US Bitcoin ETFs shed $277 million over past week amid market downturn

Key Takeaways

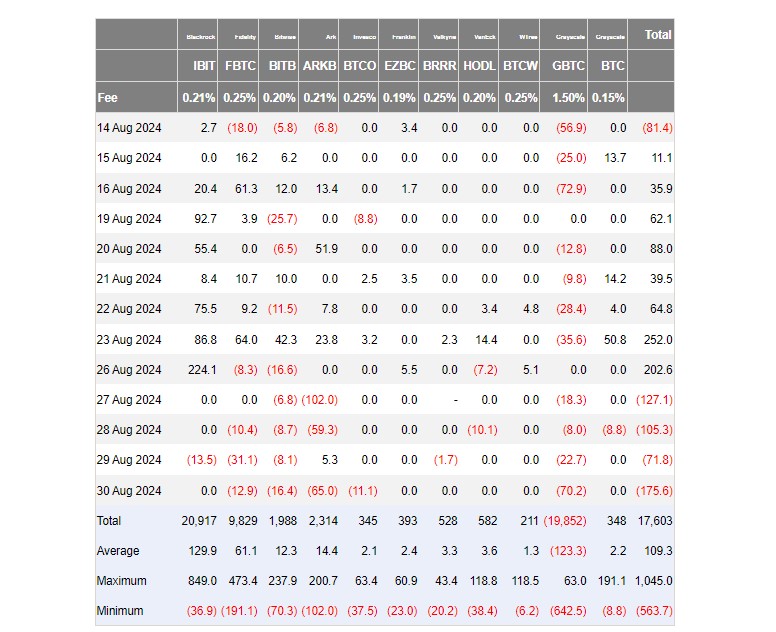

- US Bitcoin ETFs saw a total of $277 million in outflows last week.

- BlackRock's iShares Bitcoin Trust reported rare net outflows by week's end.

Share this article

Outflows from US spot Bitcoin exchange-traded funds (ETFs) hit $277 million last week as the crypto market faced downturns, with Bitcoin lingering below the $60,000 mark and most altcoins continuing to decline.

According to data from Farside Investors, the group of US Bitcoin funds collectively drew in around $202 million in new investments on Monday, with BlackRock’s iShares Bitcoin Trust (IBIT) accounting for the majority of daily inflows. On that day alone, IBIT logged over $224 million in net capital.

After a strong start to the week, spot Bitcoin ETF flows turned negative on Tuesday and extended their losing streak until Friday.

Source: Farside Investors

Source: Farside Investors

Data shows that investors pulled approximately $480 million from the funds during this period. On Friday alone, US Bitcoin ETFs saw over $175 million withdrawn, the largest outflow since August 2.

Amidst a week of the market downturn, BlackRock’s IBIT, a fund known for its consistent inflows, experienced its second-ever outflow since its launch . However, strong inflows on Monday allowed it to end the week with a net inflow of around $210 million.

Last week, Ark Invest/21Shares’ Bitcoin fund (ARKB) and Grayscale’s Bitcoin ETF (GBTC) experienced the largest net outflows among Bitcoin spot ETFs, with ARKB losing $220 million and GBTC losing $119 million.

Over the same period, Bitcoin (BTC) fell around 9%, from $64,500 on August 26 to $58,000 on August 30. The flagship crypto is currently trading at around $57,700, down 10% over the past week, per TradingView data .

Source: TradingView

Source: TradingView

Bitcoin’s retreat has dragged down the broader crypto market. Ethereum, Solana, Ripple, and Dogecoin all experienced losses, with Dogecoin falling the most at 5.6%.

The global crypto market capitalization has shrunk by 2.4% to $2.1 trillion, according to CoinGecko . Most altcoins have followed Bitcoin’s downward trend, with only four—Helium (HNT), Monero (XMR), Starknet (STRK), and Fetch.AI (FET)—showing gains in the past 24 hours.

Memecoins have led the altcoin decline, with DOGS, BEAM, BRETT, and Dogwifhat (WIF) experiencing the most significant losses.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Behind the 15 million financing, does Surf aim to become an AI analyst in the crypto field?

Cyber co-founder starts a new venture.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

A cryptocurrency practitioner who once held libertarian ideals became disillusioned after reflecting on a career spent building "financial casinos," sparking a profound reflection on the divergence between the original aspirations and the current reality of the crypto space.

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.