Bitcoin ( BTC ) exchange outflows in January are chipping away at bearish BTC price prognoses.

The latest data from on-chain analytics firm Glassnode confirms that despite a 20% dip on BTC/USD, coins have continued to leave exchanges.

Data: Bitcoin ETF panic subsiding

Bitcoin investor appetite has not suffered as a result of current BTC price pressures, according to on-chain monitoring.

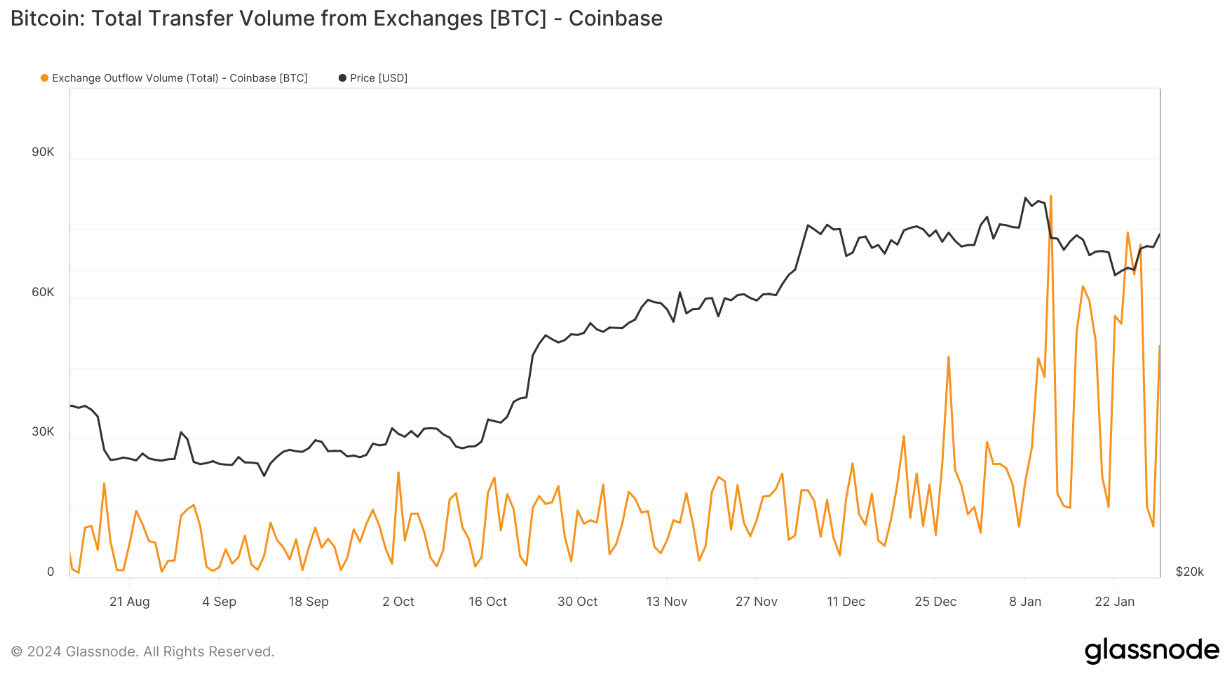

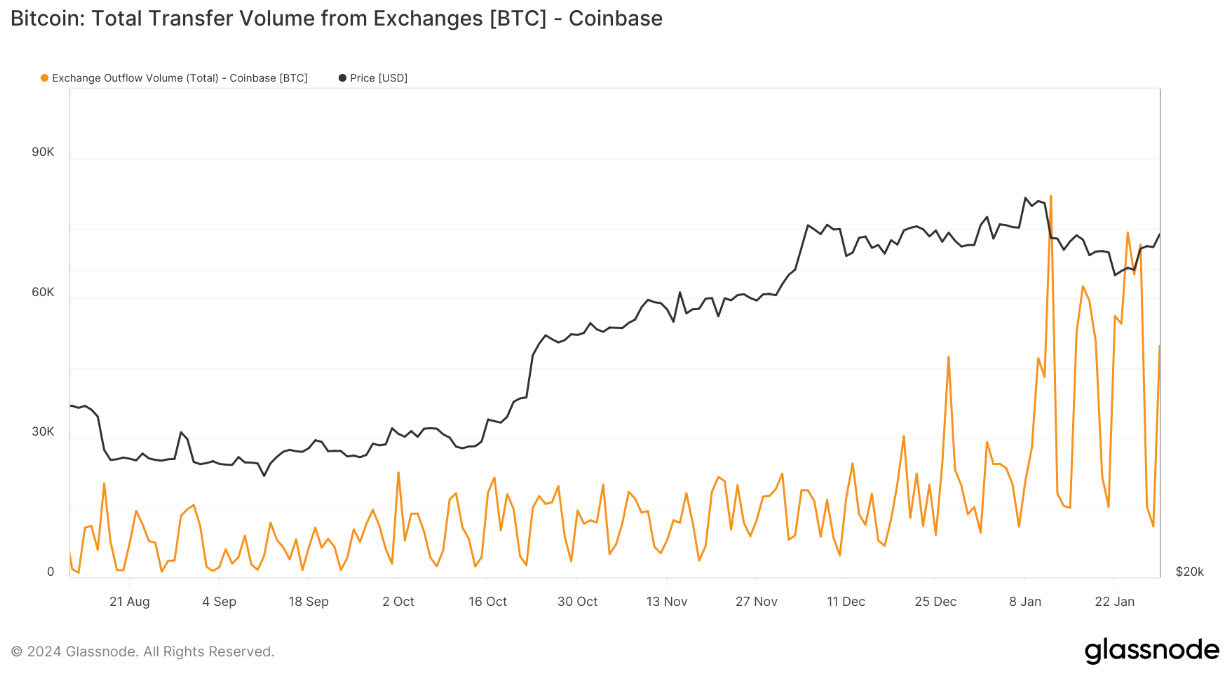

Per Glassnode, outflows from United States exchange Coinbase alone have consistently totaled more than 10,000 BTC per day since the launch of the first U.S. spot Bitcoin exchange-traded funds (ETFs).

![]() Bitcoin net outflows from Coinbase. Source: Glassnode

Bitcoin net outflows from Coinbase. Source: Glassnode

While balance data shows the impact of corresponding inflows, a trend is nonetheless emerging in the second half of the month — outflows and inflows are becoming more balanced, suggesting a cooling of the volatility seen post-ETF launch on Jan. 11.

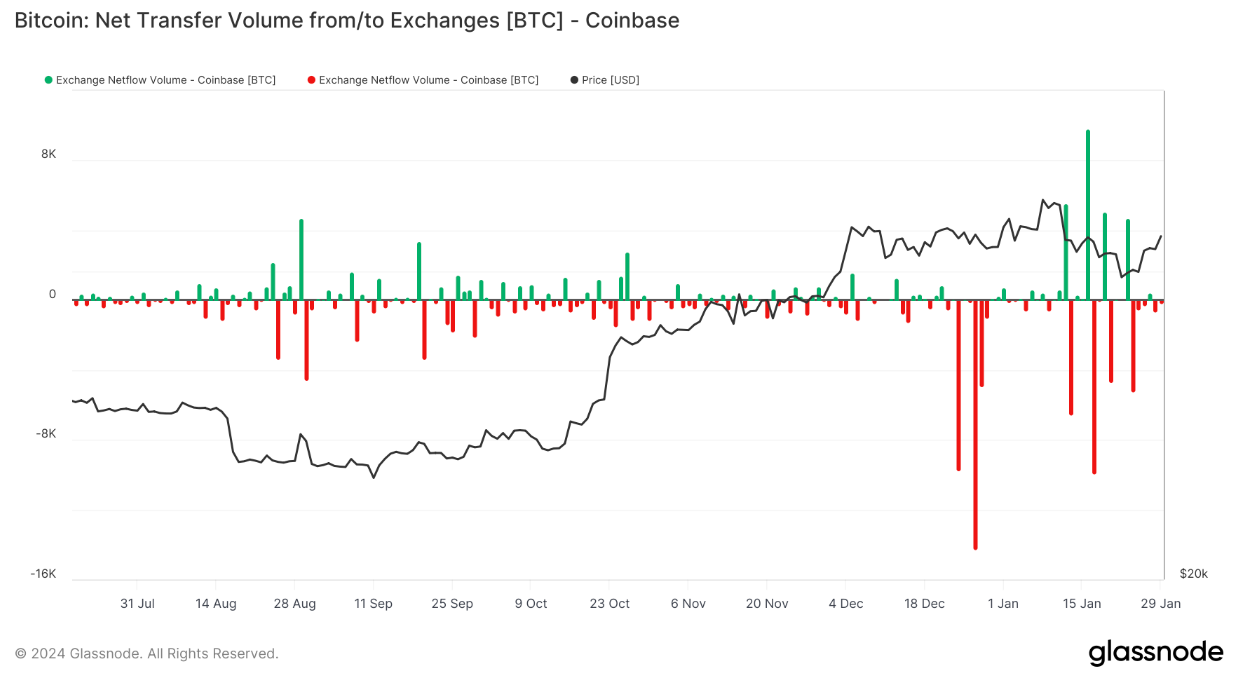

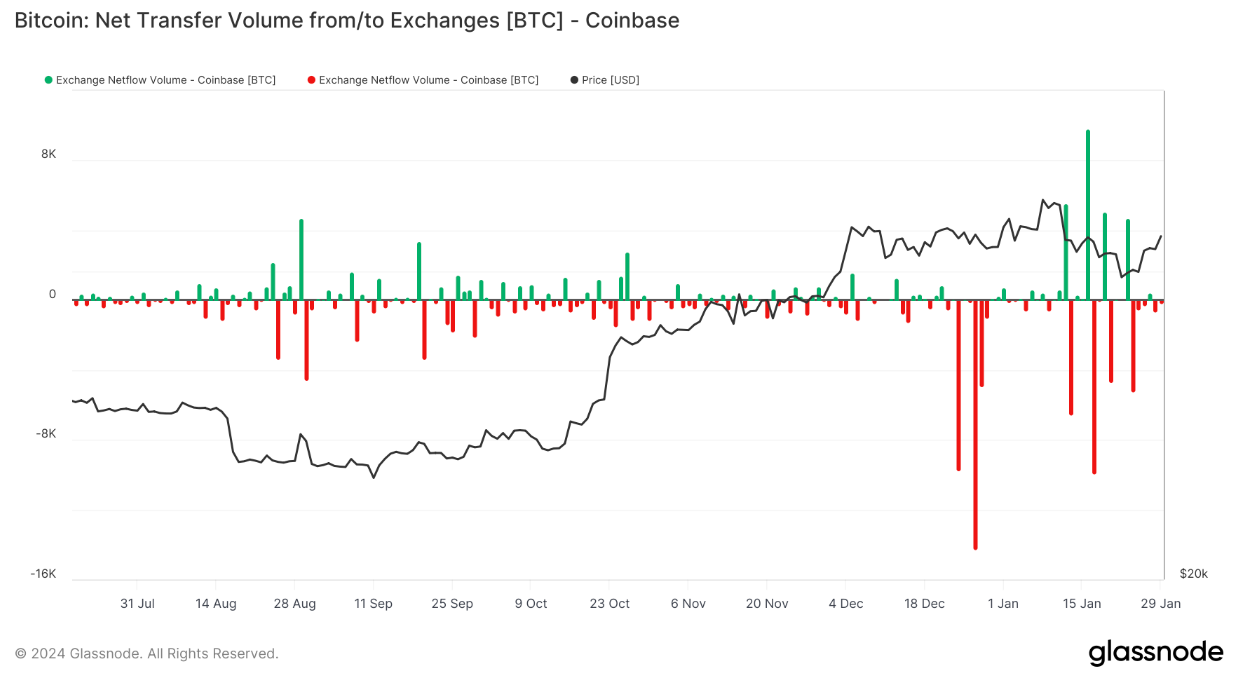

![]() Bitcoin netflows for Coinbase. Source: Glassnode

Bitcoin netflows for Coinbase. Source: Glassnode

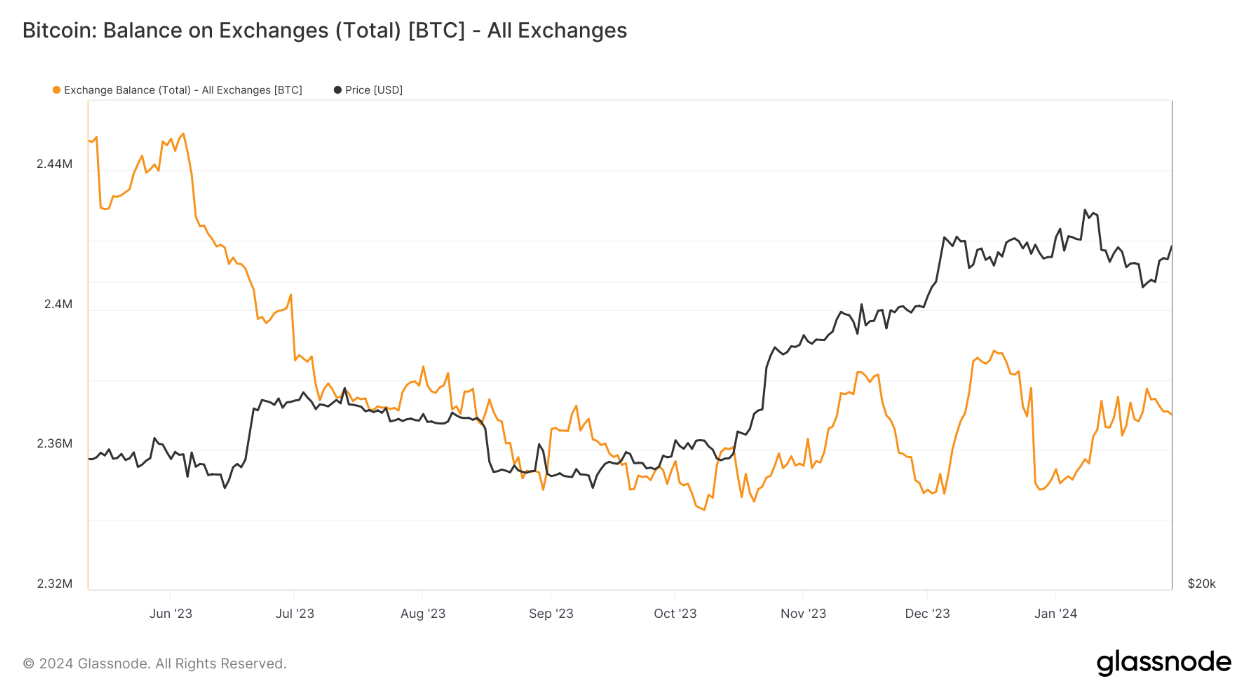

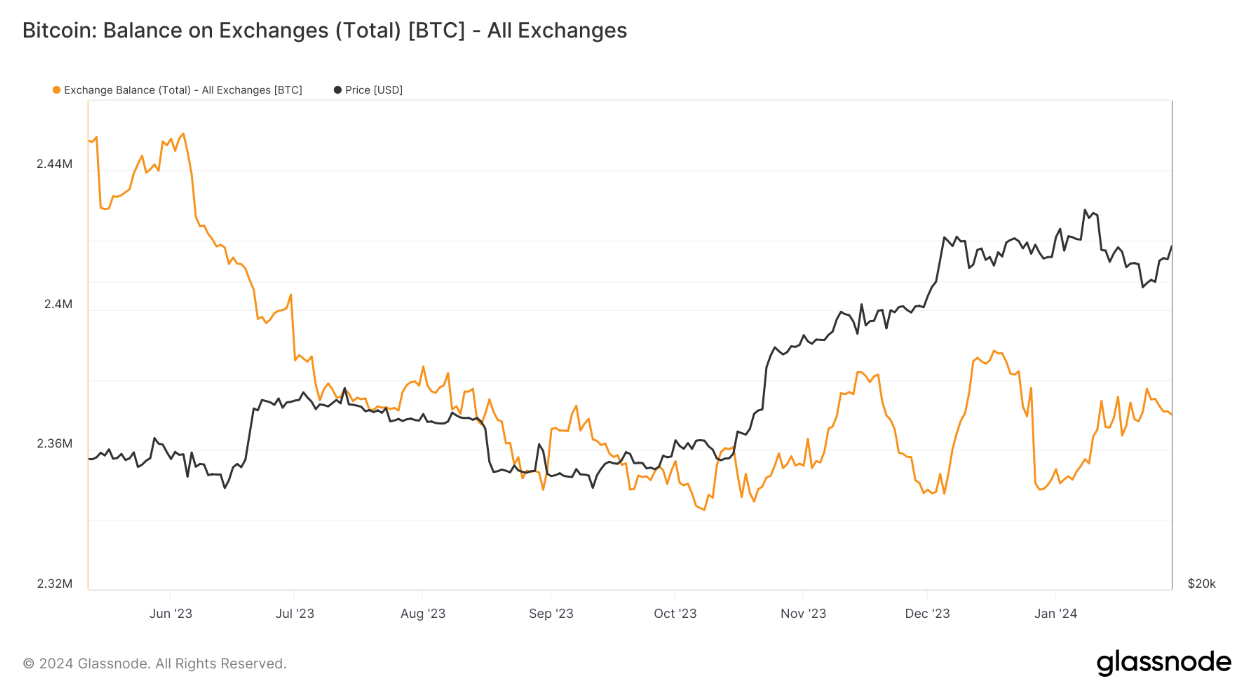

Exchanges’ BTC balance had been rising throughout January, only reversing direction on Jan. 23.

Since that date, the trading platforms tracked by Glassnode have become lighter to the tune of 7,400 BTC ($321 million).

![]() Bitcoin exchange balances. Source: Glassnode

Bitcoin exchange balances. Source: Glassnode

GBTC inches toward flow "flippening"

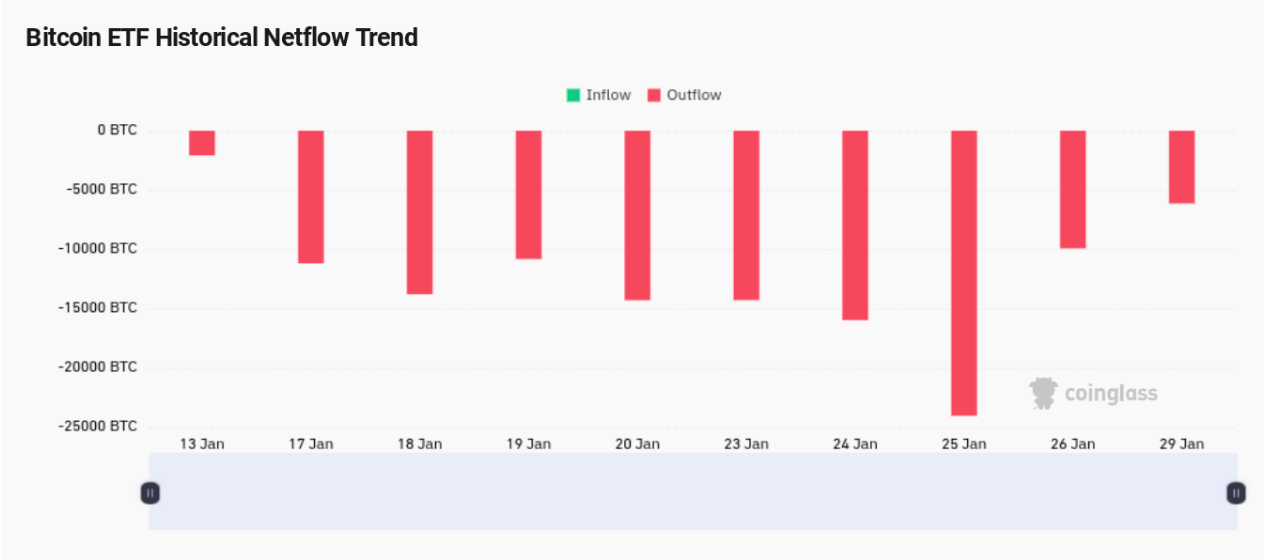

At the same time, ETF flows themselves are also trending in Bitcoin bulls’ favor.

Related: BlackRock Bitcoin ETF passes $2B holdings as GBTC outflows dip 50%

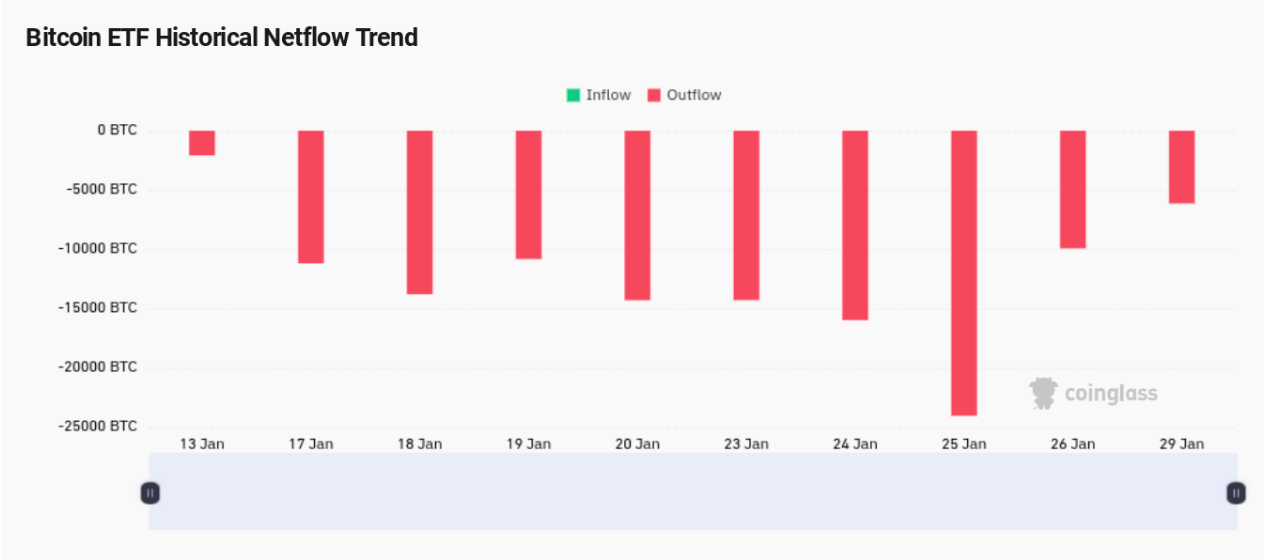

Whereas the Grayscale Bitcoin Trust (GBTC) was sending around $700 million in BTC to Coinbase per day previously, the latest daily outflows totaled less than $200 million .

In BTC terms, Jan. 25 saw 24,000 BTC in outflows, while Jan. 29 saw little over 6,000 BTC.

![]() Grayscale Bitcoin Trust (GBTC) netflows (screenshot). Source: CoinGlass

Grayscale Bitcoin Trust (GBTC) netflows (screenshot). Source: CoinGlass

Analyzing GBTC flows using data from statistics resource CoinGlass , financial commentator Tedtalksmacro predicted an incoming flip for the spot ETFs — from net outflows to net inflows.

“Once we start to see green on this chart, what narrative do you have to sell other than some unknown event that we don’t know about now,” he argued in his latest YouTube video.

Tedtalksmacro described the bearishness accompanying GBTC outflows in recent weeks as “overblown.”

“$26 billion in on-chain holdings in these BTC ETFs, and that number is going to keep going higher and higher and higher as people get more comfortable with this asset class,” he forecast about worldwide ETF products.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.