Is BTC Overdue a Correction Following Epic Rally Above $60K? (Bitcoin Price Analysis)

Bitcoin’s price has been on an almost vertical rise in the last few days, approaching its all-time high of $69K. Yet, the cryptocurrency might not make a new record right away, as some warning signals are pointing to a short-term correction.

Technical Analysis

By TradingRage

The Daily Chart

On the daily timeframe, it is evident that the price has been rallying aggressively during the last month, breaking past several significant resistance levels. The market is currently one step away from making a new all-time high, as there are no significant long-term resistance levels left apart from the $69K level itself.

Yet, the Relative Strength Index demonstrates a clear overbought signal that could point to a potential consolidation or pullback in the coming days.

The 4-Hour Chart

Looking at the 4-hour timeframe, the price has created a short-term resistance level at the $64K mark. BTC has been consolidating between this level and the $60K support level recently.

Meanwhile, the Relative Strength Index is retreating from the overbought zone without the price showing a significant drop. This can be interpreted as a cooldown for momentum and hint at a potential continuation soon after a breakout from the $64K level.

Sentiment Analysis

By TradingRage

Bitcoin Funding Rates

While Bitcoin’s price is quickly approaching its all-time high, the market attracts many buyers and speculators. However, this extreme optimism might be costly in the short term.

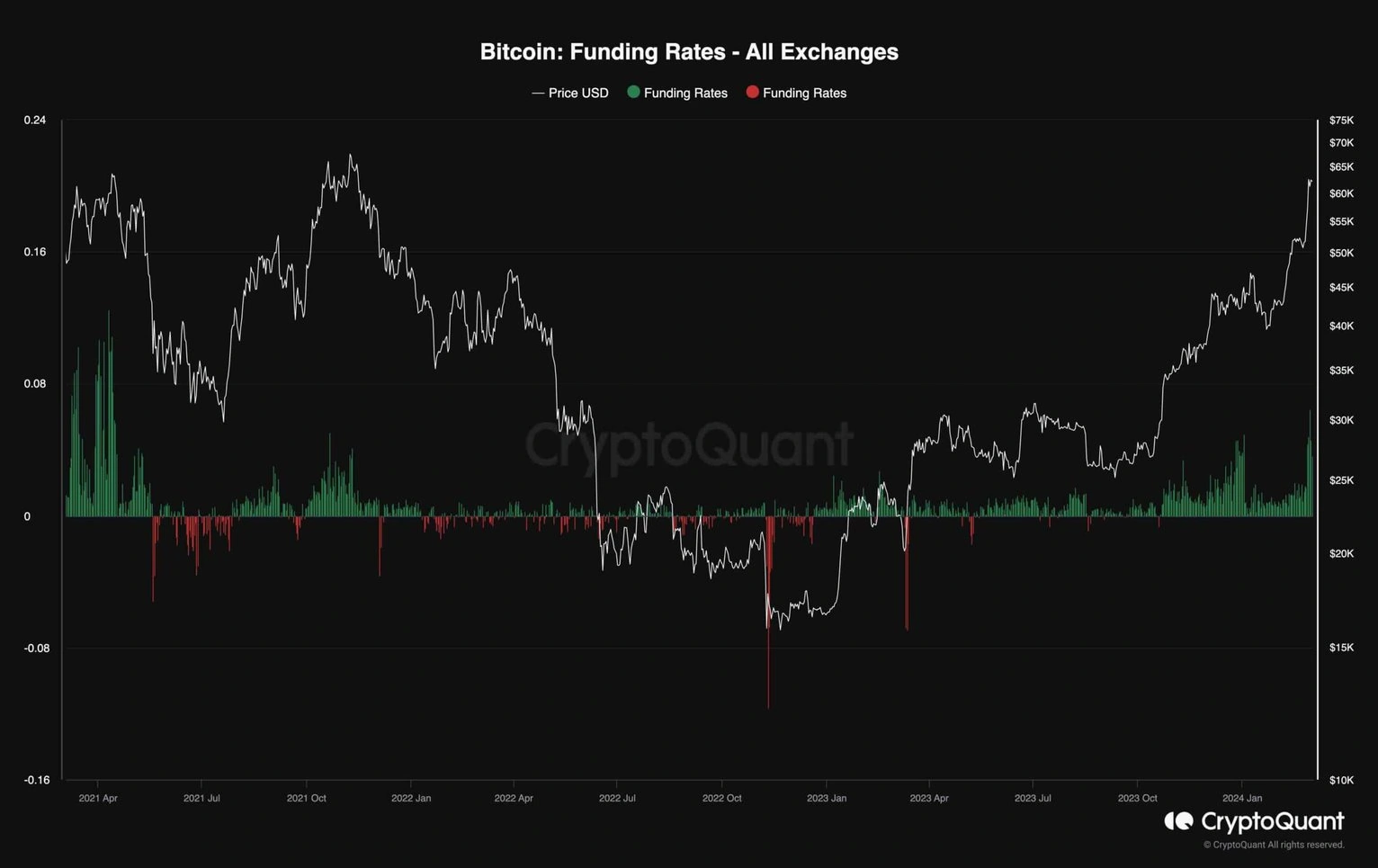

This chart demonstrates the Bitcoin funding rates, one of the most valuable metrics for future market sentiment evaluation. Values above zero are associated with optimism, while negative values indicate bearish sentiment.

Currently, the funding rates are displaying high values, as they have spiked significantly in the last few days. This might result in a long liquidation cascade in the short term, which could then lead to a quick drop. Therefore, a correction might be due shortly before the bullish trend continues.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Durov's new project: Want to mine TON on Cocoon? Ordinary people can't afford to play

Want to mine TON on Cocoon? The starting capital is 250,000; ordinary people shouldn't dream of becoming a "computing power landlord."

"If you're afraid, buy bitcoin": BlackRock CEO calls bitcoin a "panic asset", says sovereign funds have quietly increased their holdings

BlackRock CEO Larry Fink defines Bitcoin not as a "hope asset," but as a "panic asset."

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.