SignalPlus: In the short term, Chinese retail investors may still maintain a strong momentum of "buying on dips"

In its latest research report, SignalPlus analyzed the macroeconomy. In China, the much-anticipated Ministry of Finance press conference over the weekend was a mixed bag. It did not explicitly mention the scale of specific stimulus policies and generally lacked implementation details. There were also no announcements about measures to stimulate retail consumption. Despite declines in iron ore, crude oil, and A-shares in early trading on Monday, prices rebounded strongly before lunch break. In the short term, Chinese retail investors' funds may still maintain strong momentum for "buying on dips".

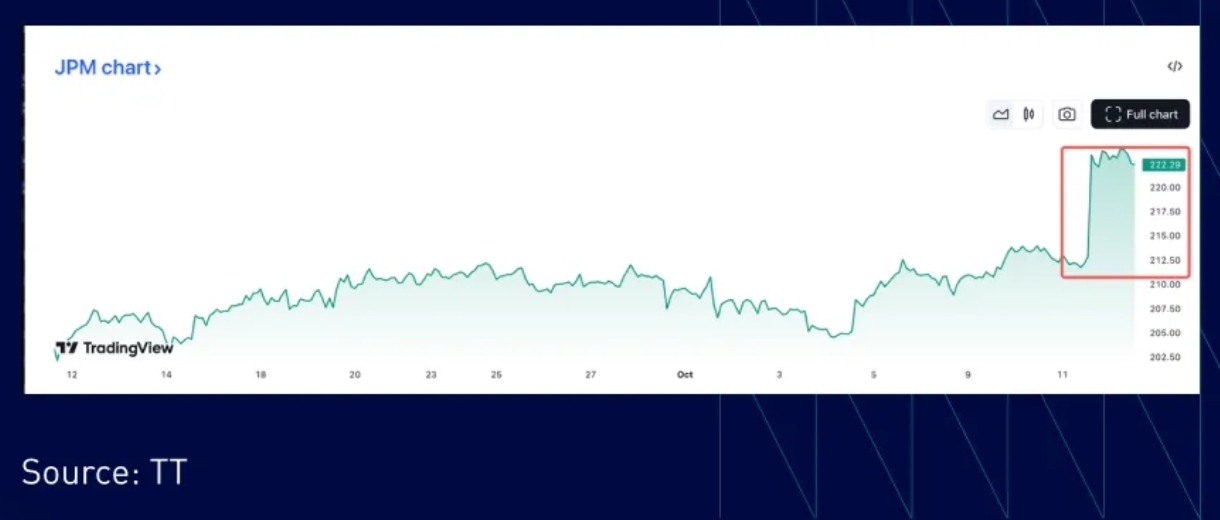

As for U.S stock market, JPM kicked off Q3 earnings season with a very strong performance. The banking giant's share price rose 5% after it announced an unexpected increase in interest income and raised its revenue forecast. The overall KBW Bank Index also rose to its highest level since April 2022; it is expected that steeper yield curve trends will further drive bank industry revenue growth over the next few quarters.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan issues Galaxy short-term bonds on the Solana network

Data: 97,500 COMP transferred to a certain exchange, worth approximately $2.9462 million

A certain whale staked 25,000 ETH, worth $79.48 million.

dYdX launches Solana spot trading and opens access to US users for the first time