U.S. Federal Reserve Takes Action Against Customers Bank, Requires Enhanced Anti-Money Laundering Protocols

On 9 August, the US Federal Reserve reportedly took decisive measures against Customers Bank, citing significant compliance deficiencies in its digital asset strategy and instant payment network.

The enforcement measure requires the bank to strengthen its anti-money laundering (AML) protocols and limit the risks associated with digital asset customers.

The growing prominence of cryptocurrencies is becoming a politically divisive issue, further complicating the regulatory environment.

The recent failures of Silicon Valley Bank (SVB) and Signature Bank further highlight the risks and regulatory challenges facing U.S. banks in the tech and crypto industries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: A certain wallet withdrew 823,368 UNI tokens worth approximately $4.72 million from CEX within 5 hours.

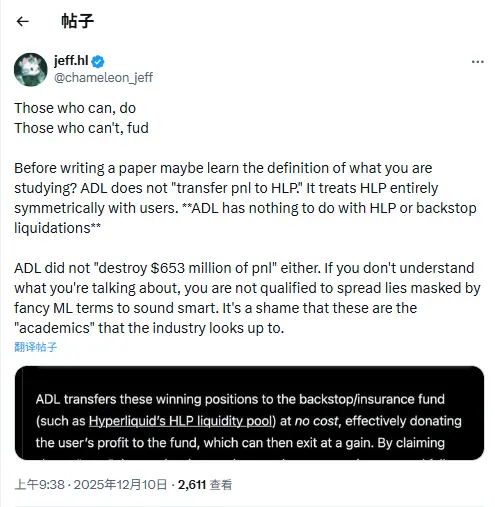

Data: Hyperliquid platform whales currently hold $4.828 billions in positions, with a long-short ratio of 0.94

Data analytics firm Inveniam announces acquisition of on-chain asset tokenization platform Swarm Markets