SUI Overtakes Bitcoin, Aptos To Become 13th-Largest DeFi Network

The SUI blockchain has been ramping up since the year 2024 began, and a natural consequence of this rapid growth is that it has now surpassed some major players in the decentralized finance (DeFi) space. This has put it ahead of heavy hitters such as Bitcoin and Aptos as SUI begins to leave its mark on the market.

SUI Network TVL Crosses $360 Million

The total value locked (TVL) on the SUI network has completely exploded in the last year. The total value locked on the blockchain was sitting at less than $12 million in the middle of 2024. But now, less than a month into the year 2024, the TVL has already crossed the $360 million mark.

While this figure is still far off from the likes of Ethereum and BSC which continue to dominate the DeFi TVL, it puts it ahead of some heavy hitters in the game. For example, the Bitcoin TVL is currently sitting at $298.8 million, which means SUI TVL is much higher than that of Bitcoin.

Then again, another network which is currently lagging behind SUI is the Aptos TVL. The Aptos blockchain, which was launched to much fanfare back in 2022, is sitting at a TVL of $133 million. This means that SUI’s TVL is more than 2x higher than that of Aptos .

Other DeFi networks which SUI has surged ahead of include the likes of Kava at a TVL of $251 million, Near at a TVL of $94 million, and Metis at a TVL of $124 million. With its TVL figures, SUI is now the 13th-largest DeFi network.

DeFi Making A Comeback

After a long stretch of poor performance, the DeFi market looks to be making its comeback in 2024. As DeFiLlama data shows, after the market peaked at a TVL of almost $245 billion in 2022, it dropped more than 50%, spending the majority of 2023 trailing below $70 billion.

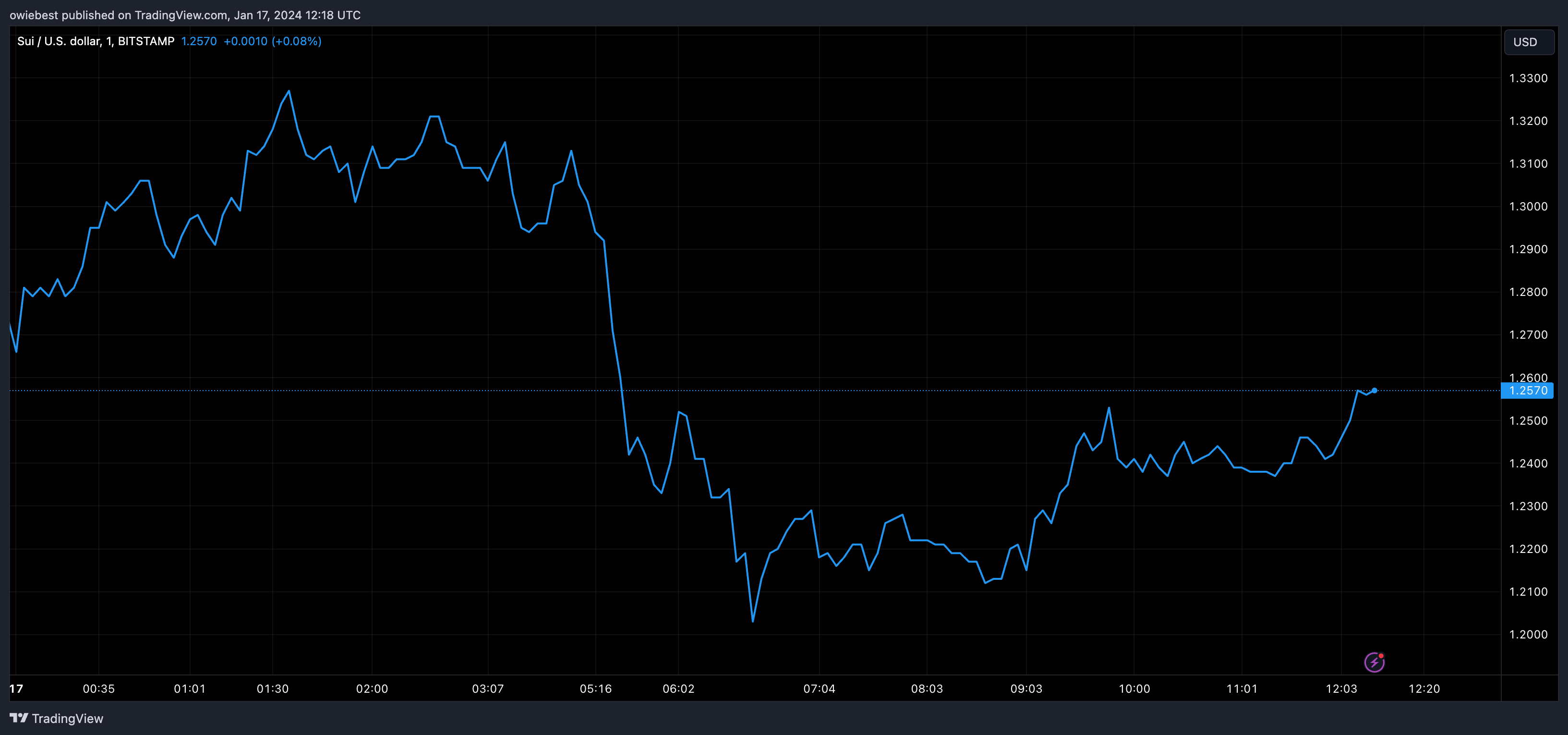

However, as crypto market sentiment has improved, so has the DeFi TVL. The TVL has grown from its October 2023 lows of $47 billion to more than $72 billion so far in 2024. This is as a result of the likes of SUI gaining more adoption and their token prices also increasing.

As expected, Ethereum dominates the majority of this TVL, currently sitting at $43.743 billion. The Tron and BSC networks are the second and third-largest, with TVLs of $8.14 billion and $5.41 billion, respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Talus (US)

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.