around $2,718 to about $115,000, despite market volatility. In contrast, Bitcoin Cash’s price peaked near $1,600 in May 2021 but dropped to lows near $90 during the 2022 bear market and currently trades around $552, close to its initial post-fork value. Bitcoin’s market capitalization now exceeds $2.2 trillion, while Bitcoin Cash holds about $10.9 billion.

The price of Bitcoin Cash, shown in magenta, has remained fairly flat, despite oscillations throughout the years, while BTC has appreciated to over $115,000. Source: TradingView

What ongoing debates define Bitcoin’s future?

The split between Bitcoin and Bitcoin Cash underscores a continuing debate: whether Bitcoin should serve primarily as a decentralized store of value or as a scalable medium for daily transactions. This tension influences development priorities, community support, and market perception, with Bitcoin focusing on security and decentralization, while Bitcoin Cash emphasizes transaction throughput and usability.

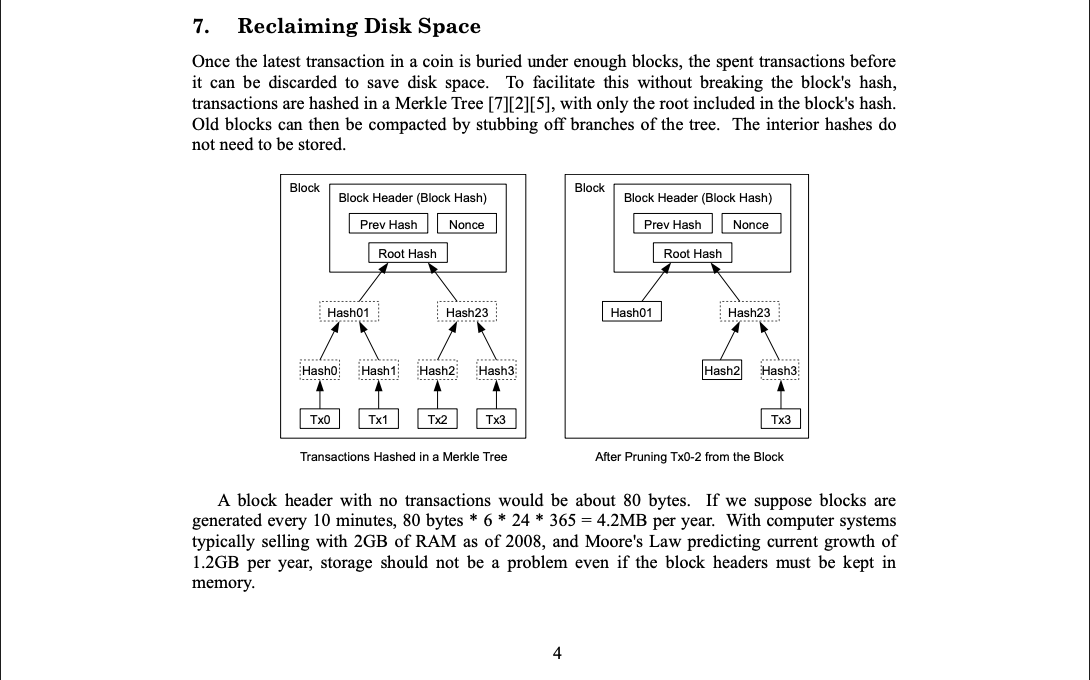

Excerpt from Satoshi Nakamoto’s Bitcoin white paper about keeping storage costs for nodes manageable. Source: Bitcoin.Org

Frequently Asked Questions

What is Bitcoin Independence Day?

Bitcoin Independence Day refers to August 1, 2017, when SegWit was activated on the Bitcoin network, reducing miner control and leading to the Bitcoin Cash hard fork.

Why did Bitcoin Cash split from Bitcoin?

Bitcoin Cash split due to disagreements over block size, with BCH proponents wanting larger blocks to increase transaction capacity, diverging from Bitcoin’s focus on decentralization.

How has Bitcoin’s price changed since 2017?

Bitcoin’s price has surged over 4,200% since 2017, growing from approximately $2,718 to around $115,000, reflecting strong market adoption and investment.

Key Takeaways

- SegWit activation: Improved Bitcoin’s scalability and reduced miner dominance.

- Bitcoin Cash fork: Emerged from block size disagreements, focusing on larger blocks.

- Market performance: Bitcoin’s value surged significantly, while Bitcoin Cash remained relatively stable.

Conclusion

The 2017 SegWit activation and subsequent Bitcoin Cash fork represent a defining moment in cryptocurrency history, highlighting fundamental debates over scalability and decentralization. Bitcoin’s remarkable growth since then underscores its position as a leading store of value, while Bitcoin Cash continues to serve niche use cases. These dynamics will shape the future of blockchain technology and digital finance.