Benchmark maintains a "buy" rating for MicroStrategy, with a target price of $650

MicroStrategy plans to issue $2 billion in perpetual preferred shares to raise funds. Currently, the specific terms of issuance have not been announced and are expected to be disclosed within the first quarter of this year. Despite this, investment firm Benchmark remains optimistic about MicroStrategy's development prospects, maintaining a "buy" rating and predicting that its stock price could reach $650. As of Monday, MicroStrategy has purchased an additional 2,530 BTC, bringing its total holdings to 450,000 BTC. Next week on January 21st , MicroStrategy will hold a special shareholders meeting where investors will vote on whether or not to increase authorized Class A common shares and preferred shares. MSTR's fourth-quarter earnings call is scheduled for February 4th.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

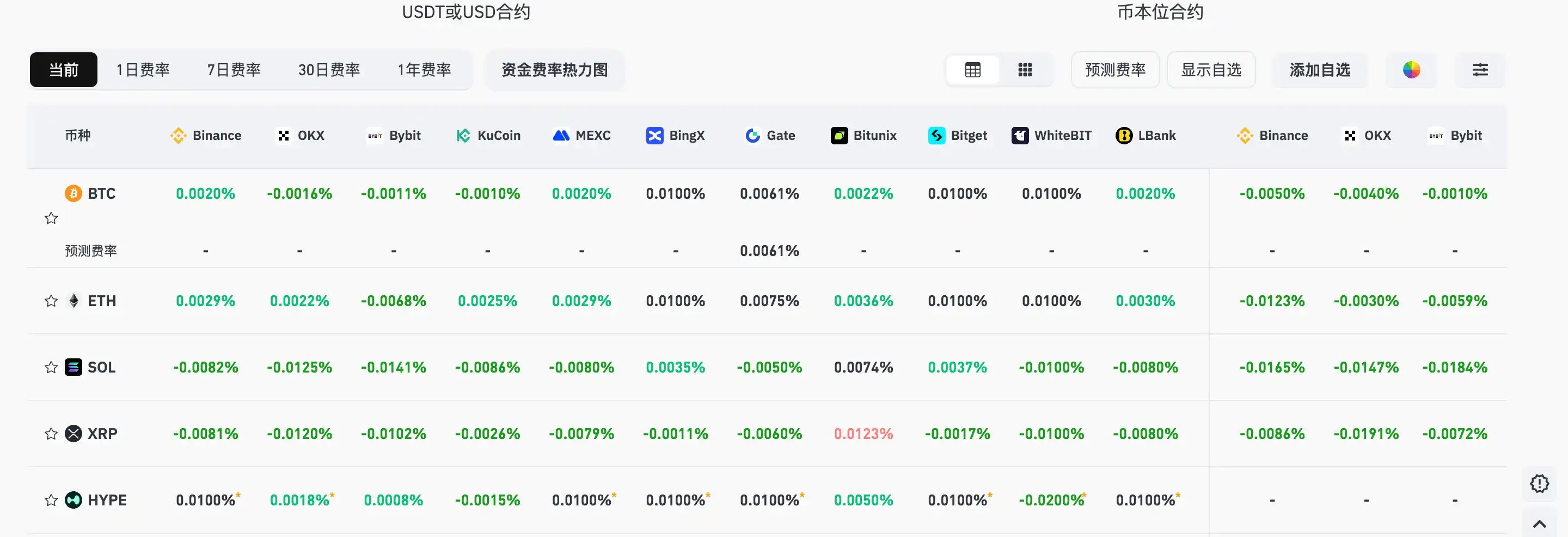

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.

Some Meme coins continue to rise during the market pullback, with JELLYJELLY surging 37% against the trend.