Research Report | In-depth Analysis of Allo & RWA Market Valuation

I. Project Overview

II. Key Highlights

Tokenized stocks on AlloX can be staked to earn yield.

alloBTC holders can borrow stablecoins without selling BTC.

The $RWA token is used for governance and ecosystem incentives, aligning user and protocol growth.

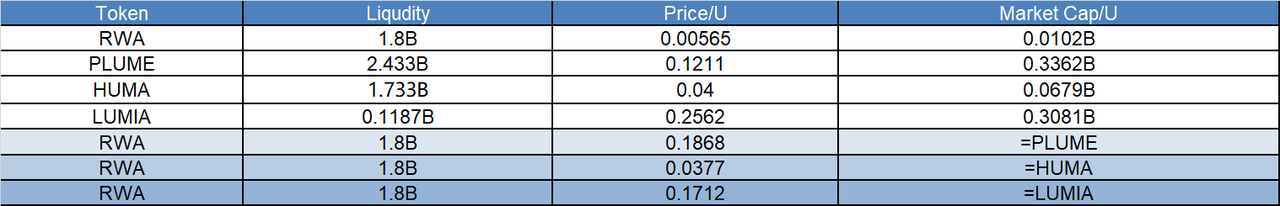

III. Market Valuation Outlook

-

Price: ~$0.00565

-

Circulating Supply: ~1.8B

-

Market Cap: ~$10.17M

IV. Tokenomics

-

Ecosystem Incentives (30%): Released via liquidity mining and governance participation;

-

Private Sale (25%): 6-month lock, then linear 12-month vesting for early investors;

-

Institutional Reserve (20%): For M&A and protocol expansion, unlocked via DAO vote;

-

Market Stability Fund (15%): Multi-sig managed, for extreme market volatility;

-

Initial Circulating Supply (10%): 180M released on Binance TGE day, with staged unlocks for the remainder.

-

Up to 50% discount on trading fees;

-

Staking yields (APY between 8%–15%);

-

Governance voting rights across the ecosystem.

V. Team & Fundraising

-

Founder: Kingsley Advani, a prominent crypto investor with early bets on Coinbase and eToro, known for sharp market insight and resource integration.

-

CTO: Dhruvin Prajapati, an expert in smart contracts and asset mapping, ensuring robust protocol scalability and security.

-

Debt Financing – Dec 19, 2024

-

Amount: $100M

-

Lead Investor: Greengage

-

Use: Market expansion, RWA partnerships, compliance frameworks

-

-

Seed Round – Dec 19, 2024

-

Amount: $2M

-

Investors: NGC Ventures, Morningstar Ventures, Gate.io Labs

-

Use: Core product development, AlloX and alloBTC ecosystem

-

-

Pre-Seed – Sept 30, 2024

-

Amount: $750K

-

Investor: YZi Labs

-

Use: Platform prototype and initial tech infrastructure

-

VI. Risk Factors

-

Early RWA Infrastructure Maturity While RWA is widely regarded as a future mainstream narrative, user education, technical standards, and off-chain verification systems are still developing. If user adoption or partner ecosystem growth falls short, Allo’s expansion may face temporary constraints.

-

Dependence on Babylon Protocol for alloBTC alloBTC relies on Babylon Protocol for BTC staking infrastructure. Any issues such as technical bugs, yield instability, or TVL outflows on Babylon could impact Allo’s users and limit the broader utility of alloBTC.

VII. Official Links

-

X (Twitter): https://x.com/allo_xyz

-

Website: https://allo.xyz

-

Telegram: https://t.me/allo_xyz

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data-Anchored Tokens (DAT) and ERC-8028: The Native AI Asset Standard for the Decentralized AI (dAI) Era on Ethereum

If Ethereum is to become the settlement and coordination layer for AI agents, it will need a way to represent native AI assets—something as universal as ERC-20, but also capable of meeting the specific economic model requirements of AI.

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.