Ethereum Eyes $4,000 as Whales and ETFs Pour Billions into Market

With ETH trading at a six-month high and ETF inflows topping $2.2 billion in five days, analysts suggest a potential breakout past $4,000, with projections as high as $10,000 by year-end.

Ethereum is drawing heightened attention from institutional investors and crypto whales, pushing its price toward the $4,000 mark for the first time since late 2024.

On July 20, blockchain analytics firm Lookonchain reported that two newly created wallets purchased 58,268 ETH, worth approximately $212 million. The wallets, suspected to belong to institutional investors or whales, acquired the assets from Galaxy Digital and FalconX.

Ethereum Gains $450 Billion Market Cap as Institutional Bets Intensify

On-chain analyst EmberCN added to the narrative by highlighting another significant Ethereum purchase involving another whale. The transaction involved 13,462 ETH—worth approximately $50 million—acquired from Binance at an average price of $3,714.

Ethereum Whales ETH Purchase. Source:

Ethereum Whales ETH Purchase. Source:

Meanwhile, the buying pressure isn’t coming from anonymous whales alone. The corporate sector is also contributing to this accumulation trend by pulling their weight in the market.

SharpLink, currently the largest corporate holder of Ethereum, has continued its aggressive ETH accumulation this month.

Over the past day, the firm added 4,904 ETH, worth approximately $17.45 million. This pushed its monthly total to 157,140 ETH, valued at nearly $493 million at an average acquisition price of $3,136.

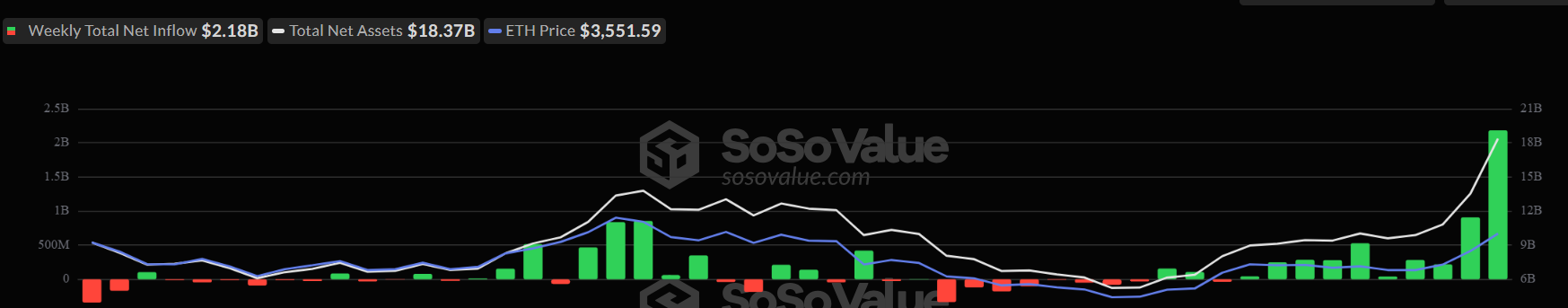

Beyond direct purchases, Ethereum is also seeing record inflows into spot exchange-traded funds (ETFs).

In the last five trading sessions, ETH spot ETFs attracted $2.2 billion, which is more than double the $1 billion added the week before.

Spot Ethereum ETFs Weekly Flows. Source:

Spot Ethereum ETFs Weekly Flows. Source:

“Back-to-back record weeks. 4 of top 5 inflow days since launch over past two weeks,” Nate Geraci, an ETF expert, pointed out.

This momentum suggests increasing conviction among investors that Ethereum is well-positioned for future growth.

Notably, the network’s role in powering stablecoins, decentralized finance (DeFi), and tokenized assets continues to draw attention from traditional financial institutions, including BlackRock.

Considering this bullish momentum, Arthur Hayes, CIO of Maelstrom, suggested that Ethereum could soon breach the $4,000 threshold. His outlook supports broader market forecasts projecting a potential run toward $10,000 before year-end.

As of press time, the digital asset is trading at a six-month high of $3,710, the highest level since December 2024. Meanwhile, the price rally has elevated ETH’s market capitalization to over $450 billion, making it the 25th most valuable asset globally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?