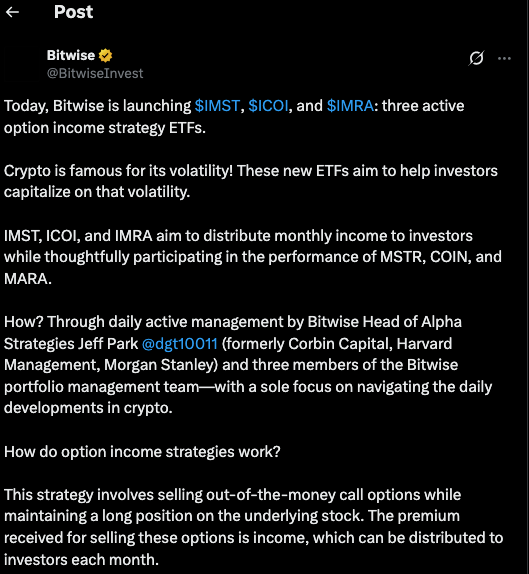

Bitwise Asset Management launched a Crypto ETF collection of three new actively managed products to its existing portfolio.

The funds apply covered call strategies using volatile crypto-related stocks to produce revenue.

The funds strive to merge market risk exposure with regular monthly distributions for crypto-related investments.

The newly introduced crypto ETFs operate under the Bitwise MSTR Option Income Strategy ETF (IMST), Bitwise COIN Option Income Strategy ETF (ICOI) and Bitwise MARA Option Income Strategy ETF (IMRA).

Every ETF implements synthetic covered call strategies through advanced algorithms for its selected stock.

The funds seek to collect option premiums as they minimize their susceptibility to instances of significant upward price increases.

The ETFs from Bitwise awarded their investors the ability to pick stocks linked closely to digital assets and activate their price volatility.

Every ETF operates through dynamic management of its options based on continuous market price updates.

The investment structure delivers both exposure to equity assets tied to crypto markets alongside revenue generation across volatile market periods.

Bitwise Uses MSTR Volatility Strategically With Crypto ETF

The IMST fund specializes in Strategy (MSTR) shares because this company maintains a considerable amount of Bitcoin reserves.

The covered call strategies employed by Bitwise allow the fund to obtain returns from the frequent price movements of MSTR stock.

The crypto ETF manages to generate monthly income through its ownership structure although it keeps minimal exposure to Bitcoin appreciation.

Source: X

Source: X

IMST generates a dependable source of steady cash flow by executing the sale of call options on its platform.

The ETF restricts investors from achieving maximum profits when MSTR experiences big price growth.

The trading strategy delivers composed earnings ranges within markets exhibiting irregular price behavior.

Bitcoin exposure as a direct holder makes Strategy highly volatile yet highly attractive for option-based investments.

IMST modifies its portfolio through constant evaluation of market sentiments as well as price shifts and regulatory activities.

The expense ratio of IMST amounts to 0.98 percent but the fund provides free services until March 2027.

ICOI Balances Risk With Option Trades

ICOI relies on Coinbase (COIN) as its foundational component because the company serves as a major cryptocurrency exchange corporation across the globe.

The crypto ETF creates income through synthetic covered call options as it manages price movements in the stock.

This system provides volatility profits for investors independently of their involvement in handling options trades.

Bitwise constructed ICOI as a response to capital flow changes and news-related sentiment shifts affecting the stock prices of COIN.

ICOI uses call and put option purchases and sales to find a proper risk-management return relationship.

This fund provides regular monthly distributions through its algorithmically managed program, which helps improve adaptability.

The real-time crypto market reflections in Coinbase stock make it appropriate for this strategy.

ICOI targets consistent income rather than pure capital appreciation. ICOI maintains the same expense ratio of 0.98% with a fee waiver set to remain until March 2027.

IMRA Leverages Marathon Digital for Income from Swings

The IMRA ETF targets Marathon Digital Holdings (MARA), one of the largest Bitcoin mining companies in the U.S.

Just like its peer funds, IMRA follows a covered call strategy that concentrates on active markets.

The high volatility of MARA offers prospects for deriving extra premium payments through options.

The strategy of IMRA consists of option purchase and sale activities to duplicate covered calls despite keeping physical shares from direct ownership.

The strategy enables investors to achieve precise management of exposure limitations together with risk control.

The fund operates from fixed-income foundations, but actively controls risks associated with sudden price fluctuations.

MARA was developed from digital mining activities that causes its performance to align with Bitcoin price cycles yet results in elevated market fluctuations.

The method enables IMRA to collect steady premiums as a result of option transactions.

The crypto ETF operates with a 0.98% expense ratio that currently has no announced fee suspension.

Bitwise Pushes Forward with Broader Crypto ETF Expansion

Bitwise actively seeks permissions from the SEC to launch spot cryptocurrency ETFs that will increase accessibility for investors.

The company has submitted applications to the SEC for crypto-related products that connect to SOL, XRP, LINK, Dogecoin, and Aptos.

The firm demonstrates its goal of regulatory crypto investment through these public documents.

Bitwise seeks to obtain investor demand for diverse cryptocurrency exposure by using structured investing products.

The SEC recently accepted these submissions, while market analysts predict regulatory approval for the filings during 2023.

The OWNB ETF has been launched by Bitwise specifically to track Bitcoin ownership by companies in their balance sheets.

The investment firm includes two distinct names at this time in its portfolio: Strategy and Marathon.

The firm devises a strategic approach that integrates income generation features with volatility management systems alongside access to regulated crypto investments.