Date: Mon, February 10, 2025 | 04:38 AM GMT

The cryptocurrency market continues to experience a correction following November’s rally. Recent global events, including new trade tariffs, have added to market uncertainty. In the past 12 hours, China has announced 10-15% tariffs on U.S. energy and vehicles, while President Trump is preparing to introduce a 25% tariff on steel and aluminum. These developments have triggered heightened volatility across financial markets, impacting investor sentiment globally.

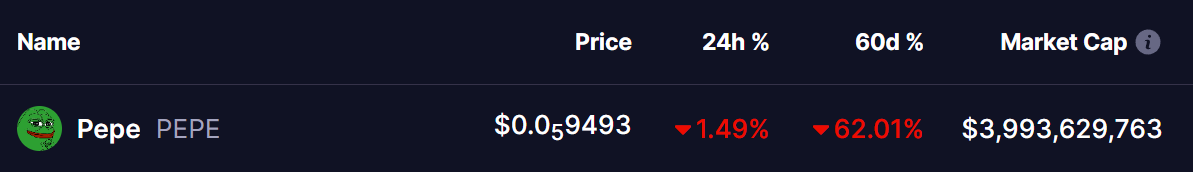

Among the hardest-hit assets is Pepe (PEPE), which has dropped 62% over the past two months. The memecoin is now trading around $0.0000095 after hitting a three-month low.

Source: Coinmarketcap

Source: Coinmarketcap

Buy Signals Flashing on the Chart

According to crypto analyst Chandler , PEPE’s weekly Stochastic RSI is now in the oversold zone, a level that has historically signaled strong buying opportunities. The chart highlights multiple instances where PEPE entered this oversold region, leading to significant rebounds in the following weeks.

PEPE Weekly Chart/Source: @ChandlerCharts (X)

PEPE Weekly Chart/Source: @ChandlerCharts (X)

Each previous buy signal on the chart has aligned with PEPE’s price stabilizing before a strong rally. The last three major buy zones appeared in mid-2023, early 2024, and mid-2024, all leading to impressive price surges.

Additionally, the current price structure resembles past bottoms, where PEPE consolidated within a tight range before breaking out. The presence of a green buy box on the chart suggests that the current level could be a strong accumulation zone for buyers.

If PEPE follows this historical trend, a recovery could be in play, with upside potential in the coming weeks. However, confirmation from price action and trading volume will be key to determining the strength of the reversal.

Final Thoughts

While technical indicators suggest a possible reversal, the broader market remains uncertain due to ongoing U.S.-China trade tensions and other macroeconomic factors. If PEPE holds its current support level, a rebound could be on the horizon. Traders should keep an eye on upcoming price action for confirmation of a trend shift.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before making investment decisions.