Trading Takes a Back Seat While Crypto Waits For Further Catalysts

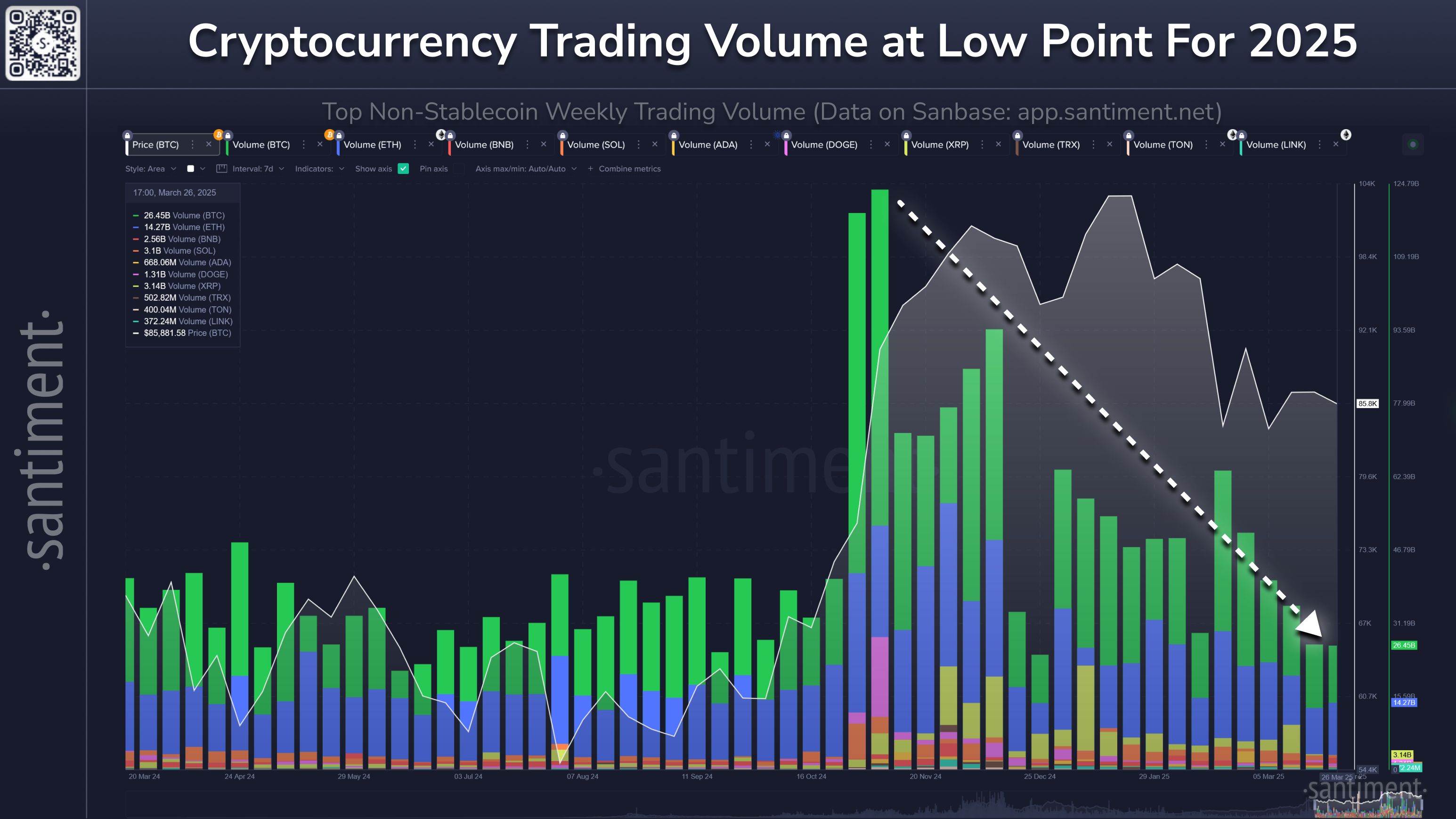

📉 Trading volume among crypto's 10 largest stablecoins has dropped to roughly 1/4th of the level we saw in the midst of the bull cycle in early December. Several factors are contributing to this:

📌 Trader Fatigue: Following the all-time high top back on January 19th, both institutional and retail traders have increasingly moved capital and taken profits while awaiting new catalysts.

📌 There have been new regulatory announcements in major markets, raising the level of uncertainty and causing traders of all sizes to take more of a 'hodling' approach for the time being

📌 Bitcoin's supply on exchanges recently reached a 7-year low, indicating trader contentment with executing less on-chain trading on a daily basis

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

STABLEUSDT now launched for futures trading and trading bots

Martingale bot upgraded–simpler setup, more flexible features

Stock Futures Rush (phase 9): Trade popular stock futures and share $240,000 in equivalent tokenized shares. Each user can get up to $5000 META.

CandyBomb x POWER: Trade to share 4,387,500 POWER