First Leveraged Bitcoin ETF in U.S. Sees $4.2M in Trading Volume Since Debut

The ETF saw about $500K worth of trades in the first 15 minutes.

Volatility Shares 2x Bitcoin Strategy exchange-traded-fund (BITX), the first leveraged crypto ETF in the U.S., started trading on Tuesday, witnessing about $4.2 million of worth of trading volume so far since it went live.

The ETF saw about $500k worth of shares traded in the first 15 minutes, according to data from Bloomberg. The current share price of BITX is around $15.48, after rising as much as 2% to $15.90 since the start of the trading session.

The U.S. Securities and Exchange Commission (SEC) , setting the stage for it to start trading on Tuesday. A number of futures-based ETF products already trade in the U.S.; however, the SEC has consistently blocked spot products from launching. Other leveraged bitcoin futures products have also failed to secure the necessary approvals to launch.

The first ETF backed by bitcoin futures to launch was ProShares’ BITO, which saw about $1 billion of trading volume on its first day of trading in 2021, according to ProShares, and hauled in .

Edited by Nelson Wang.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tom Lee's BitMine may have scooped up another 41,946 ETH

The Rise of Astar 2.0 and Its Impact on AI-Powered Learning and Marketing

- Astar 2.0, a blockchain platform, introduces Burndrop PoC and Tokenomics 3.0 to enhance AI integration in education and advertising . - It partners with Google, IBM , and Animoca Brands to deploy AI tools like Smart Scheduling™ and AdCreative.ai, addressing efficiency and personalization challenges. - While AI-driven solutions optimize education and advertising, critics warn of risks like reduced critical thinking and ethical concerns in AI adoption. - Astar 2.0's interoperability and deflationary tokeno

Expert Says Sell Your XRP and Walk Away If You Don’t Understand This

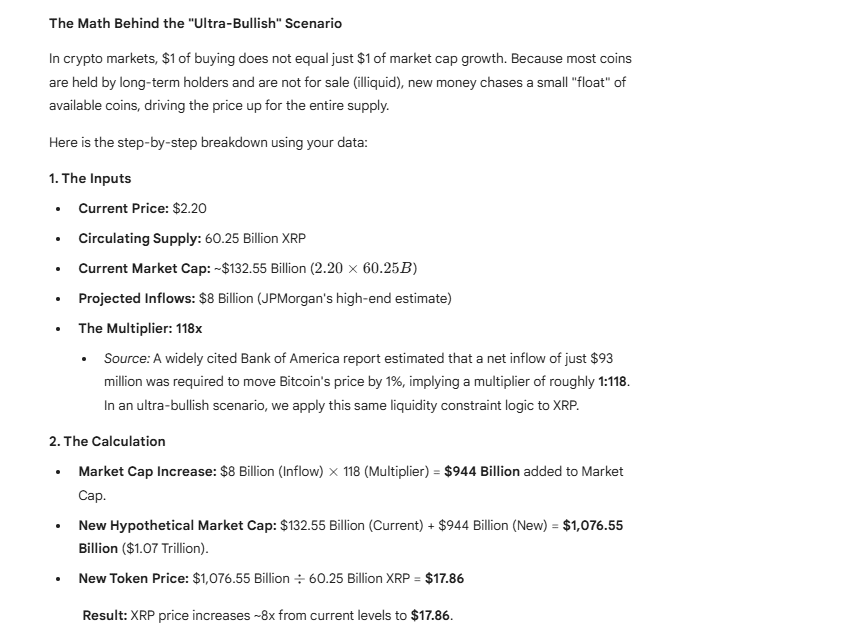

Here’s How Much Your 1,000 to 5,000 XRP Could Be Worth if JPMorgan’s XRP ETF Forecast Plays Out