Cathie Wood: Sovereign wealth funds have begun to allocate Bitcoin, and the proportion of institutions in open futures contracts has risen to about 63%

Odaily Planet Daily reports that Ark Invest founder, CEO and Chief Investment Officer Cathie Wood said in an interview with Bloomberg that the model of DeepSeek could attract more companies to join the open-source AI camp, thereby breaking the existing market structure and forming a new competitive situation.

Cryptocurrency is the next internet revolution, currently witnessing a triple paradigm shift: First, institutional holdings in Bitcoin futures' open contracts rose from 17% in 2020 to 63%; secondly, sovereign wealth funds began allocating - Norway's oil fund disclosed last month it held 42 thousand BTC. Most importantly, Bitcoin is becoming a balance sheet tool for tech companies - MicroStrategy holds 214 thousand BTC and Tesla also has strategic reserves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

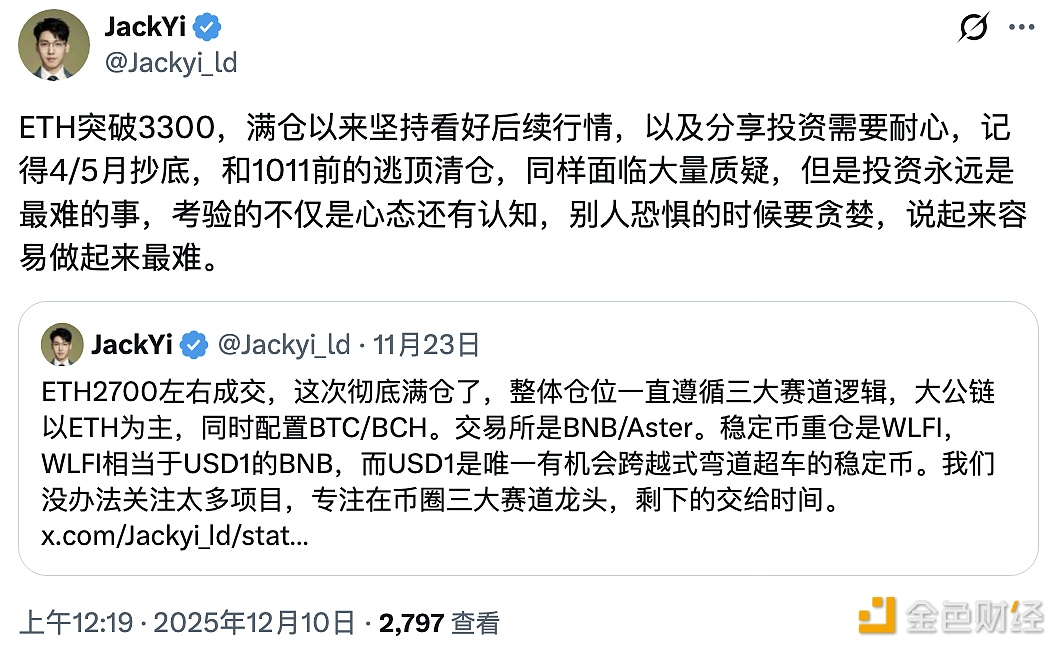

Yilihua: Remains bullish on ETH's future market since going all-in

Machi increases ETH long positions to 6,225 coins, with current unrealized profit of $1.13 million

A trader used 10x leverage to go long on ETH, earning an unrealized profit of over $578,000 in 20 minutes.

Odaily Airdrop Hunter 24-Hour Express Special Topic Event Opinion Article Hot List