Bernstein predicts MicroStrategy's momentum to further accelerate amid potential Nasdaq 100 inclusion

Quick Take Analysts at Bernstein expect the MicroStrategy flywheel effect to accelerate amid the potential inclusion of MSTR in the Nasdaq 100 and the new Trump administration’s focus on crypto. On Tuesday, Bloomberg analyst James Seyffart said MicroStrategy will likely enter the index on Dec. 23, with net buying of at least $2.1 billion in shares by ETFs to follow.

Analysts at research and brokerage firm Bernstein expect the MicroStrategy flywheel effect to continue, given the potential inclusion of the stock in the Nasdaq 100 index this month and the incoming Trump administration's dialling up of its crypto focus.

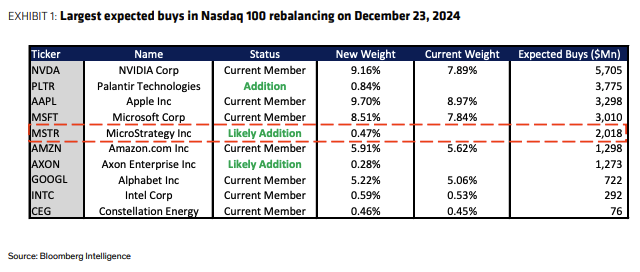

On Tuesday, Bloomberg analyst James Seyffart said MicroStrategy will likely enter the Nasdaq 100 on Dec. 23, potentially to be announced this Friday, with estimated net buying of at least $2.1 billion in shares by exchange-traded funds to follow. This is equal to about 20% of daily volume and a "conservative number" in Seyffart’s view.

Fellow Bloomberg ETF analyst Eric Balchunas noted that Moderna was likely to get the boot, with MicroStrategy allocated a 0.47% weight in the Nasdaq 100 index.

“This would lead to inclusion of MSTR in some of the largest ETFs such as QQQ (5th largest ETF), leading to one-time fresh buying and ongoing participation in future inflows,” Bernstein analysts led by Gautam Chhugani said in a Wednesday note to clients.

Largest expected buys in Nasdaq 100 rebalancing on Dec. 23, 2024. Image: Bernstein.

Reservations on MicroStrategy’s premium to NAV and bitcoin acquisitions

MicroStrategy has added $16 billion in bitcoin — 40% of its total $40 billion position — over the past 40 days alone and currently trades at a 147% premium to its bitcoin net asset value ($103 billion enterprise value). “Many investors may have reservations on its premium to NAV valuation and its bitcoin purchase program dependent on its ability to issue equity and debt convertible at this premium,” Chhugani noted.

However, the Bernstein analysts believe this can continue for a long time. MicroStrategy has used around $15 billion of its proposed $42 billion debt and equity raise plan for bitcoin acquisitions so far and shows no signs of slowing, seemingly comfortable buying in the $95,000 to $100,000 range, the analysts said. “Further, as MicroStrategy buys more bitcoin, the valuation premium normalises, with bitcoin stock (denominator) going up,” they added. “At 18% leverage levels (convertible debt to bitcoin NAV), MSTR has the room to issue more debt, apart from tapping its equity ATM. And if bitcoin’s price remains range bound around the $100K levels, we expect MicroStrategy to maintain its trajectory of bitcoin buying.”

Following MicroStrategy’s potential inclusion in the Nasdaq 100 and QQQ, Bernstein expects more visibility and recognition beyond the ETF inflows, with the market setting its sights on SP 500 inclusion in 2025. Joining the SP 500 is more challenging due to the firm’s software business’ lack of profit.

However, an accounting rule change for bitcoin valuations could make the firm eligible next year, Seyffart said yesterday. “As a new mark to market, FASB goes live in 2025, MicroStrategy would be able to recognize its unrealized gains on its bitcoin position (~$41 billion market value vs. ~$25 billion cost basis), improving its SP prospects,” the Bernstein analysts explained.

Alongside the “Trump 2.0” administration’s increased crypto focus, with the nomination of a crypto-friendly SEC Chair and appointment of an AI and Crypto Czar, Bernstein said the stock presented a reasonable entry under the current market conditions, rating MicroStrategy as outperform with a price target of $600.

MicroStrategy shares closed up 3.3% at $377.32 on Tuesday, having gained over 444% year-to-date, according to TradingView. The stock is currently up 1.7% in pre-market trading on Wednesday.

MSTR/USD price chart. Image: TradingView .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.