Meanwhile, the cryptocurrency market continues trading in the red, with Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and other tokens trading in bearish territory.

Husky Inu (HINU) Set For Move To $0.00021800

The project also crossed the $900,000 milestone after several delays as the cryptocurrency market struggled with volatility and selling pressure in September. As a result, fundraising slowed down before picking up again after markets rebounded. Husky Inu adopted a dynamic pricing strategy during its pre-launch phase, increasing the value of the HINU token every two days. This has allowed the project to raise funds quickly while maintaining favorable pricing and empowering its growing community. Thanks to its dynamic strategy, Husky Inu has raised $903,276 so far, and remains on track to reach its stated goal of $1.2 million.

Cryptocurrency Market Struggles To Get Going

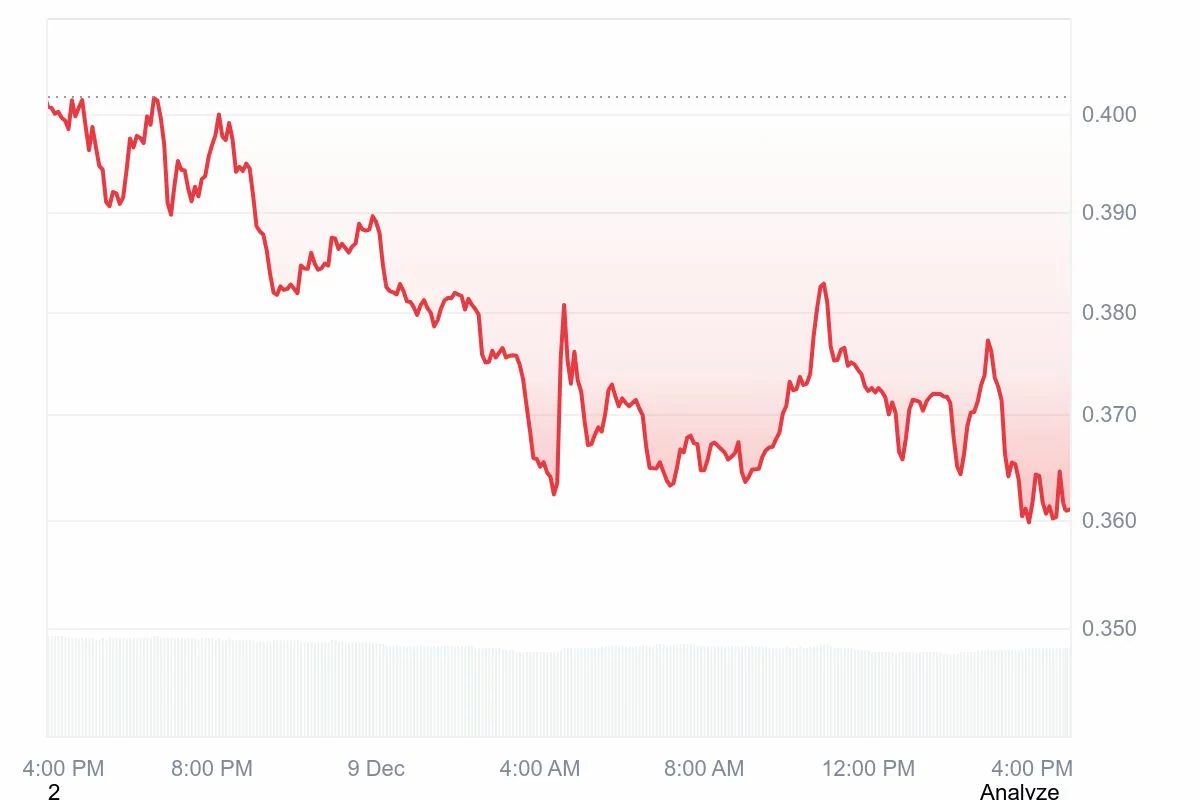

The cryptocurrency market is struggling to rebound as Bitcoin (BTC) and other cryptocurrencies failed to regain momentum. BTC is marginally up over the past 24 hours, trading around $108,200. The flagship cryptocurrency’s recovery stalled after it crossed $113,000, with selling pressure dragging the price below $110,000. Meanwhile, Ethereum (ETH) is struggling to reclaim the $4,000 mark. The altcoin is down nearly 1% over the past 24 hours, trading around $3,862. Ripple (XRP) is also down almost 1%, while Solana (SOL) is marginally down, trading around $184.

Dogecoin (DOGE) is down over 1% and Cardano (ADA) is also trading in the red at $0.636. Chainlink (LINK), Stellar (XLM), Hedera (HBAR), Litecoin (LTC), Toncoin (TON), and Polkadot (DOT) have also registered notable losses over the past 24 hours.