Crypto asset manager Grayscale’s Bitcoin ( BTC ) exchange-traded fund (ETF) has notched another day of high outflows as nearly $359 million exited the fund on March 21, but analysts think the Grayscale-led exodus could soon be coming to an end.

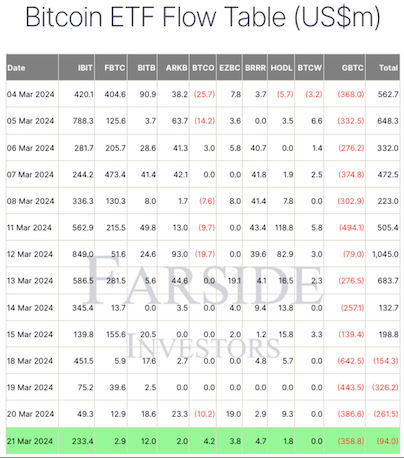

The Grayscale Bitcoin Trust’s (GBTC) March 21 net outflows of $358.8 million follows a massive week of outflows, with its $642 million on March 18being the largest day on record, per Farside Investors data.

GBTC outflows have thinned out since Monday. Source: Farside Investors

The latest figures bring this week’s total outflows for GBTC to $1.8 billion and marks the fourth consecutive day of net outflows across all 10 Bitcoin ETFs.

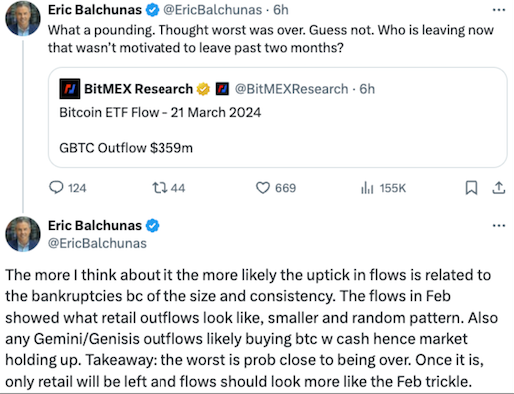

Senior Bloomberg ETF analyst Eric Balchunas speculated in a March 21 X post that much of Grayscale’s outflows could soon drawi to a close, with the majority of them coming from bankruptcies of crypto firms due to their “size and consistency.”

“Any Gemini/Genisis outflows likely buying BTC [with] cash hence market holding up,” said Balchunas.

“Takeaway: the worst is [probably] close to being over. Once it is, only retail will be left and flows should look more like the Feb trickle,” he added.

Source: Eric Balchunas

As of March 21, Grayscale reported that its Bitcoin Trust held a total of $23.2 billion in assets under management. In total, GBTC has shed $13.6 billion since being converted to an ETF on Jan. 11.

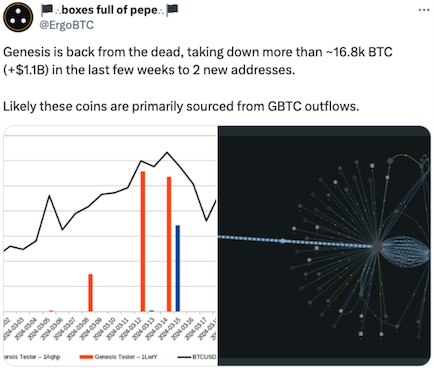

In line with Balchunas, pseudonymous independent researcher ErgoBTC suggested that approximately $1.1 billion worth of GBTC outflows over the last few weeks appear to have come from bankrupt crypto lender Genesis.

Source: ErgoBTC

“Resulting activity volumes and timings of funds out of GBTC and into Genesis match pretty well,” Ergo said. “Simply there just aren’t that many 2k BTC txs per day so likely the GBTC outflows and Genesis inflows are related.”

Pseudonymous crypto market commentator Whale Panda offered similar sentiment, pointing to a March 19 statement from Genesis which said the firm would be returning assets to creditors "in kind" — meaning that the defunct lender would be selling GBTC shares for Bitcoin.

On Feb. 14, Genesis received approval from a United States court to begin liqudiating its $1.3 billion worth of GBTC shares in a bid to repay its creditors.

Nearly a month prior, bankrupt cryptocurrency exchange FTX sold 22 million GBTC shares, valued at nearly $1 billion, completely liquidating all of its holdings .