JPMorgan’s Chief Global Strategist Issues Urgent Alert, Says Market ‘Just Blindly Moving Higher’ Amid Deteriorating Economic Fundamentals

A top-level executive at banking titan JPMorgan Chase is warning that investors may be turning a blind eye to worsening economic data as they pour into stocks.

In a new interview on CNBC Television, JPMorgan Asset Management’s chief global strategist, David Kelly, says that stocks may be getting overheated.

“Where we are is an economy which is growing more slowly. It’s heating up in terms of inflation, and the outlook, of course, is just getting cloudier and cloudier as we lack these government data.

From a market perspective, I am a little bit concerned here, because the market is just blindly moving higher when really a lot of the fundamentals are deteriorating beneath it. I think investors need to be cautious here and recognize that there is clearly a disconnect between market euphoria and really some growing problems in the economy.”

Kelly also says that stocks may be trading at higher values than make sense, creating a greater risk for a sudden market correction.

“If people are really scared about a recession or a huge credit event or some other huge event, then you get a gap down in the market, and that could be very painful. But for investors, you never know the hour nor the day when such a thing could happen. I think it’s just best to play it on the safe side and recognize that there is something a little irrational about how high the market is going and how well it is doing given this uncertainty.”

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNA Climbs 0.75% as Rumors Swirl About SBF Clemency and Ongoing Legal Updates

- LUNA rose 0.75% in 24 hours, driven by speculation around Sam Bankman-Fried’s potential legal resolution. - Market speculation about SBF’s possible pardon and Terra-Luna collapse legal fallout fueled investor interest. - LUNA’s long-term recovery remains uncertain despite short-term gains, as legal clarity and ecosystem rebuilding are critical.

Bitcoin Leverage Liquidation Spike: Systemic Threats and Institutional Investor Responses in 2025

- 2025 Bitcoin leverage liquidations exposed systemic risks across DeFi, institutional portfolios, and traditional markets, triggered by macroeconomic tightening and regulatory uncertainty. - Institutions accelerated adoption of AI-driven risk frameworks, with 72% implementing crypto-specific strategies post-crisis to mitigate cascading losses. - MicroStrategy's 60% stock collapse and $3.5B Bitcoin ETF outflow highlighted cross-market contagion, while hedging tools helped institutions navigate volatility.

Bitcoin Price Fluctuations and Institutional Involvement in Late 2025: Optimal Timing for Long-Term Investment

- Bitcoin's 2025 volatility dropped to 43% amid $732B inflows and institutional-grade infrastructure maturing. - Regulatory clarity (MiCA/GENIUS Act) and $115B ETF assets (BlackRock/Fidelity) normalized crypto in institutional portfolios. - $90K price near Fibonacci support zones reflects technical strength and improved liquidity from tokenized assets. - Vanguard's $9T Bitcoin access and Fed policy shifts reinforced crypto's transition from niche to $4T mainstream asset class.

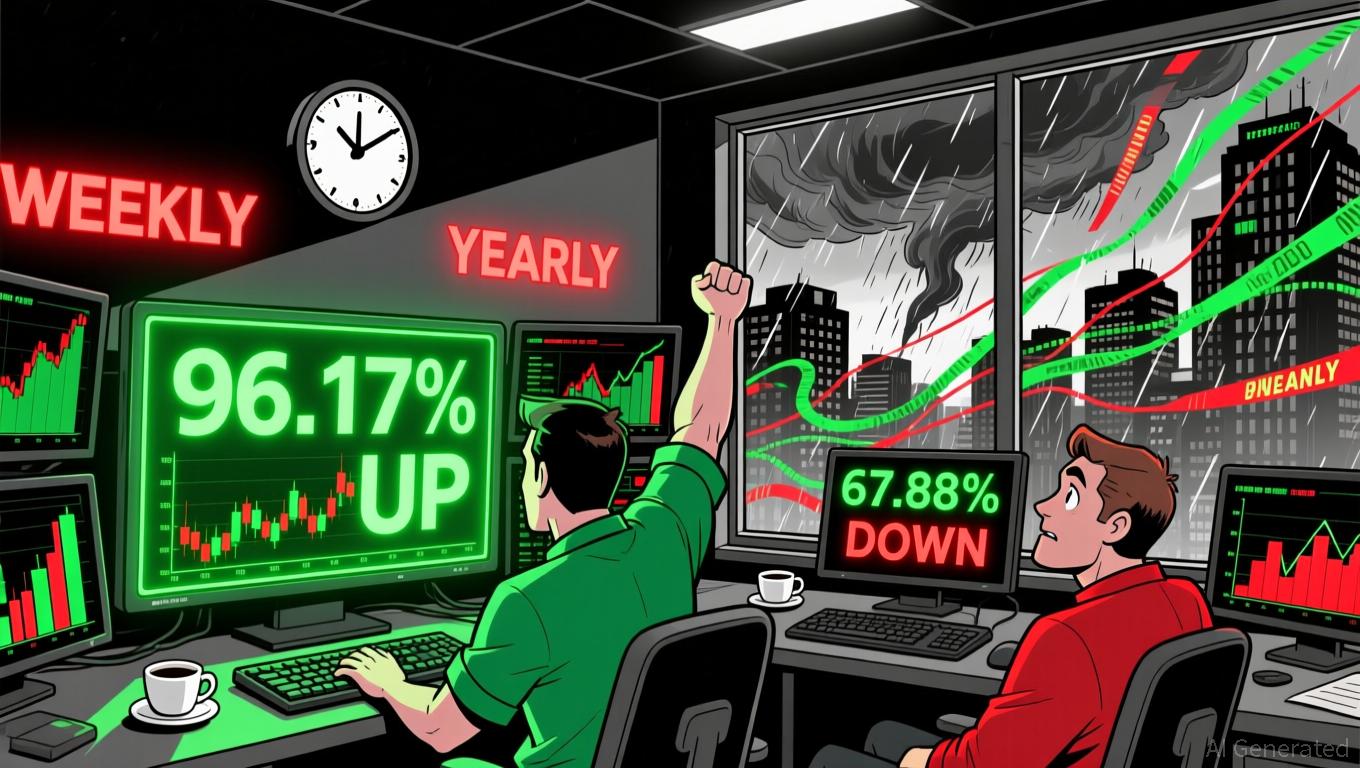

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.