-

The recent resurgence in crypto inflows underscores a renewed rush of investor interest, with Bitcoin at the forefront of this bullish trend.

-

Amidst a period of heightened volatility, Bitcoin’s ability to attract substantial capital highlights its position as a market leader.

-

“The inflows into Bitcoin signal robust institutional confidence,” comments a report from COINOTAG, indicating strong market support.

This article explores the latest $644 million inflow into cryptocurrency, emphasizing Bitcoin’s resilience amid market fluctuations.

Renewed Capital Flow: Bitcoin Leads the Charge

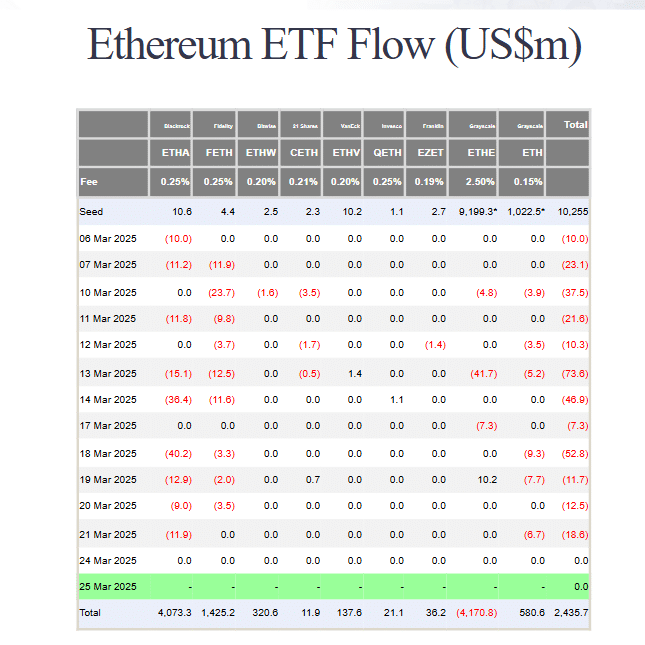

After a challenging five-week streak of outflows, the crypto market experienced a significant turnaround last week with inflows totaling $644 million. This impressive recovery signals a shifting sentiment among investors, pointing towards increased confidence, particularly in Bitcoin. Bitcoin’s dominance remained firm, garnering a staggering $724 million in new investments, while alternative cryptocurrencies like Ethereum saw mixed results, emphasizing a selective investor approach.

Investor Confidence: Rise of Institutional Demand

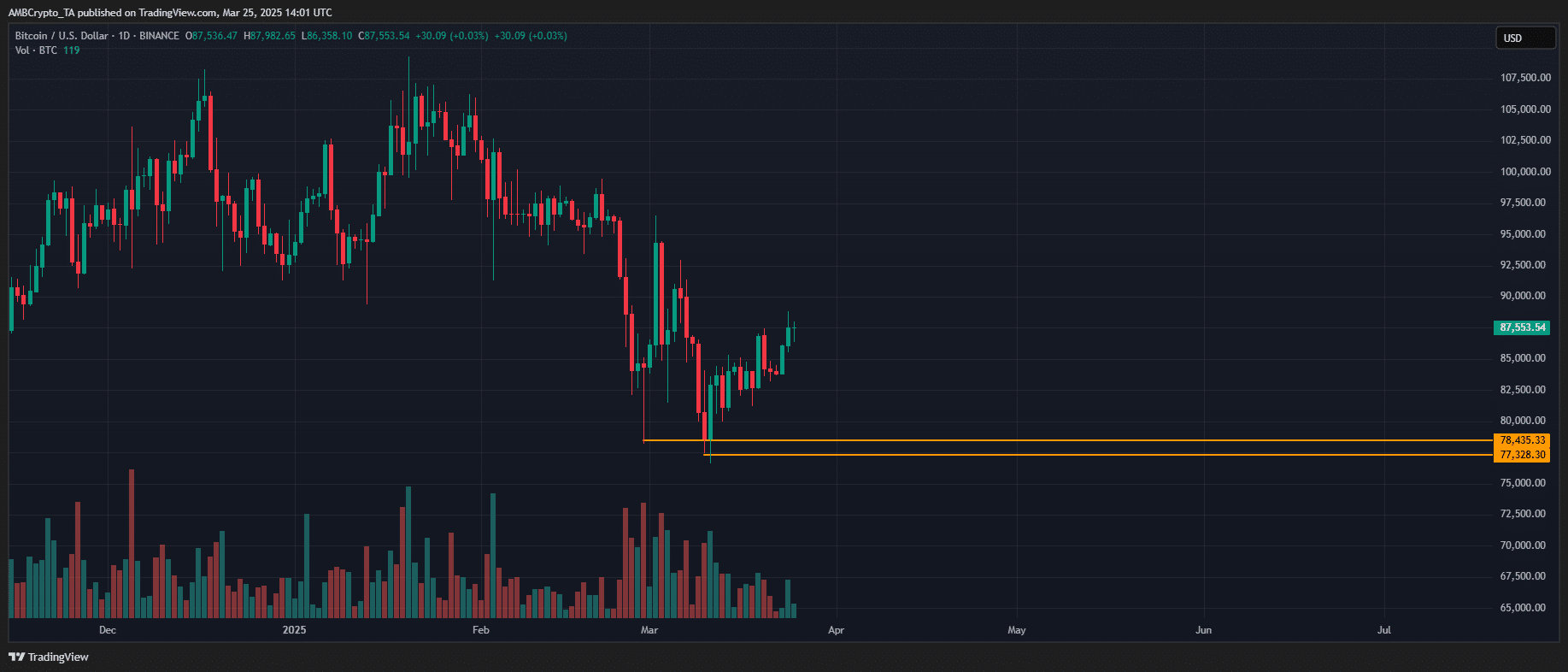

The robust capital inflows into Bitcoin not only demonstrate a resurgence in trading interest but also highlight the growing institutional demand for digital assets. Bitcoin’s market dominance has reflected stability in challenging conditions, consistently remaining above the 60% threshold. This strong positioning is critical considering the previous volatility witnessed, where Bitcoin’s price fluctuated significantly from an all-time high of $109k to a drop to $78k.

Source: Farside Investors

As institutional investors remain undeterred by recent volatility, the influx of new capital allows Bitcoin to reinforce its competitive edge amid uncertainty within the broader market spectrum. Despite Ethereum’s recent struggles, Bitcoin continues to capture the majority share of investor interest, consolidating its position as a leading digital asset.

Bitcoin’s Future Amidst Market Challenges

With the onset of Q2 potentially introducing bearish market dynamics, fueled further by political and economic shifts like President Trump’s new tariffs, Bitcoin’s historical resilience will be put to the test. Previous downturns have led to steep price corrections, notably testing crucial support levels.

Source: TradingView (BTC/USDT)

On-chain metrics and sustained inflows, however, suggest that while market volatility may increase, Bitcoin possesses the structural support necessary to navigate these challenges. With institutional and retail investment trends aligning positively, the cryptocurrency could withstand potential adverse conditions. The ongoing performance will be critical; should inflows diminish significantly, the risk of retracement to historical support levels could emerge, thereby heightening the need for ongoing vigilance in investment strategies.

Conclusion

The latest influx of $644 million into the cryptocurrency market, primarily driven by Bitcoin, signifies a pivotal moment reflecting increasing investor sentiment. While pressures loom from regulatory and economic fronts, Bitcoin’s robust performance and demand could ultimately offer traction towards future market recovery. Maintaining a focus on both institutional and retail investment trends will remain essential as market conditions evolve.