Bitcoin ( BTC ) circled $65,500 at the April 15 Wall Street open as traders licked their wounds after the weekend BTC price washout.

Bitcoin eats up fresh bid liquidity as BTC price fights for $65K

Bitcoin is in no mood for a comprehensive BTC price recovery as the week gets underway.

BTC price stems volatility after weekend dip bounce

Data from Cointelegraph markets Pro and TradingView tracked a comparatively calm start to the United States “TradFi” trading week.

The lack of volatility at the time of writing contrasted firmly with scenes from the weekend in which BTC/USD dropped to near $61,000.

This came in the form of a knee-jerk reaction to geopolitical instability in the Middle East, with Bitcoin avoiding some of the deeper losses that hit altcoins.

Now, traders turned to what many saw as a difficult period to navigate in the short term. Bitcoin’s block subsidy halving was just days away — an event that traditionally brings unsettled trading conditions in its own right.

“With the halving coming up in less than a week, I won't be surprised to see a pump to the halving followed by a dump after the halving to shakeout weak hands before the next leg up,” Keith Alan, co-founder of trading resource Material Indicators, wrote in part of commentary on X (formerly Twitter).

“Of course escalating geopolitical tensions might alter the trajectory, so certainly tuned into that.”

Alan highlighted changing exchange order book liquidity conditions, suggesting that overhead resistance above $70,000 would remain in place until bulls could lure bids closer to current spot price.

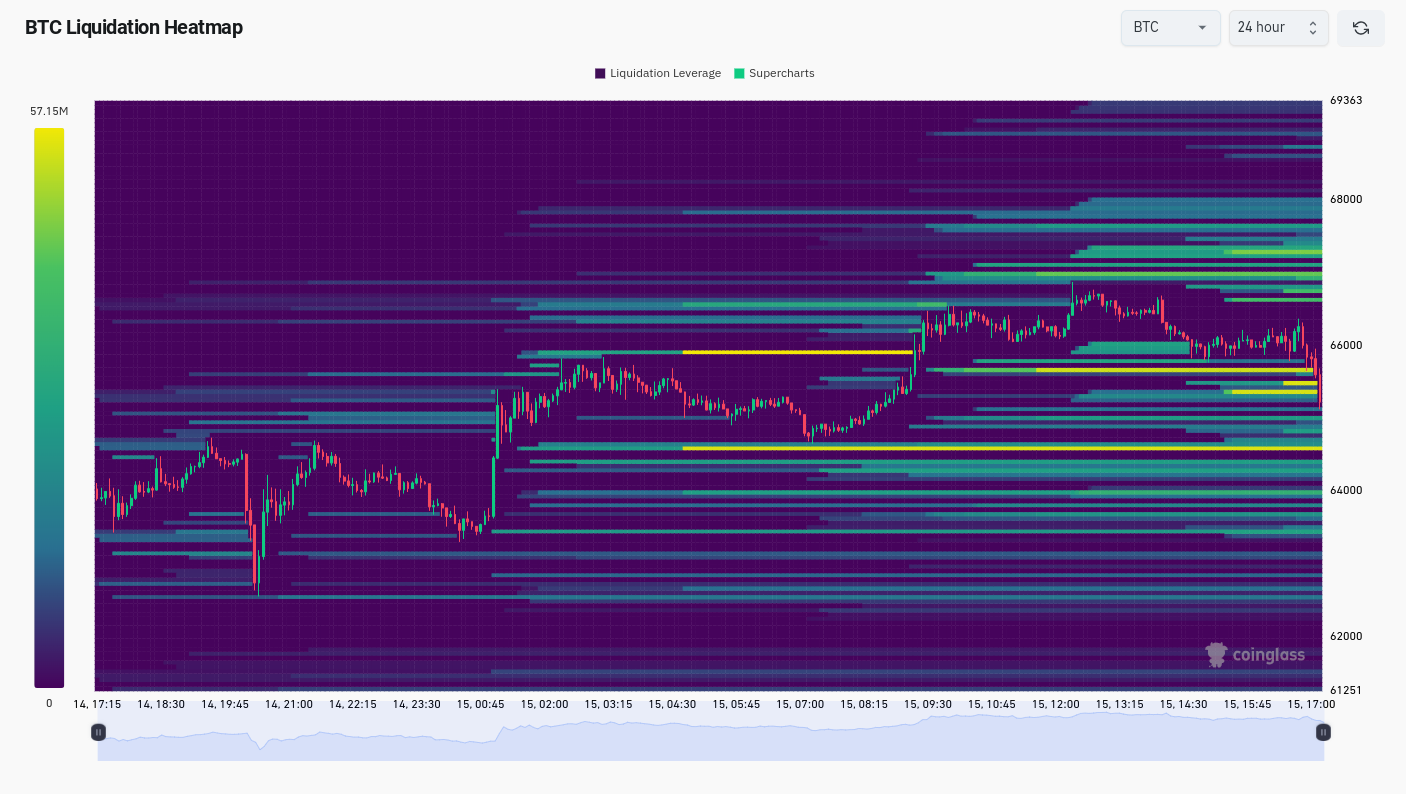

Data from monitoring resource CoinGlass meanwhile showed Bitcoin eating into bid liquidity at and below $66,000 at the time of writing.

“Lots of systematic retests this morning, important day I think for crypto market to establish the next phase for direction,” popular trader Skew meanwhile continued.

Skew highlighted the need to preserve exponential moving averages (EMAs) on both 4-hour and daily timeframes. Bitcoin’s relative strength index (RSI) further needed to return above the central 50 level.

Bitcoin ETF buyers under the microscope

With news that Hong Kong had approved both spot Bitcoin and Ether ( ETH ) exchange-traded funds (ETFs), attention once more focused on their U.S. counterpart.

Given the drop over the weekend, Skew was among those concerned that investors might vote with their feet on the first trading day of the week.

“Red premarket, going to be keeping an eye on these today and potential price impact of spot flows,” he wrote in part of an X post about spot ETF markets.

As Cointelegraph reported , overall ETF inflows have slowed considerably versus their peak in recent weeks.

The day meanwhile saw only a modest outflow from the Grayscale Bitcoin Trust (GBTC), coming in at an estimated 1,600 BTC ($105 million).

The data, compiled by crypto intelligence firm Arkham, was uploaded to X by popular trader Daan Crypto Trades, who suggested that GBTC flows had become less important as a metric.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | The first SUI ETF is approved for listing and trading; SEC meeting reveals regulatory differences on tokenization, with traditional finance and the crypto industry holding opposing views

The first SUI ETF is listed, an SEC meeting reveals regulatory disagreements, bitcoin price drops due to employment data, US debt surpasses 30 trillions, and the IMF warns of stablecoin risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Moore Threads makes its debut with a surge of over 500%! The market value of the first domestic GPU stock once exceeded 300 billions yuan.

On its first day of trading, the "first domestic GPU stock" saw an intraday peak increase of 502.03%, with its total market value once exceeding 300 billions RMB. Market analysis shows that a single lot (500 shares) could earn up to 286,900 RMB at the highest point.

ETFs are being launched in clusters, but coin prices are falling. Can ETF approval still be considered good news?

On one hand, Vanguard Group has opened trading for Bitcoin ETFs, while on the other, CoinShares has withdrawn its applications for XRP, Solana Staking, and Litecoin ETFs, highlighting a significant divergence in institutional attitudes towards ETFs for different cryptocurrencies.

Trending news

MoreMars Morning News | The first SUI ETF is approved for listing and trading; SEC meeting reveals regulatory differences on tokenization, with traditional finance and the crypto industry holding opposing views

Moore Threads makes its debut with a surge of over 500%! The market value of the first domestic GPU stock once exceeded 300 billions yuan.