Data: The lending activity of the loan agreement Aave on Ethereum has sharply increased, with the net flow rising to 500 million US dollars in the past week

According to data revealed by IntoTheBlock, Aave's lending activity on Ethereum has sharply increased, with the net flow rising to $500 million over the past week. Multiple indicators of the Aave protocol have reached new highs, and compared to 2021, the total supply of stablecoins is significantly higher. According to DeFiLlama data, Aave's current TVL (Total Value Locked) is higher than during the last bull market in October 2021, setting a historical record at $38.6 billion. The estimated annual income for this protocol is $117 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: A certain wallet withdrew 823,368 UNI tokens worth approximately $4.72 million from CEX within 5 hours.

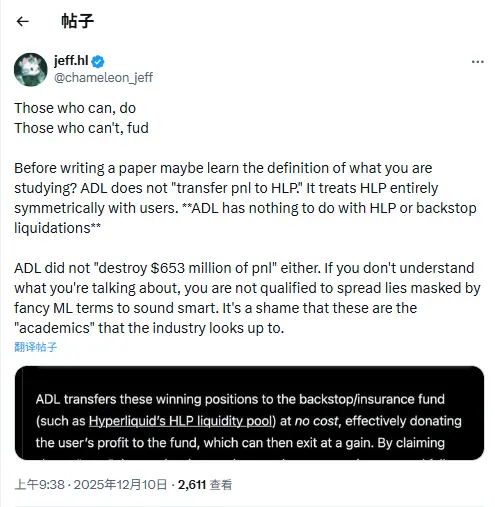

Data: Hyperliquid platform whales currently hold $4.828 billions in positions, with a long-short ratio of 0.94

Data analytics firm Inveniam announces acquisition of on-chain asset tokenization platform Swarm Markets