Why a Pi Network ETF is premature despite rumored listing and ecosystem upgrades

Analysts say no Pi Network ETF is in sight, stressing the need for real price discovery, liquidity, regulatory maturity and regulated custody before any filing.

- No Pi Network ETF exists, and no issuer has filed or announced plans, according to industry observers and the ActuFinance analysis.

- ActuFinance says Pi needs a reliable public price, stronger trading volume, clearer regulation and a regulated custodian before institutional ETF interest.

- A rumored MiCA-compliant Pi listing on OKX Europe in late 2025 could aid liquidity, but an ETF still hinges on sustained stability and transparency.

No Pi Network exchange-traded fund currently exists, and no filings or official announcements have been made regarding such a product, according to industry observers.

Analysts at ActuFinance have outlined several criteria that Pi Network would need to meet before institutional consideration of an ETF could occur.

Why are there no Pi Network ETFs?

The cryptocurrency would require a public and widely accepted market price, according to the analysis. Pi Network currently displays a visible price across multiple platforms, though the network experiences recent fluctuations, the analysts stated.

Strong liquidity represents another essential requirement, the report noted. ETF issuers need sufficient trading volume to execute large transactions. Pi Network’s ( PI ) current trading volume remains significantly lower than major cryptocurrencies, according to market data.

Regulatory maturity constitutes a necessary component, the analysts said. Regulators require assets that are verifiable, trackable, and protected against manipulation. Pi Network continues to move toward greater transparency and compliance, though additional development is needed to demonstrate institutional-grade maturity, according to the analysis.

A regulated custodian capable of securely storing the tokens would be required for ETF functionality, the report stated. No traditional financial institution currently holds Pi Network tokens in a regulated environment. Custodian approval and full network accessibility would be necessary prerequisites, according to ActuFinance.

If Pi Network achieves full listing status, openness, and stability, an ETF structure could theoretically be created, the analysts said. Such a product would hold actual Pi tokens managed by a regulated custodian, with regular reporting to maintain transparency. The ETF price would track Pi Network’s market value , allowing investors to gain exposure through standard brokerage accounts.

Market observers have noted a rumored major network update scheduled for November 28. A MiCA -compliant listing on OKX Europe is expected on November 28, 2025, which could influence trading volume and liquidity, according to industry reports.

The creation of a Pi Network ETF would depend on the cryptocurrency achieving stable pricing, increased liquidity, regulatory approval, and a trusted custodian arrangement, the ActuFinance analysis concluded.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

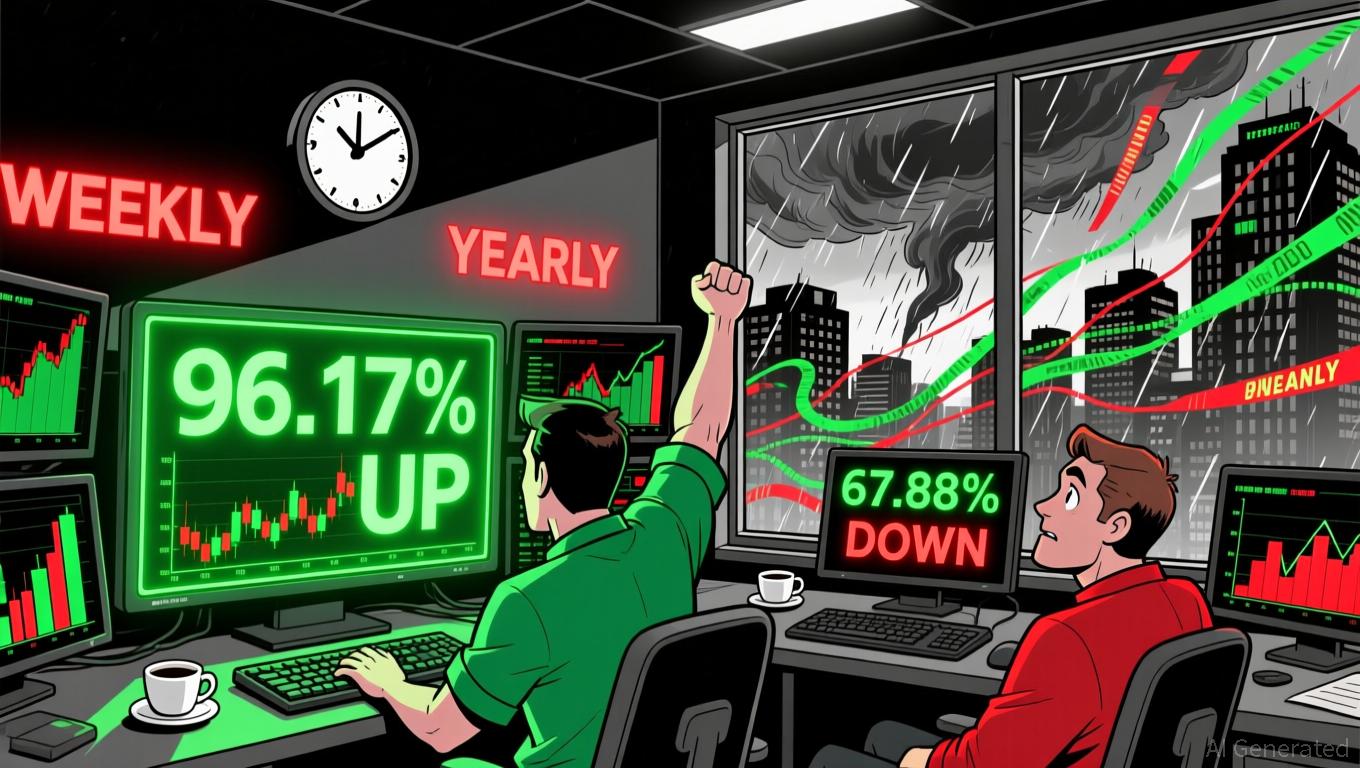

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.

Bitcoin’s Steep Drop: Uncovering the Triggers and What It Means for Investors

- Bitcoin's 2025 year-end 20% plunge highlights systemic risks and psychological volatility in crypto markets. - Trump's 100% China rare earth tariffs and Fed's 75-basis-point rate hike triggered initial 38% price collapse. - China's crypto ban erased 5% of Bitcoin's value, amplifying global regulatory risks for digital assets. - Algorithmic trading accelerated selloffs by detecting bearish signals faster than human traders could respond. - Investors must prioritize diversification and adapt strategies to

Bitcoin’s Latest Price Swings: Causes, Impacts, and Tactical Prospects

- Bitcoin's 2023-2025 volatility stemmed from macroeconomic uncertainty, delayed Fed rate cuts, and AI-driven credit strains, with prices swinging from $109,000 to $70,000 amid Bybit's security breach. - Regulatory shifts like U.S. Strategic Bitcoin Reserve and custody rules, plus offshore stablecoin risks, exacerbated systemic fragility as crypto financialized through ETFs and derivatives. - Growing equity correlations (e.g., Nasdaq 100) and institutional adoption (MicroStrategy, ETF inflows) highlight Bi

Dogecoin Could Reboot Soon: Rising Wallets Signal Accumulation Around Key Zones