usual.money: RWA decentralized stablecoin

Why usual?

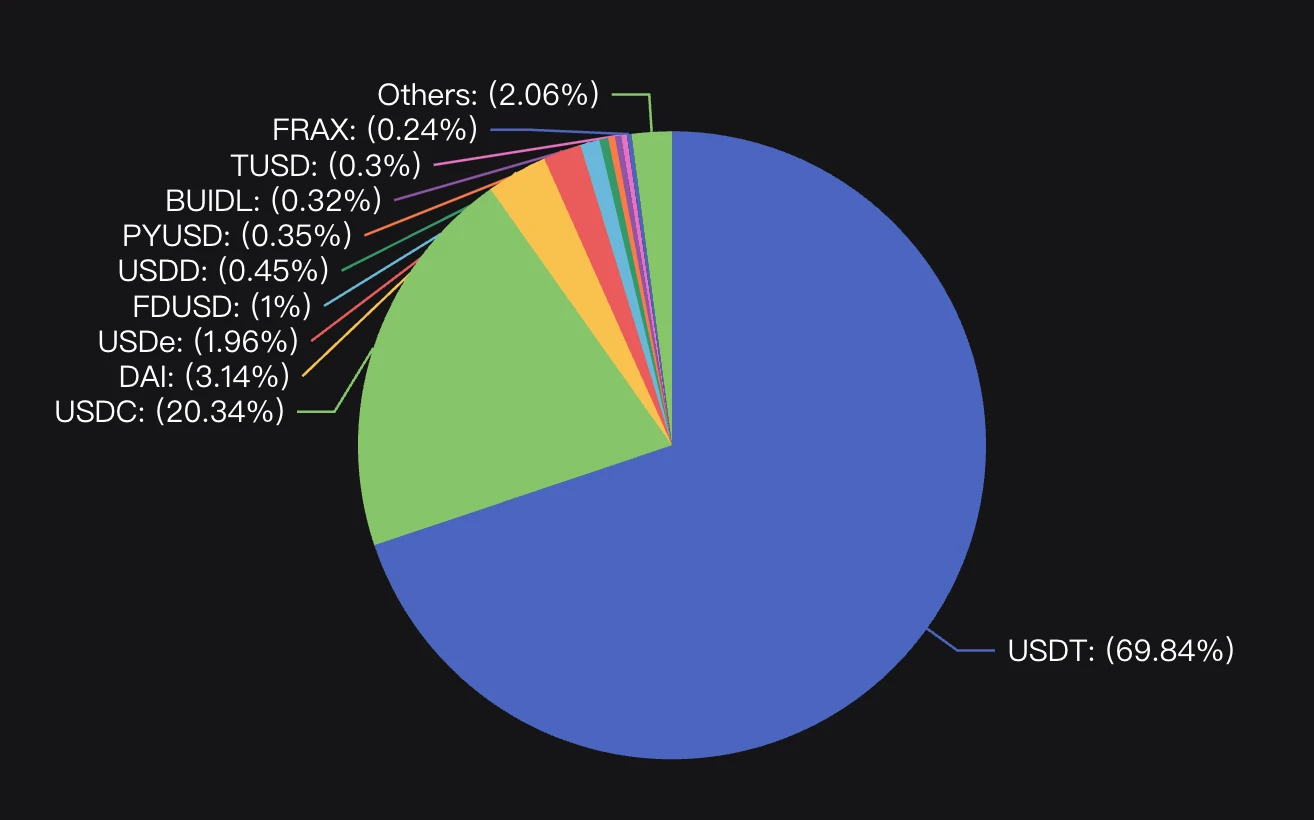

Stablecoins can be said to be the foundation of the cryptocurrency industry. People need stablecoins as a use case for large-scale payments, and stablecoins also play a key role in the industrys Mass Adoption. As of July 30, 2024, the total market value of stablecoins is $168 B, and from the stablecoin market value overview chart below, it can be seen that the two centralized stablecoins, USDT and USDC, together account for about 90% of the total market value of stablecoins.

Image source: Deflama, data as of July 30, 2024

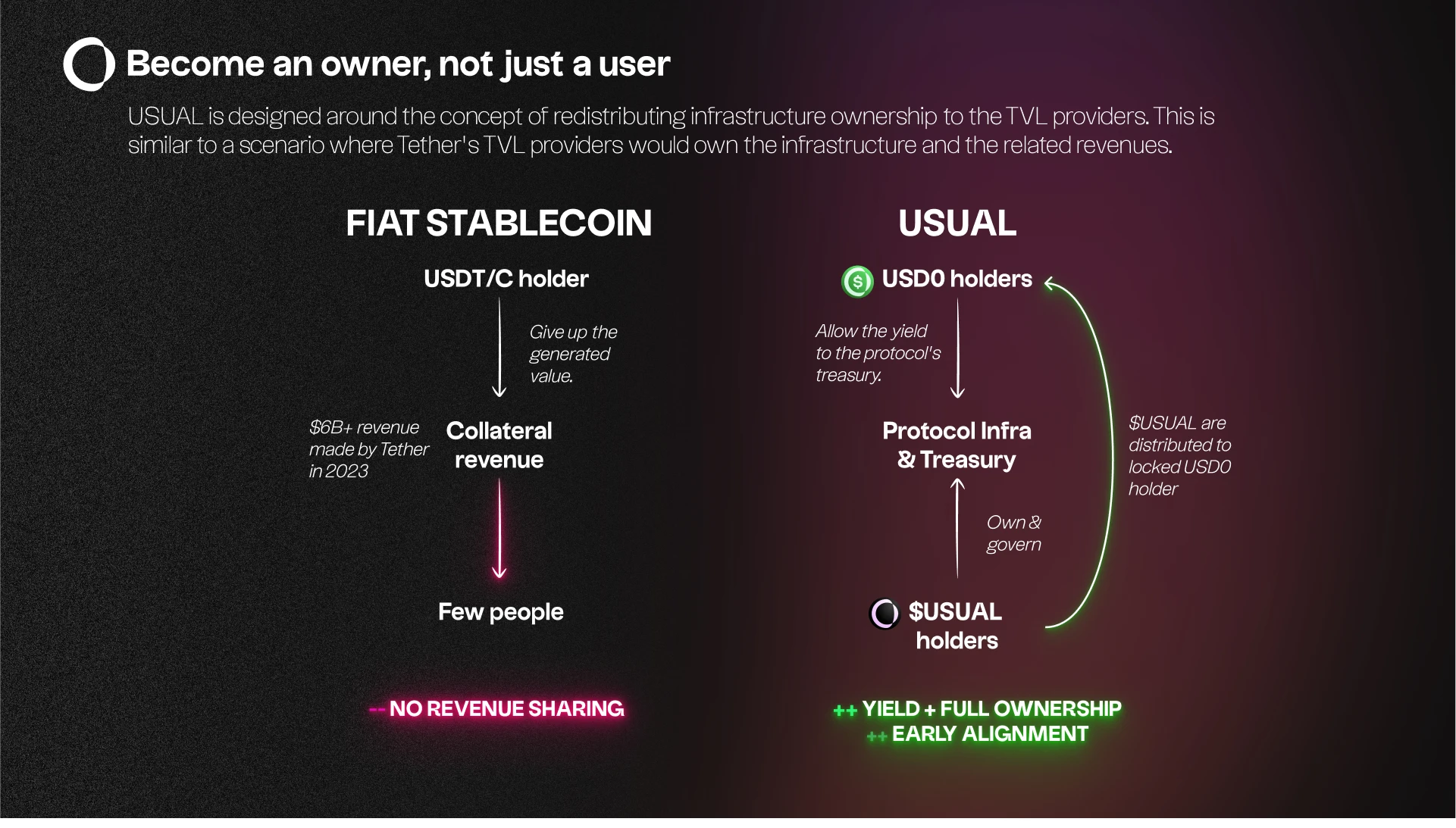

Stablecoins are the money printing machines of Crypto. The two giants Tether and Circle generated more than $10 billion in revenue in 2023, with a valuation of more than $200 billion. Tether made a record profit of $4.52 billion in Q1 2024. Such a huge profit monopoly is obviously contrary to the spirit of encryption, so various decentralized stablecoin projects are constantly emerging. According to the collateral amount, decentralized stablecoins can be divided into over-collateralized represented by MakerDAO (DAI), equal collateralized represented by Ethena (USDe), and under-collateralized (currently there are no large-cap projects).

There have been many successful decentralized stablecoin projects, but the collateral of these projects is generally crypto assets, so a sophisticated mechanism needs to be designed to combat the volatility of the currency price. If RWA (real world assets) are introduced, this problem will be solved. RWA is growing and in the ascendant, with RWA on the blockchain growing by more than 800% in 2023. usual.money introduces U.S. Treasury bonds as collateral, while providing transparency and security based on Ethereum smart contracts, and returning profits to the community and contributors. This design can be said to be tether-on-chain, combining the 1: 1 RWA characteristics of centralized stablecoin protocols with the security and transparency of the chain.

Image source: https://docs.usual.money/start-here/why-usual

background

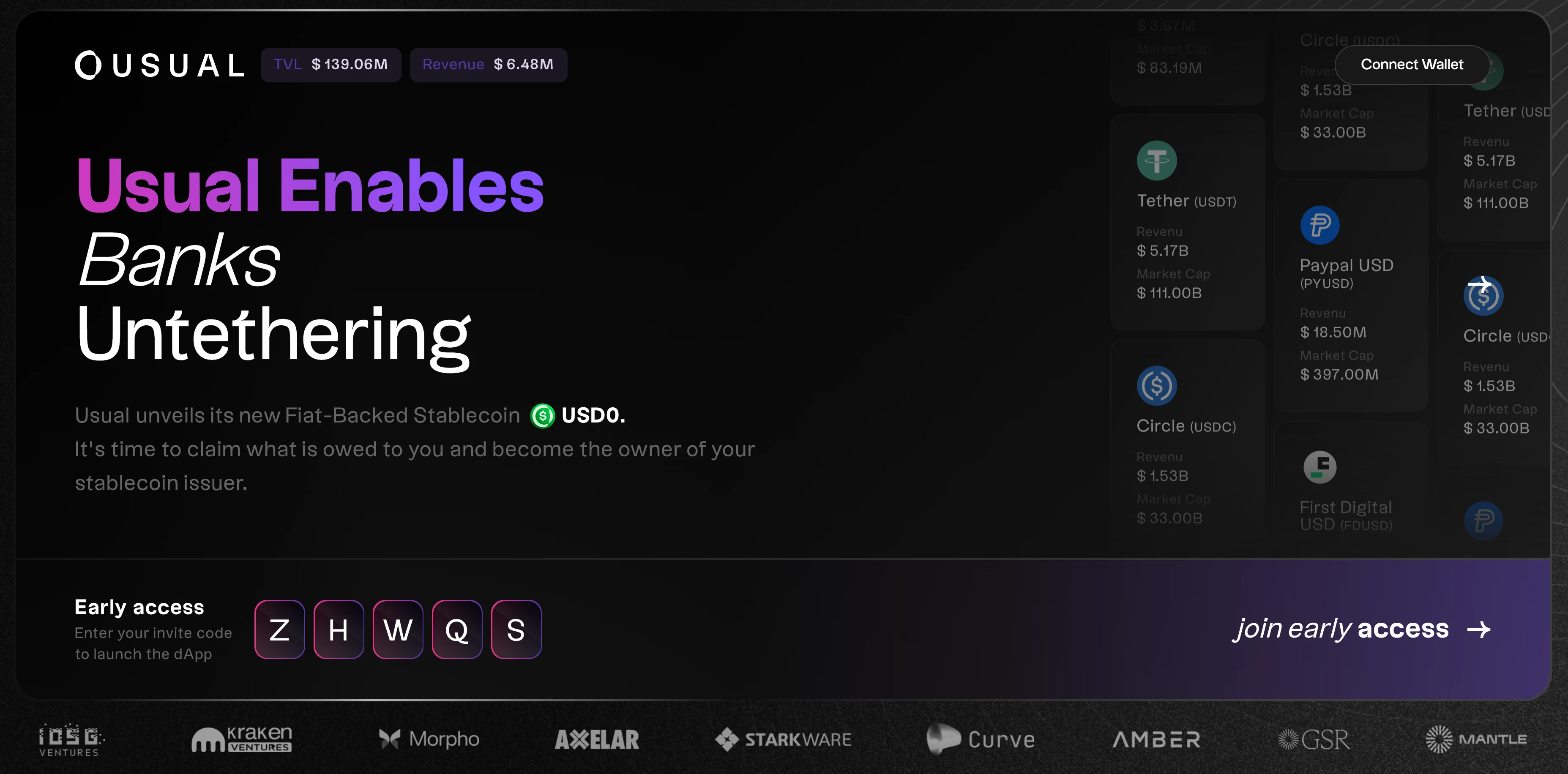

On April 17, 2024, Usual Labs completed a US$7 million financing round, led by IOSG and Kraken Ventures, with participation from GSR, Mantle, Starkware, Flowdesk, Avid 3, Bing Ventures, Breed, Hypersphere, Kima Ventures, Psalion, Public Works and X Ventures.

Founder Pierre Person is a former French politician, member of the National Assembly, and most recently vice-president of the president’s political party, spearheading the push for crypto asset legislation in the country.

On July 10, Usual announced the launch of its mainnet. As of August 6, the projects TVL is $146M.

According to Coinmarketcap data on August 6, nearly 95% of USD 0 transactions are currently in Curves USD 0/USDC pool, with a liquidity of $11.33 M. At the same time, there are LPs of Aaves stablecoin GHO and USD 0 on Maverick Protocol, with a current TVL of $100k.

Currently, USD 0 has a treasury planned by MEV Capital on the lending project Morpho, USD 0 USD 0++/USDC and USD 0++/USDC liquidity pools, with a total collateral of nearly $ 30 M at 86% LLTV (Liquidation Loan-to-Value). Through this pool, you can get Usual Pills rewards (see the interactive section at the end of the article for details) and Morpho token rewards at the same time.

$USUAL TGE is expected in Q4 2024, with 90% of USUAL tokens allocated to the community.

Mechanism Analysis

Mortgage and Minting

$USD 0 is the first RWA stablecoin that aggregates various US Treasury tokens and can be minted on Usual in two different ways:

a. Direct RWA deposit: Users deposit eligible RWA into the protocol and receive an equivalent amount of USD 0 at a 1:1 ratio.

b. Indirect USDC/USDT deposit: Users deposit USDC/USDT into the protocol and receive USD 0 at a 1:1 ratio. This indirect method involves third-party collateral providers who provide the necessary RWA collateral. This allows users to obtain USD 0 without having to directly handle RWA.

RWA has grown significantly, but still only accounts for a small portion of the underlying assets in the cryptocurrency market. The main challenge lies in liquidity issues, including the difficulty faced by institutions in liquidating RWA holdings in the secondary market, and retail investors are unable to obtain RWA returns in the core DeFi ecosystem. Through USD 0, Usual is able to seamlessly integrate RWA token liquidity from platforms such as Hashnote .

income

$USD 0++ is an added value Treasury note, USD 0++ is a wrapped and locked version of USD 0.

$USUAL is the governance and reward token of the Usual protocol.

The income comes from staking: users lock their USD 0 in USD 0 Liquid Bond (USD 0++) for a period of time. The income can be obtained in one of the following two ways:

USUAL Yield: Liquid Bond holders can receive their daily yield in the form of USUAL tokens (calculated every block).

Basic Interest Guarantee: USD 0++ holders are guaranteed to receive a return at least equal to the return on their USD 0 collateral (risk-free return). To achieve this, users must lock their USD 0++ for a specified period of time (currently designed to be 6 months). At the end of this period, users can choose to receive the Basic Interest Guarantee in the form of USUAL tokens or USD 0 risk-free return.

It is important to note that regardless of whether USD 0++ is obtained through primary issuance or the secondary market, holders are automatically entitled to receive USUAL tokens.

Interaction

Pills Event Overview

The pre-launch phase starts at 00:00 (UTC) on July 10 and lasts for 4 months.

Airdrop Amount: 7.5% of total $USUAL supply minted at the Token Generation Event (TGE)

Users can get $USUAL airdrop allocation through referral program and TVL contribution. Similar to Ethenas planting pills activity.

Linear distribution: the more you deposit, the more you get.

Detailed interactive guide

1. Open Usual Money dApp: https://app.usual.money/#ZHWQS or enter through the official website and enter the early access code: ZHWQS

2. Deposit USDC, USDT, ETH to mint USD 0 (Ethereum mainnet). Click the link to mint: https://app.usual.money/counter/deposit

3. Ways to earn pills:

1. Minting: When users lock USD 0 into USD 0++, they can earn 5 pills each time.

2. Hold: Users holding USD 0++ can get 3 pills per day.

3. USD 0/USDC Pool: Users who provide liquidity in Curve’s USD 0/USDC pool can receive 1 pill per day.

4. USD 0/USD 0++ Pool:

Users who contribute USD 0 to the pool can receive 3 pills per day.

For every USD 0++ minted, you can also get 5 pills, which will be distributed proportionally to the USD 0 LP in the pool.

NOTE: Providing USD 0++ to this pool will not yield any pills.

There is also a time multiplier that starts at 1 and increases by 2% every day. It resets to 1 if the user exits their position.

4. Add liquidity to get pills: Select the USD 0/USD 0++ option and enter the USD 0 amount. Link: https://app.usual.money/desk/liquidity

Pills Event Phase 2

On August 4, Usual launched the second event, where you can get Pills by completing tasks on Galxe. Event link: https://app.galxe.com/quest/usual/GCsgvtvTNA

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.