Bitcoin sinks under $60,000 as $157 million in long positions are liquidated

Key Takeaways

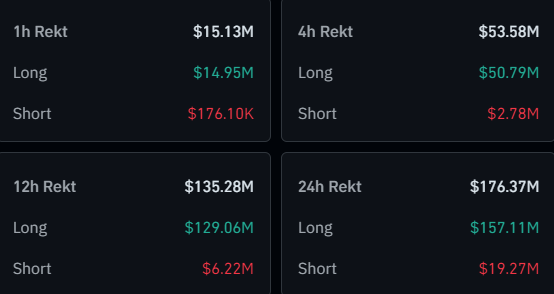

- Bitcoin fell 4.4% in 24 hours, dropping below $60,000 and triggering $157m in long position liquidations.

- Market concerns stem from potential Mt. Gox creditor sell-offs and Fed Chairman Powell's remarks on US economic instability.

Bitcoin (BTC) is down 4.4% in the past 24 hours after losing the $60,000 price floor today, according to data aggregator CoinGecko. This movement prompted a price slump in the whole market, resulting in nearly $157 million in long positions being liquidated intraday.

Image: Coinglass

Image: Coinglass

The negative performance of Bitcoin and other crypto could be tied to the looming fears of a Mt. Gox creditors’ sell-off this month, and a potential negative reaction to Jerome Powell’s remarks yesterday about the US economy.

As reported by Crypto Briefing, a CoinShares study highlights that the fear of a huge BTC sell-off by the repayment of Mt. Gox creditors might be exaggerated. The worst-case scenario shared in the study reveals a single 19% daily drop in price, although CoinShares analysts find this outcome to be unlikely.

Moreover, the speech by the Chairman of the Federal Reserve yesterday, in Portugal, raised some concerns among investors. Highlights from Powell’s remarks are the budget deficit being “very large and unsustainable,” the unemployment rate at 4% is still very low, and the Fed is not confident enough to cut interest rates.

This paints a picture of continuous economic instability in the US and leaves the market wondering how long it will take for the first interest rate cut. Therefore, this impacts crypto directly, as risk assets need both smaller interest rates and an optimistic landscape to become more attractive.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.