BTC Still Shaky Below $64K Days Ahead of Halving, NEAR Soars 6% (Market Watch)

PEPE has followed NEAR on the way up.

Bitcoin’s price movements continue to be quite underwhelming as the asset failed to overcome the $64,000 level and has remained just below it.

Most altcoins are also quite sluggish, with ADA and BCH charting minor losses, while NEAR and PEPE have gained the most.

Bitcoin’s Uncertainty Continues

The primary cryptocurrency went through a highly violent weekend in which it first slumped by six grand on Friday evening to $65,000 before another decline drove it south to just over $61,000 a day later. Both of these collapses were blamed on external events like the US Fed’s most recent comments and Iran’s retaliation against Israel.

Bitcoin started to recover some ground on Sunday and Monday morning and jumped to just over $67,000. However, that was short-lived , and the cryptocurrency started losing value almost immediately.

It has been unable to regain any traction since then and now stands below $64,000 after another failed attempt to overcome that line. Its market capitalization has slipped to $1.250 trillion, but its dominance over the altcoins remains just over 51.5% on CG.

Bitcoin’s fourth halving, an event generally regarded as a catalyst for future price increases, is just days ahead. It would be interesting to follow how the asset will perform in the next 72 hours or so leading to the event.

NEAR, PEPE Stand Alone

Most altcoins slumped hard during the weekend crash, with numerous double-digit drops seen by almost all altcoins on both days. Although they have bounced off the lows, the situation is still quite gloomy.

ETH, BNB, ADA, AVAX, BCH, DOT, and LINK are still in the red from the larger-cap alts, while only SOL, XRP, TON, DOGE, and SHIB have produced insignificant gains.

The most substantial price increases come from NEAR Protocol’s native token and the popular meme coin – PEPE. The former has jumped by about 6% in a day, while the latter by 5%.

The total crypto market cap, though, still remains quite shaky and is close to breaking below $2.4 trillion on CG.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

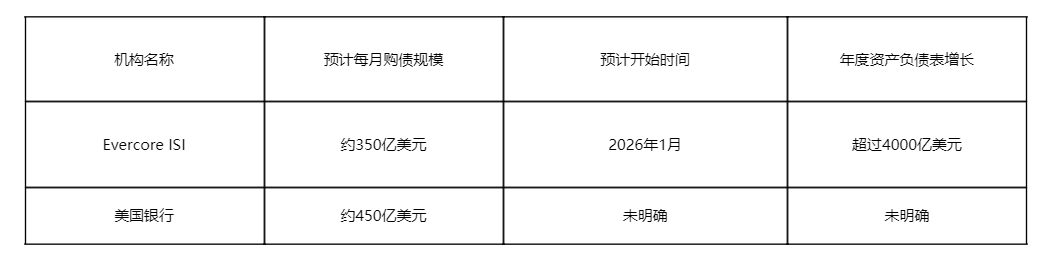

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

The Federal Reserve cuts interest rates as expected, what happens next?

Trending news

MoreThe Federal Reserve cuts interest rates as expected, what happens next?

[Bitpush Daily News Selection] The Federal Reserve cut interest rates by 25 basis points as expected; the Federal Reserve will purchase $40 billions in Treasury securities within 30 days; Gemini received CFTC approval to enter the prediction market; State Street Bank and Galaxy will launch the tokenized liquidity fund SWEEP on Solana in 2026.

![[Bitpush Daily News Selection] The Federal Reserve cut interest rates by 25 basis points as expected; the Federal Reserve will purchase $40 billions in Treasury securities within 30 days; Gemini received CFTC approval to enter the prediction market; State Street Bank and Galaxy will launch the tokenized liquidity fund SWEEP on Solana in 2026.](https://img.bgstatic.com/multiLang/image/social/87a413b57fb2c702755e8bc5b4385a781765441081405.png)