Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

The layer-1 blockchain Cardano ( ADA ) is primed to continue its long-awaited price surge, according to a popular crypto analyst.

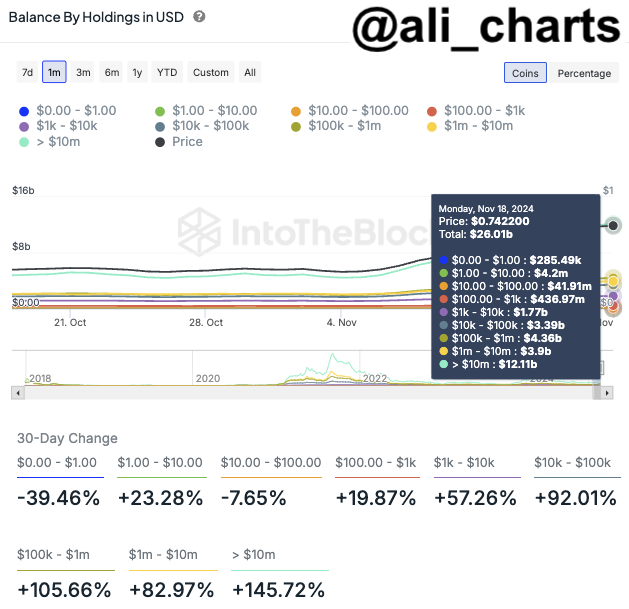

The digital asset trader Ali Martinez tells his 87,300 followers on the social media platform X that whales and “institutional players” have been buying into the Ethereum ( ETH ) competitor in anticipation of further price increases.

“The volume of large Cardano ADA transactions on the network has surpassed $22 billion per day. Those large transactions appear to be related to high accumulation levels. Indeed, whales holding from $1 million to over $10 million in ADA have increased their positions by more than 100% in the past month.

The high buying pressure is starting to move prices, and from a technical perspective, Cardano seems to be mirroring its previous bullish cycle. If this pattern holds true, ADA could target $6!”

Source: Ali Martinez/X

Source: Ali Martinez/X

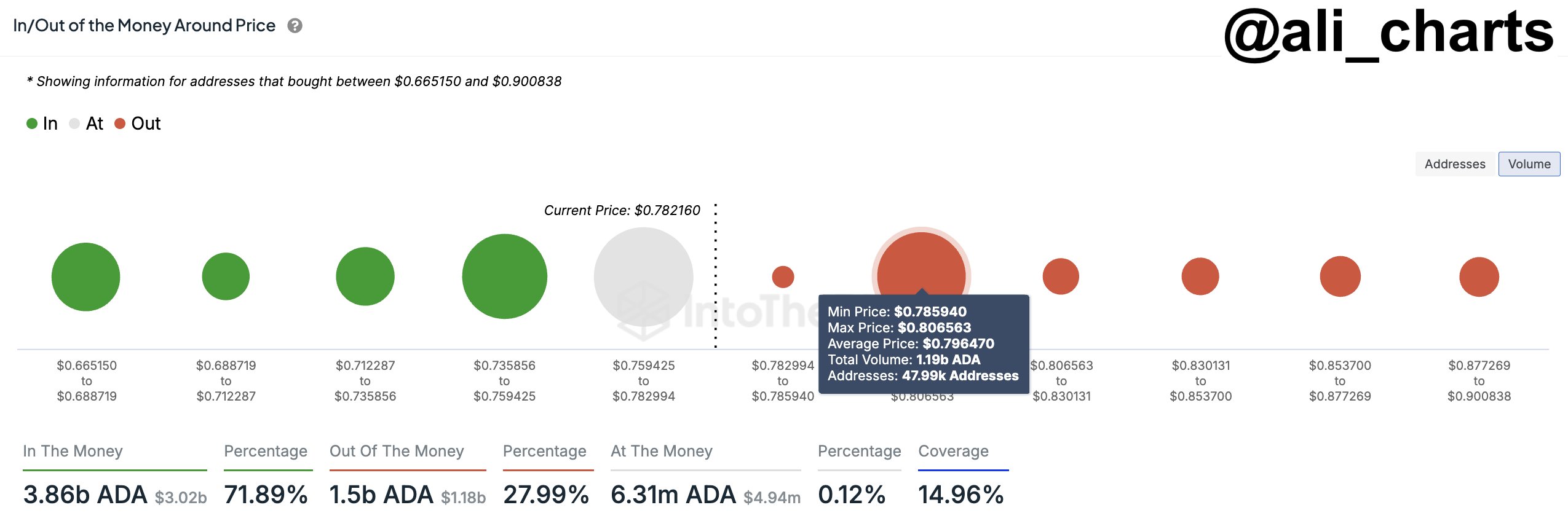

Martinez also notes that one “key area” of support that ADA needs to hold to maintain its bullish thesis is $0.80. At that price point, 48,000 addresses bought nearly 1.20 billion ADA.

Source: Ali Martinez/X

Source: Ali Martinez/X

ADA is trading at $1.06 at time of writing. The ninth-ranked crypto asset by market cap is up more than 24% in the past 24 hours, more than 48% in the past seven days and nearly 200% in the past month.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Long English Thread] Scroll Co-founder: The Inevitable Path of ZK

"Tether" in 2025: Capital Analysis

Mars Morning News | The first SUI ETF is approved for listing and trading; SEC meeting reveals regulatory differences on tokenization, with traditional finance and the crypto industry holding opposing views

The first SUI ETF is listed, an SEC meeting reveals regulatory disagreements, bitcoin price drops due to employment data, US debt surpasses 30 trillions, and the IMF warns of stablecoin risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Moore Threads makes its debut with a surge of over 500%! The market value of the first domestic GPU stock once exceeded 300 billions yuan.

On its first day of trading, the "first domestic GPU stock" saw an intraday peak increase of 502.03%, with its total market value once exceeding 300 billions RMB. Market analysis shows that a single lot (500 shares) could earn up to 286,900 RMB at the highest point.