Is Pendle Price About to Shock the Market?

Pendle (PENDLE) price has shown renewed momentum with strong daily and hourly patterns suggesting a possible breakout. From the Heikin Ashi charts, we observe significant bullish sentiment emerging across both timeframes. Let's dive into the technical analysis and make some projections for the coming days based on the latest market structure of Pendle Price .

Pendle Price Prediction: What’s Happening on the Daily Chart?

PENDLE/USD Daily Chart- TradingView

PENDLE/USD Daily Chart- TradingView

The daily chart reveals a steady climb with a recent price of $4.27, marking a +4.35% daily move. A key observation is the price's consistent hold above the 20-day SMA, now sitting around $3.76, signaling a bullish continuation. The longer-term 50-day and 100-day SMAs (around $3.41) are trailing far below, confirming that medium and long-term momentum is still in favor of the bulls.

A tight consolidation was seen just below the resistance at $4.33, which now looks poised to be broken. On May 20, Pendle tested this level with a high of $4.48, which suggests increasing buying pressure. If the resistance breaks and sustains above $4.33, the next Fibonacci extension levels indicate a potential target of $4.80, and beyond that, $5.55.

To put it in numbers, a close above $4.33 with a daily RSI above 60 (not shown but implied from trend steepness) could offer a 15%–30% upside. Support lies around $4.00 and $3.76, and as long as price doesn’t close below $3.76, the bullish structure remains valid.

What Does the Hourly Chart Indicate?

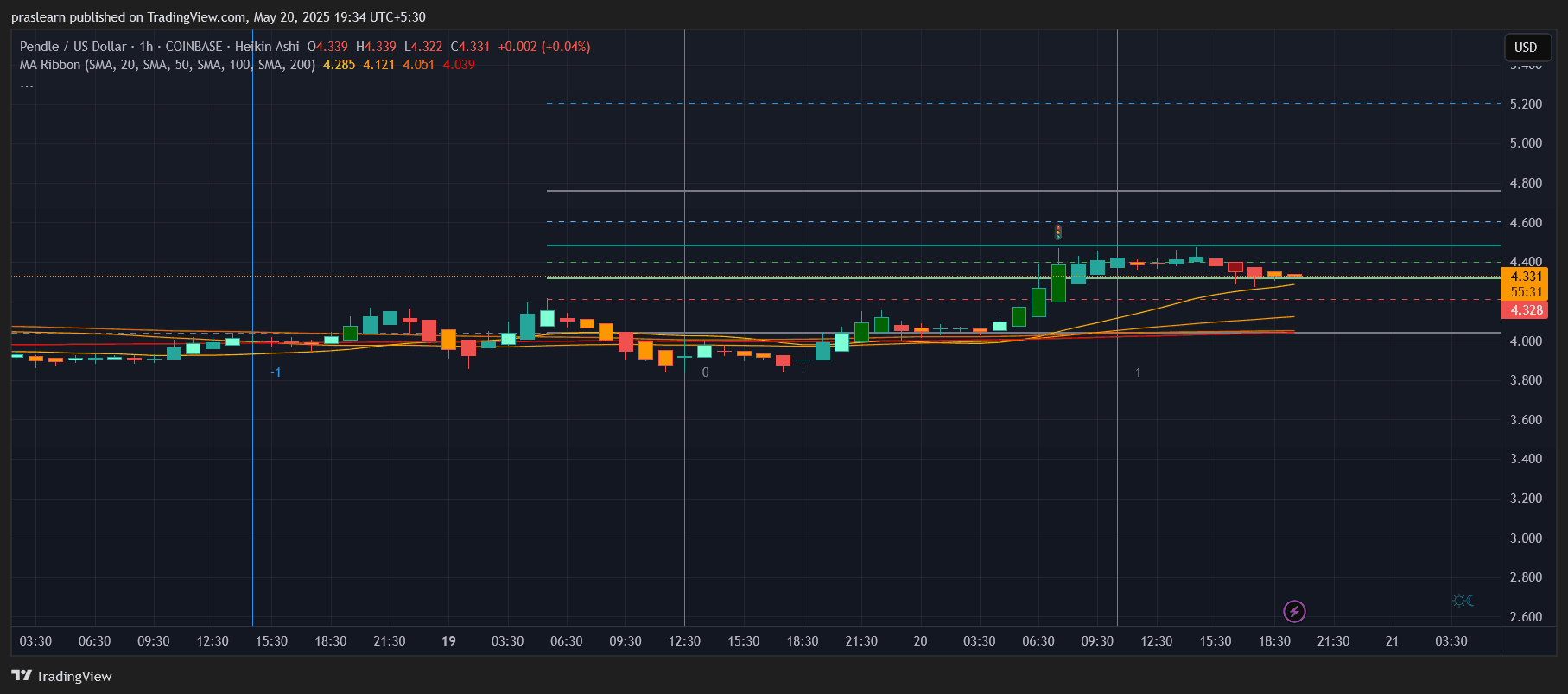

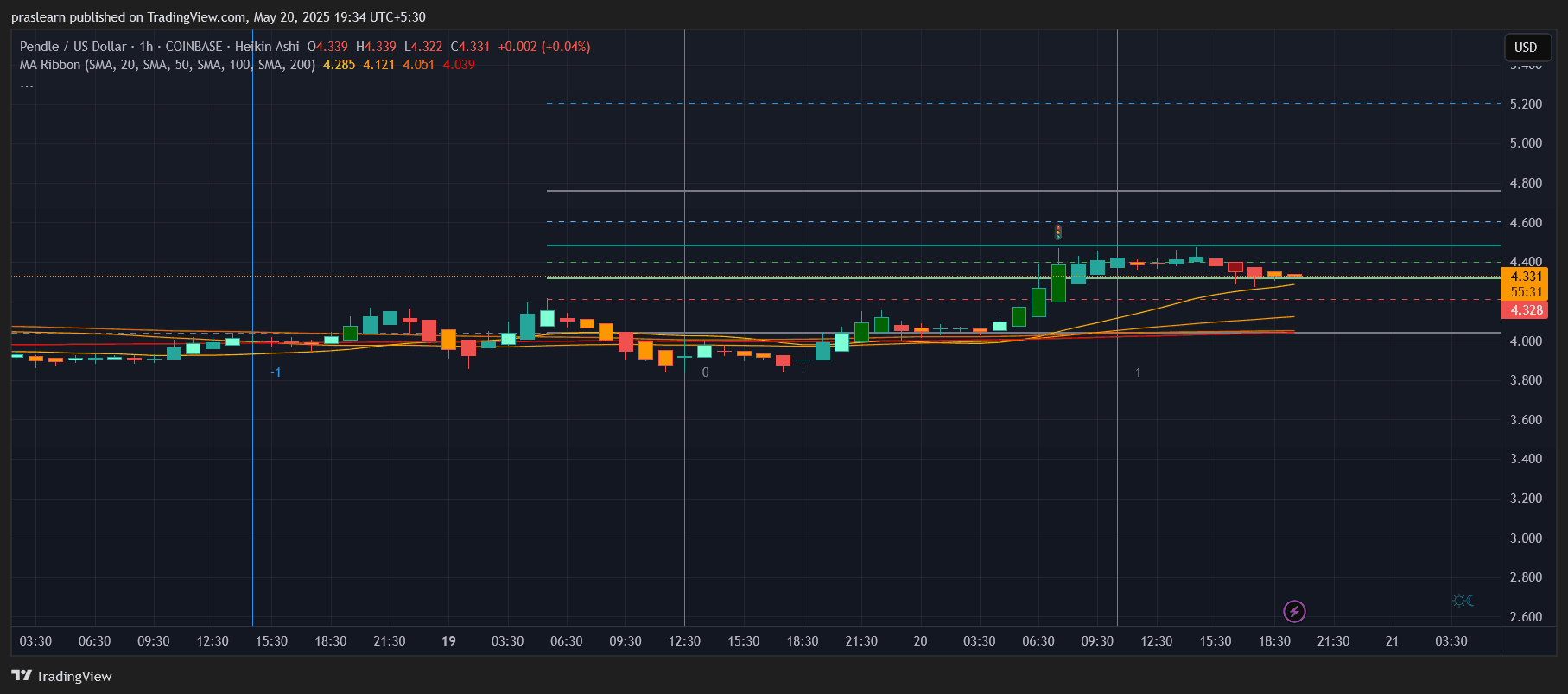

PENDLE/USD 1 Hr Chart- TradingView

PENDLE/USD 1 Hr Chart- TradingView

Zooming into the 1-hour chart, Pendle price surged to $4.48 , followed by a healthy consolidation. This is evident from the short cluster of Heikin Ashi candles near the highs, showing reduced volatility—often a precursor to the next move.

Interestingly, the price is holding above all major moving averages, with the 20, 50, and 100-hour SMAs tightly packed between $4.05–$4.28. This setup forms a classic support band that historically acts as a springboard for breakouts. As long as Pendle stays above $4.28, the uptrend remains protected.

In the short-term, bulls may retest $4.48 again. If volume picks up and breaks this resistance, Pendle could spike toward $4.80 quickly, offering a gain of nearly 11% from current levels.

Pendle Price Prediction: Can Pendle Hit $5.00 in May?

Let’s calculate. If Pendle price closes daily candles above $4.33 and follows a standard measured move based on the last breakout leg ($3.50 to $4.33 = $0.83), the next target becomes:

$4.33 + $0.83 = $5.16

This aligns closely with the upper Fibonacci projection on the daily chart. So, a conservative target would be $4.80, while an aggressive move could take Pendle to $5.16–$5.55 if broader market conditions support the rally.

Final Thoughts: Time to Buy or Wait?

The current structure of Pendle price favors buying the breakout above $4.33 with a stop-loss at $4.00. Pendle has built a solid base and appears to be forming a bullish flag pattern on the daily chart. As the hourly candles squeeze tighter near resistance, traders should stay alert for a sharp breakout in either direction.

So, all signs point toward an imminent breakout. If momentum continues, Pendle price could enter price discovery above $5.00, making it a top altcoin to watch this week.

Pendle (PENDLE) price has shown renewed momentum with strong daily and hourly patterns suggesting a possible breakout. From the Heikin Ashi charts, we observe significant bullish sentiment emerging across both timeframes. Let's dive into the technical analysis and make some projections for the coming days based on the latest market structure of Pendle Price .

Pendle Price Prediction: What’s Happening on the Daily Chart?

PENDLE/USD Daily Chart- TradingView

PENDLE/USD Daily Chart- TradingView

The daily chart reveals a steady climb with a recent price of $4.27, marking a +4.35% daily move. A key observation is the price's consistent hold above the 20-day SMA, now sitting around $3.76, signaling a bullish continuation. The longer-term 50-day and 100-day SMAs (around $3.41) are trailing far below, confirming that medium and long-term momentum is still in favor of the bulls.

A tight consolidation was seen just below the resistance at $4.33, which now looks poised to be broken. On May 20, Pendle tested this level with a high of $4.48, which suggests increasing buying pressure. If the resistance breaks and sustains above $4.33, the next Fibonacci extension levels indicate a potential target of $4.80, and beyond that, $5.55.

To put it in numbers, a close above $4.33 with a daily RSI above 60 (not shown but implied from trend steepness) could offer a 15%–30% upside. Support lies around $4.00 and $3.76, and as long as price doesn’t close below $3.76, the bullish structure remains valid.

What Does the Hourly Chart Indicate?

PENDLE/USD 1 Hr Chart- TradingView

PENDLE/USD 1 Hr Chart- TradingView

Zooming into the 1-hour chart, Pendle price surged to $4.48 , followed by a healthy consolidation. This is evident from the short cluster of Heikin Ashi candles near the highs, showing reduced volatility—often a precursor to the next move.

Interestingly, the price is holding above all major moving averages, with the 20, 50, and 100-hour SMAs tightly packed between $4.05–$4.28. This setup forms a classic support band that historically acts as a springboard for breakouts. As long as Pendle stays above $4.28, the uptrend remains protected.

In the short-term, bulls may retest $4.48 again. If volume picks up and breaks this resistance, Pendle could spike toward $4.80 quickly, offering a gain of nearly 11% from current levels.

Pendle Price Prediction: Can Pendle Hit $5.00 in May?

Let’s calculate. If Pendle price closes daily candles above $4.33 and follows a standard measured move based on the last breakout leg ($3.50 to $4.33 = $0.83), the next target becomes:

$4.33 + $0.83 = $5.16

This aligns closely with the upper Fibonacci projection on the daily chart. So, a conservative target would be $4.80, while an aggressive move could take Pendle to $5.16–$5.55 if broader market conditions support the rally.

Final Thoughts: Time to Buy or Wait?

The current structure of Pendle price favors buying the breakout above $4.33 with a stop-loss at $4.00. Pendle has built a solid base and appears to be forming a bullish flag pattern on the daily chart. As the hourly candles squeeze tighter near resistance, traders should stay alert for a sharp breakout in either direction.

So, all signs point toward an imminent breakout. If momentum continues, Pendle price could enter price discovery above $5.00, making it a top altcoin to watch this week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price dips below 88K as analysis blames FOMC nerves

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.