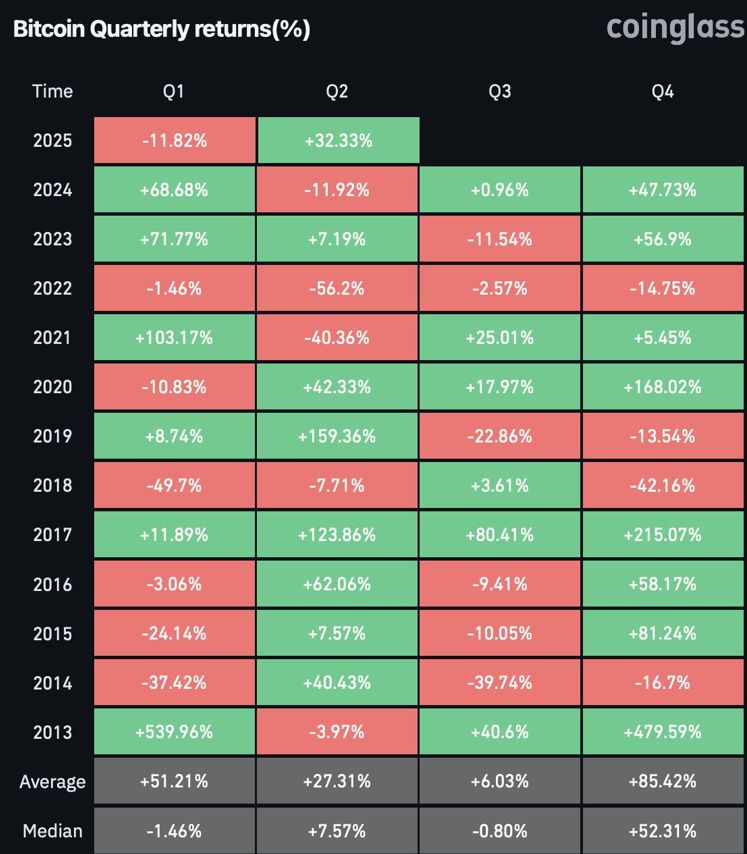

- Bitcoin bounced back from a -11.82% drop in Q1 2025, with a strong 32.33% surge in Q2.

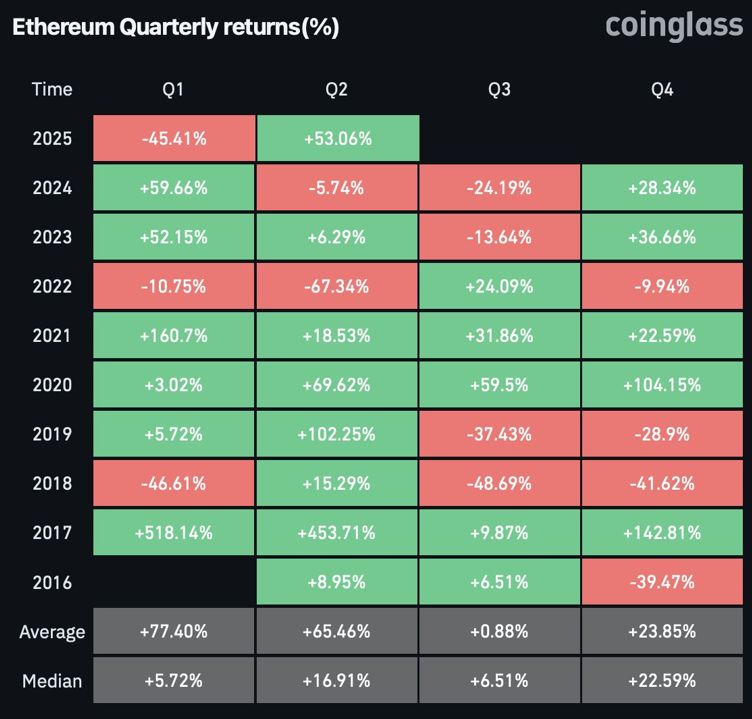

- Ethereum’s Q2 2025 growth of 53.06% highlights its ability to recover from previous losses.

- Bitcoin and Ethereum’s Q2 strength boosts bullish outlook and long-term investor confidence.

Bitcoin and Ethereum have always been bullish in the second quarter (Q2) for most of the years. 2025 is no exception, as both cryptocurrencies are rallying massively in Q2. After a volatile Q1, Bitcoin recovered to have an excellent Q2, and Ethereum followed its lead. Both assets are therefore set to extend gains.

Bitcoin’s Q2 2025 Recovery: A Strong Rebound After Early Setback

Bitcoin started the year 2025 roughly on a down note, recording an 11.82% decrease in Q1. Nevertheless, it recovered in Q2 with 32.33% growth. Analytical platform Coinglass data showed that Bitcoin futures reached an open interest of $75.81 billion. This demonstrates high demand and investor confidence in the cryptocurrency.

Related: Bitcoin Holders Show Record Conviction as Prediction Markets Price in a Calm June

Source: Coinglass

Source: Coinglass

However, Bitcoin rose by 68.68% in Q1 of 2024 but fell by -11.92% in Q2. Nonetheless, Bitcoin closed the year with a notable 47.73% rally in Q4, which also revealed the trend of outperforming in the latter half of the year. Bitcoin has a positive future with its Q2 2025 rally, and there is a possibility of further upsurge as the year progresses.

Ethereum’s 53% Q2 Surge: Strong Recovery and Bullish Momentum

Ethereum also gained significantly during Q2 of 2025, by 53.06%. This strong recovery indicates the resilience of Ethereum and its ability to recover from market losses. Ethereum has shown a gain of 59.66% in the first quarter of 2024 and a loss of 5.74% in the second quarter, reflecting market volatility. The bullish Q2 2025 performance also highlights the upward trend of Ethereum, as the rest of the market is exhibiting a similarly bullish attitude.

Source: Coinglass

Source: Coinglass

The strong Q2 performance of Bitcoin and Ethereum supports the notion of their solid bullish momentum. Having rebounded strongly from Q1 and showing solid performance in Q2, both cryptocurrencies are gaining investor interest and appear well-positioned for continued growth in the second half of 2025, making them attractive long-term investment prospects.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.