Cardano (ADA) May Remain Below $1 Amid Whale Selloff and Profit-Taking

Cardano’s price faces downward pressure from a combination of whale sell-offs and widespread profit-taking, putting its value at risk of falling below $1 in the short term.

Layer-1 coin Cardano (ADA) has consolidated within a price range since the start of December. However, its price has trended downward over the past week, dropping by 17% in the last seven days.

This decline is attributed to a combination of factors, including sell-offs by large holders and profit-taking by many of its holders. This puts the altcoin at risk of remaining below the $1 price level in the short term, and this analysis details how.

Cardano Sees Spike in Profit-Taking Activity

The decline in Cardano’s large holders’ netflow, a metric tracking the buying and selling activity of large investors or whales, confirms a reduction in ADA accumulation by this cohort of coin holders. IntoTheBlock’s data shows ADA’s large holders’ netflow has plunged by 139% over the past seven days.

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. When their netflow drops, it indicates that whales are selling their holdings of an asset. This is a bearish signal, suggesting that these large investors may be losing confidence in the asset’s future price.

Cardano Large Holders’ Netflow. Source:

IntoTheBlock

Cardano Large Holders’ Netflow. Source:

IntoTheBlock

The recent increase in profit-taking within the ADA market is not limited to large-scale investors. This trend has extended to a majority of coin holders, reflecting a broad loss of confidence in the asset’s future price potential.

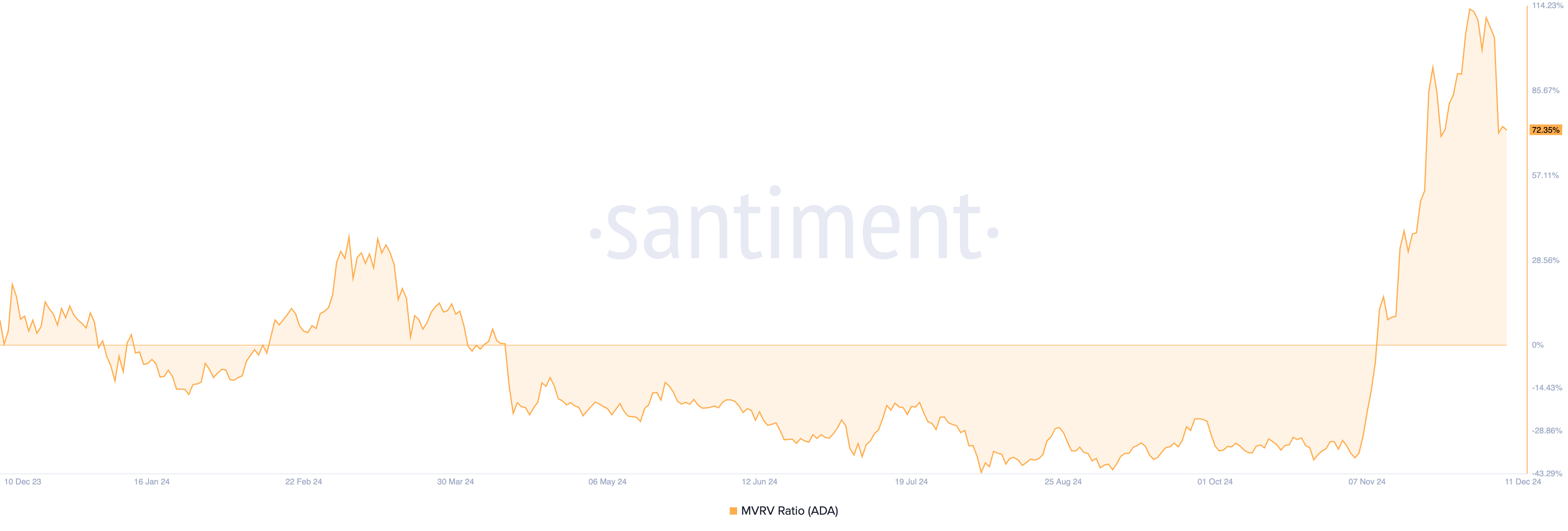

Supporting this sentiment, the altcoin’s Market Value to Realized Value (MVRV) ratio has shown a consistent decline. Data from Santiment indicates the MVRV ratio peaked at 113% on December 2 before starting its downward trajectory. As of the latest update, it stands at 72.35%.

This metric tracks whether an asset is overvalued or undervalued relative to its holders’ average cost basis. When it declines, it signals that the gap between an asset’s market value and its realized value is narrowing.

Cardano MVRV Ratio. Source:

Santiment

Cardano MVRV Ratio. Source:

Santiment

In ADA’s case, despite remaining positive, the MVRV decline suggests that holders are taking profits, reducing the extent of unrealized gains. This indicates waning bullish sentiment and increasing selling pressure in the market.

ADA Price Prediction: A Decline Toward $0.77 Is Possible

From a technical perspective, the daily chart shows that ADA’s next major support lies at $0.90. While it trades at $1.01 at press time, an increased profit-taking activity will cause it to test this support level. If it fails to hold, the coin’s price will plummet to $0.77.

Cardano Price Analysis. Source:

TradingView

Cardano Price Analysis. Source:

TradingView

On the other hand, if buying activity resurges, the ADA coin price may rebound to $1.06 and climb toward its two-year high of $1.32.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.