New Survey Shows Massive Missed Opportunity In Bitcoin Finance (BTCFi)

Despite Bitcoin’s record highs, a GoMining survey finds 77% of holders haven’t used BTCFi—missing out on potential passive income gains.

As Bitcoin reaches a new all-time high above $126,000, new data shows that most holders still haven’t explored Bitcoin Finance (BTCFi).

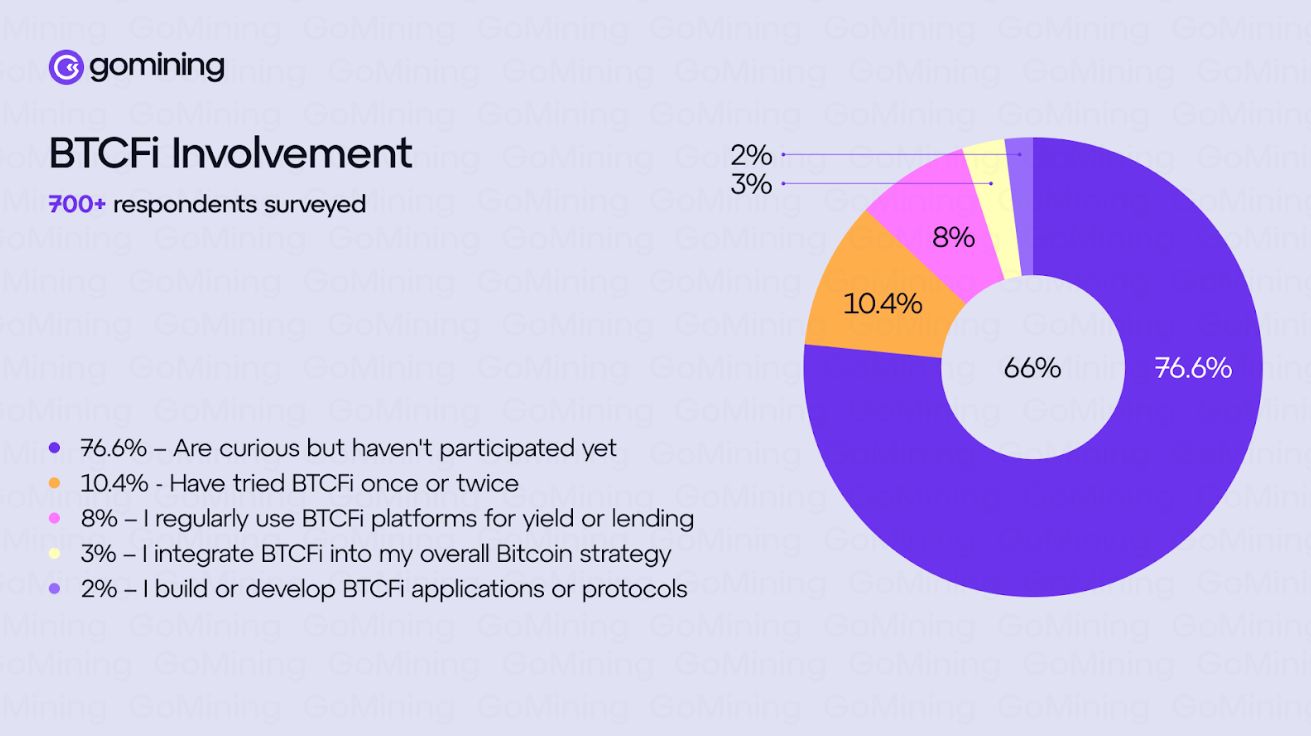

A survey by GoMining of more than 700 respondents across North America and Europe found that 77% of Bitcoin holders have never used a BTCFi platform.

77% of Bitcoin Holders Haven’t Tried BTCFi

This finding highlights a major disconnect between the growing hype around BTCFi and its real-world adoption. The sector has attracted significant venture capital and media coverage, yet the majority of its target users remain untouched.

The GoMining survey reveals that interest in BTCFi’s core offerings—yield and liquidity—is high, but trust remains the critical barrier.

Bitcoin Finance Survey Results. Source: GoMining

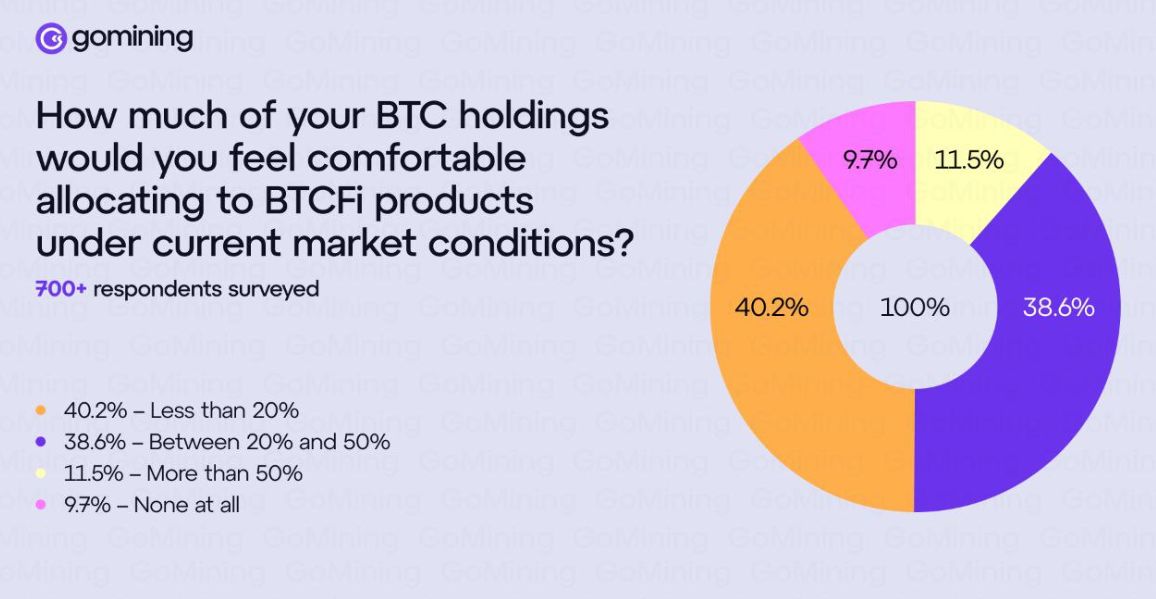

Bitcoin Finance Survey Results. Source: GoMining

Around 73% of respondents said they want to earn yield on their Bitcoin through lending or staking, and 42% expressed interest in accessing liquidity without selling BTC.

However, more than 40% of participants said they would allocate less than 20% of their holdings to BTCFi products.

This conservative stance reflects broader trust and complexity issues facing the industry.

“Although the majority of Bitcoin investors hold it in store for future valuation boost, the asset has more liquidity to power the next generation of DeFi applications. While the corporate adoption of Bitcoin as a treasury asset is growing, the coin can act as much more than a HODL asset. BTCFi will offer new potential use cases — earning, borrowing, and spending,” said Mark Zalan, CEO of GoMining.

A Bitcoin Education Problem

Perhaps the most revealing figure is that 65% of Bitcoin holders cannot name a single BTCFi project.

Despite millions in venture funding and an increasing number of conferences, BTCFi’s message has yet to reach its core audience—Bitcoin holders themselves.

Industry experts argue this is not a user failure but a communication failure. BTCFi platforms have largely replicated Ethereum’s DeFi model, assuming familiarity that many Bitcoin investors simply do not have.

BTCFi Survey Findings. Source: GoMining

BTCFi Survey Findings. Source: GoMining

Different Users, Different Expectations

The survey supports a growing view that Bitcoin users are fundamentally different from DeFi users.

While Ethereum users embrace experimentation and composability, Bitcoin holders prioritize security, regulation, and simplicity.

This difference explains why Bitcoin ETFs and custodial platforms have achieved mass adoption while BTCFi remains niche.

The timing of these findings is critical. Bitcoin’s surge to an all-time high reflects renewed institutional and retail interest in BTC.

“At $125,559, many still consider Bitcoin undervalued, drawing on its superior technology, Wall Street adoption, and its limited supply. The Bitcoin price outlook is benefiting from the September interest rate cut, the current US government shutdown, and the expanding M2 global money supply,” Zalan told BeInCrypto.

Yet, the survey shows the financial layer around Bitcoin remains underdeveloped.

If even a fraction of holders deploy their BTC into yield or liquidity protocols, the BTCFi sector could unlock billions in dormant capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

dYdX Considers BONK Partnership in Bid to Tap Solana’s Retail Trading Power

The Influence of Academic Institutions on Developing STEM Professionals and How This Affects Technology Stock Values

- Global STEM education investments hit $9B in 2025, driving $132B market by 2030 with 13.7% CAGR as governments and private sectors prioritize tech workforce development. - EdTech firms like Coursera see 60x EBITDA multiples, outperforming traditional sectors as STEM graduates correlate directly with GDP growth per OECD 2025 study. - Tech giants (LEGO, Makeblock) partner with schools for AI/robotics kits, creating innovation pipelines while addressing 411,500 unfilled STEM teaching positions and 26% gende

Timeless Investment Principles: How Insights from 1927 Continue to Influence Today’s Crypto and Stablecoin Approaches

- McNeel and Buffett's 1920s investment principles combat modern crypto volatility through emotional discipline and intrinsic value focus. - The 2025 Binance crash exposed market fragility, with panic selling and FOMO-driven rebounds amplifying $19B in 24-hour liquidations. - Risk management tools like stop-loss orders and diversified portfolios reduced losses by 37%, underscoring enduring relevance of timeless strategies. - Stablecoin vulnerabilities highlighted by USDC's 2023 depegging and 2025 liquidity

Zcash Halving and Its Impact on Cryptocurrency Market Trends

- Zcash's 2028 halving will cut block rewards to 0.78125 ZEC, continuing its deflationary supply model to reduce annual inflation to 2%. - Historical data shows halvings trigger extreme volatility, with ZEC surging 1,172% in 2025 but collapsing 96% within 16 days. - Institutional adoption grows via $137M Grayscale Zcash Trust, yet EU's MiCA regulations challenge privacy coins' compliance with transparency rules. - Future success depends on balancing privacy features with regulatory adaptability as Zcash's