Hyperliquid (HYPE) Slides 16% In One Week And Nears $11 Support

HYPE faces rising bearish pressure as technical signals deteriorate, raising the stakes at key support zones just above $11.

Hyperliquid (HYPE) is under pressure, down 16% over the past seven days as technical indicators increasingly point toward bearish control. Momentum has weakened sharply, with the Relative Strength Index (RSI) dropping below 40 and showing no signs of strong buying interest since late March.

At the same time, the Directional Movement Index (DMI) shows sellers gaining dominance, with a rising ADX suggesting a potential strengthening of the downtrend. As HYPE approaches key support levels, the market now waits to see if bulls can mount a recovery—or if further downside is ahead.

Hyperliquid DMI Shows Sellers Are In Control

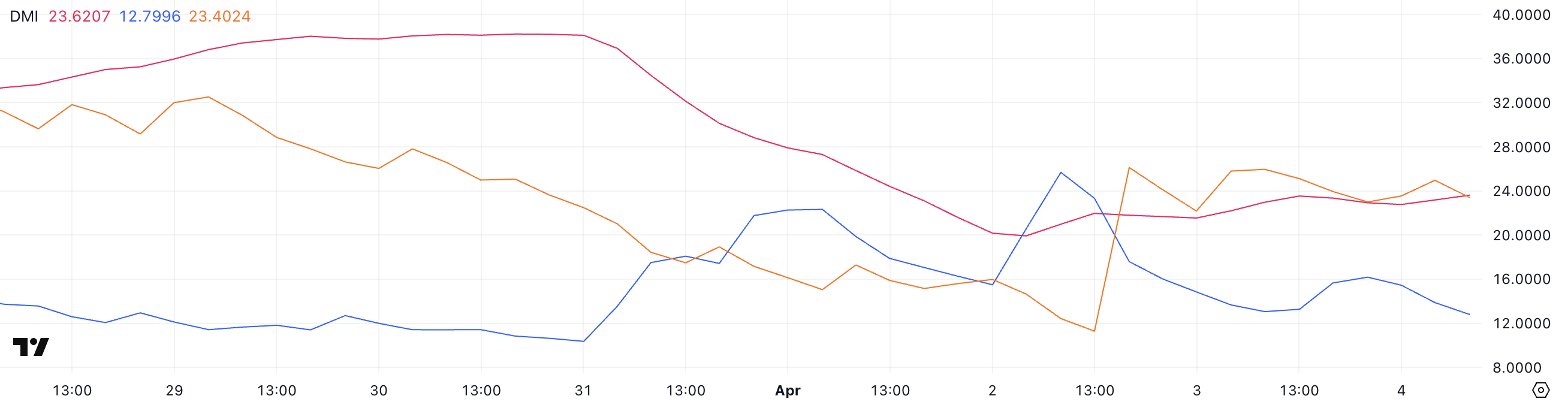

According to its Directional Movement Index (DMI), Hyperliquid is showing early signs of a developing trend, with the Average Directional Index (ADX) rising from 21.5 to 23.6.

The ADX measures the strength of a trend regardless of its direction. Readings below 20 typically indicate a weak or range-bound market, while values above 25 suggest the presence of a strong trend.

With the current ADX moving closer to that 25 threshold, it suggests that trend strength is building—but hasn’t fully confirmed yet—indicating that traders should be on alert for potential continuation in price action.

HYPE DMI. Source:

TradingView.

HYPE DMI. Source:

TradingView.

Meanwhile, the +DI and -DI lines, which represent bullish and bearish directional movement, respectively, have shifted significantly.

The +DI has dropped sharply from 25.68 to 12.79, while the -DI has surged from 11.29 to 23.4, indicating that bearish momentum has clearly overtaken bullish pressure. This shift suggests that sellers are gaining control of the market, and unless the +DI line can reverse and regain ground, HYPE could be at risk of further downside.

If the current dynamics continue, this, combined with the rising ADX, could signal the start of a stronger bearish trend.

Hyperliquid RSI Shows The Lack Of Buying Momentum

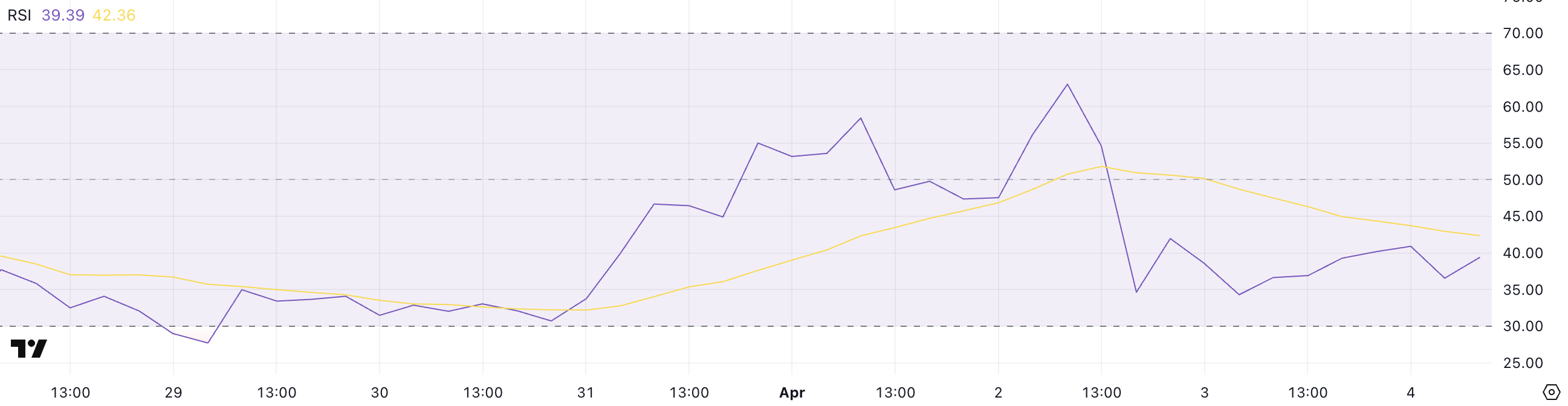

Hyperliquid has seen its Relative Strength Index (RSI) fall significantly over the past two days, dropping from 63.03 to 39.39.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes, ranging from 0 to 100.

Readings above 70 typically indicate that an asset is overbought and may be due for a correction, while readings below 30 suggest it is oversold and could be primed for a rebound. Levels between 30 and 70 are considered neutral, but directional shifts within this range often reflect changing momentum.

HYPE RSI. Source:

TradingView.

HYPE RSI. Source:

TradingView.

With HYPE’s RSI now sitting at 39.39, the indicator suggests weakening bullish momentum and growing bearish pressure. The fact that the RSI hasn’t touched or exceeded the 70 mark since March 24 signals a lack of strong buying conviction in recent weeks.

This downward trend in RSI may indicate that the market is cooling off. Unless buyers step in to reverse this trajectory, HYPE could continue to face selling pressure.

If the RSI continues to drift toward 30, it would raise the possibility of further downside or consolidation in the short term.

Will Hyperliquid Fall Below $11 Soon?

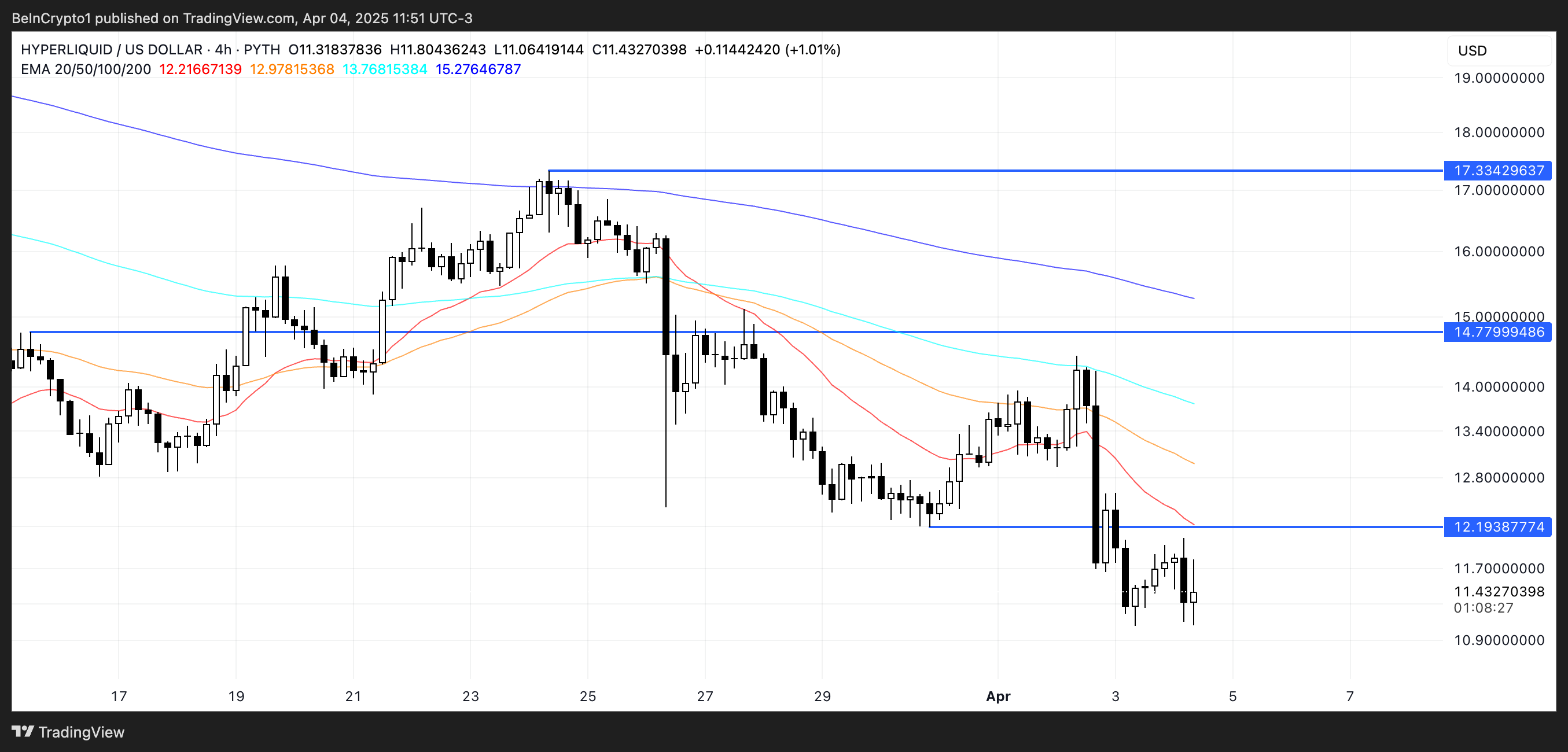

Hyperliquid price is currently at an important threshold, with action leaning bearish but potential for a rebound still on the table.

If the current downtrend continues, HYPE could soon dip below the $11 mark.

HYPE Price Analysis. Source:

TradingView.

HYPE Price Analysis. Source:

TradingView.

This would align with the recent drop in momentum indicators like the RSI and the growing bearish pressure seen in directional movement data.

However, if buyers manage to step in and shift momentum, HYPE could attempt to reclaim higher levels. A break above the immediate resistance at $12.19 would be the first sign of recovery, potentially opening the door for a move toward $14.77.

If bullish momentum accelerates, the rally could extend as far as $17.33, which would mark a full reversal of the current bearish structure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.