Tsunami Warning Has Traders Watching for a Repeat of the 2020 “Panic Sell” in Crypto

Official agencies have issued a tsunami warning for the Pacific coasts of the United States, Japan, and other regions following a massive 8.7 magnitude earthquake near Russia’s Kamchatka Peninsula. The warning has put global markets on edge, with President Donald Trump making a public appeal for those in the affected areas to stay safe.

Due to a massive earthquake that occurred in the Pacific Ocean, a Tsunami Warning is in effect for those living in Hawaii. A Tsunami Watch is in effect for Alaska and the Pacific Coast of the United States. Japan is also in the way. Please visit for the…

— Donald J. Trump (@realDonaldTrump) July 30, 2025

Depending on the severity of the tsunami, the highly leveraged and sentiment-driven crypto market could be impacted. Historical precedents show that major external shocks can trigger sharp sell-offs.

Related: Bitcoin (BTC) Price Prediction for July 30

“Panic selling” on the horizon?

For instance, the 2020 COVID-19 pandemic caused a spike in panic selling that saw the Bitcoin price plummet over 37% in 24 hours, liquidating over $1 billion in leveraged positions.

Related: Bitcoin ETFs Create “Demand Shock,” Buying 10x More BTC Than Is Mined

While the current situation may not cause a similar economic downturn, crypto traders must remain vigilant for the risk of a fear-driven sell-off.

On-chain data shows the market is not overheated

Despite this risk, the crypto market has matured significantly in recent years, with massive adoption from both retail and corporate players like Strategy (NASDAQ: MSTR).

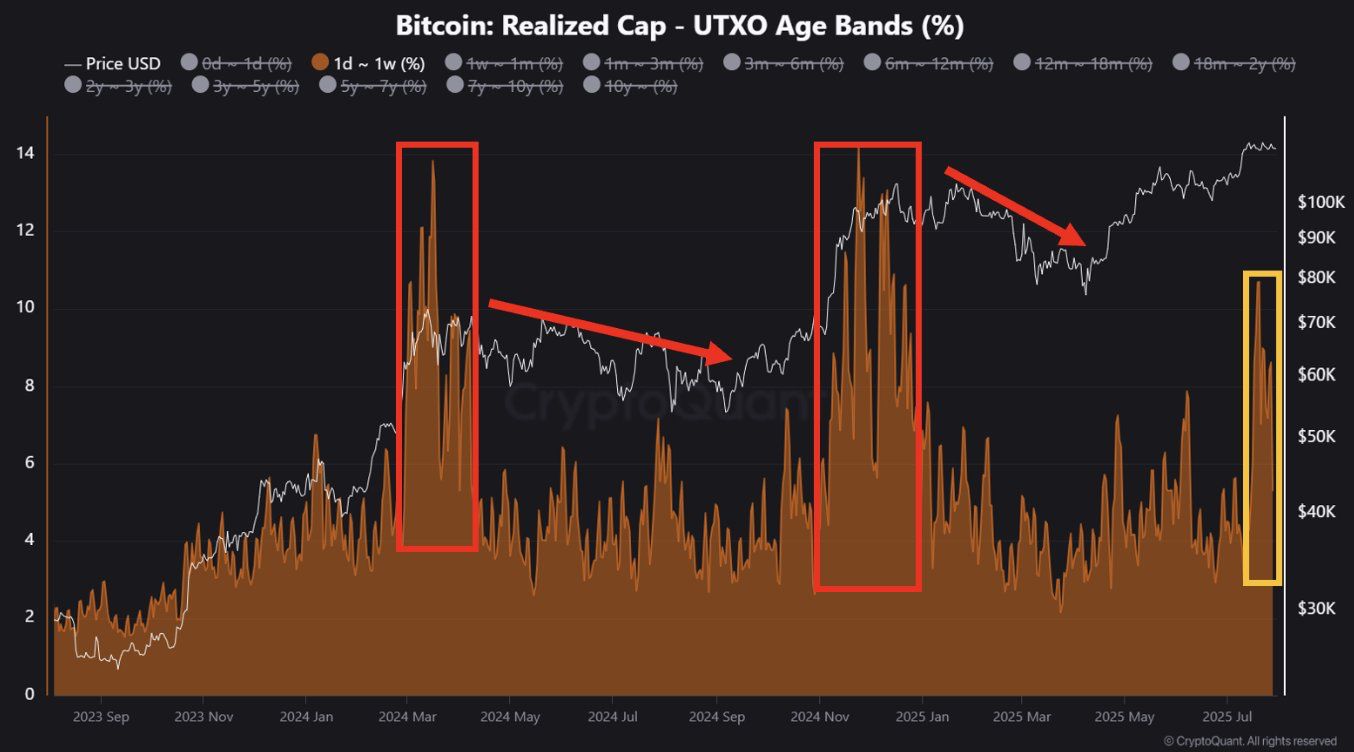

Crucially, on-chain data from CryptoQuant suggests the market has not experienced the significant overheating that was recorded before the major corrections seen earlier this year.

Crypto Market Is Cooling Off from a Short-Term Overheating Phase

— CryptoQuant.com (@cryptoquant_com) July 30, 2025

“Before the corrections in March–October 2024 and January–April 2025, the degree of overheating was higher than it is now, and the overheated state lasted for a longer period (red boxes).” – By @DanCoinInvestor pic.twitter.com/kOKL4OeAFX

As a result, CryptoQuant’s data analysis suggests the wider crypto market could record bullish sentiment in the coming months despite a potential panic selloff triggered by the Pacific Tsunami.

Central bank decisions add to market uncertainty

Adding to the market’s tension, the U.S. Federal Reserve is also meeting on Wednesday to decide on interest rates. Wall Street analysts predict the Fed will hold the rate steady at its current 4.25%–4.5% range, a level unchanged since December. This decision, along with rate statements from the Bank of Canada and the Bank of Japan this week, will be a major factor in the market’s volatility.

Alongside these central bank decisions, traders will be closely monitoring capital flows. The daily cash inflows to the U.S. spot Bitcoin and Ether ETFs will provide a clear, real-time picture of institutional sentiment in the face of these combined macro pressures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.